This regular feature focuses on developments that affect the bank examination function. We welcome ideas for future columns. Readers are encouraged to e-mail suggestions to SupervisoryJournal@fdic.gov.

Consumer protection took an important step forward with the enactment of the Credit Card Accountability Responsibility and Disclosure Act of 2009 (Credit CARD Act). The Credit CARD Act and the implementing changes to Regulation Z strengthen protections for consumer credit card holders by establishing new disclosure requirements and restricting potentially abusive practices. Although the Credit CARD Act primarily focuses on credit cards, some of the consumer protections also affect other open-end credit products. This article identifies key changes affecting bank product offerings and operations and offers the author’s suggestions for how examiners may approach the evaluation of a bank’s compliance with these new requirements and restrictions.

It is critical that an institution offering open-end credit products allocates sufficient time and resources to determine the applicability and impact of the Regulation Z amendments and implement necessary changes. Coordination across departmental lines, particularly marketing, compliance, and information technology, is essential to successful implementation and compliance. As is the case with any regulation, examiners will evaluate an institution’s processes for ensuring effective compliance.

Examiner Takeaway

To create a risk profile and identify potential gaps in compliance, examiners should look for evidence of a comprehensive, well-developed plan that involves all levels of management and functional departments. Plans should include a sensible timeline to ensure compliance by the effective dates. As part of this process, examiners may review these documents, as well as others:

- Product reviews identifying the potential impact of the changes;

- Development plans, particularly if significant changes will be required;

- Prototype periodic statements and change-in-terms notices and (particularly for credit card banks) updated cardholder agreements and initial disclosures;

- Implementation logs (for activities performed by bank personnel as well as services performed by third parties);

- Training records; and

- Board or other committee minutes.

Examiners also should evaluate ongoing, post-implementation monitoring and quality control procedures, including audits where appropriate. Monitoring procedures are particularly important in the case of third-party service provider operations as the institution retains the legal, reputational, and regulatory risk and responsibility.

Depending on the impact of the Regulation Z changes on an institution’s products and operations, examiners may conduct interviews with senior management and compliance, information technology, marketing, and customer service personnel to gain a complete understanding of what changes were necessary and how these changes were implemented.

Examiners also may review specific software application settings/parameters to assess whether information technology systems designed to carry out critical functions, such as balance calculations, rate changes, and fee imposition, were properly updated.1 Reviewing the settings in conjunction with information contained within initial disclosures, periodic statements, and any change-in-terms notices helps identify any breakdowns in compliance.

Bankers and examiners should carefully review consumer complaints as a source of information about how the new open-end credit requirements were implemented and whether information was properly communicated to customers. Complaints may be received by the FDIC, other supervisory agencies, the bank or a third party performing services for the bank. The Better Business Bureau, State Attorneys General, and Web site blogs are additional sources of consumer complaint information.

Bank management should expect examiners to conduct transaction testing based on an institution’s risk profile; recommendations for transaction testing are included in this article.

Statutory and Regulatory Background

On May 22, 2009, the Credit CARD Act was signed into law,2 establishing new protections for credit card holders and, in some instances, consumers using other types of open-end credit plans, as well.3

The consumer protections included in the Credit CARD Act take effect over time. Rules that took effect August 20, 2009, governed the:

- timing of periodic statements for open-end credit plans;4 and

- All creditors offering any type of open-end credit that features a grace period must mail or deliver periodic statements at least 21 days before the expiration of the grace period.5

- Regardless of whether there is a grace period, periodic statements for all credit card accounts under an open-end (not home-secured) consumer credit plan must be mailed or delivered at least 21 days before the payment due date disclosed on the statement.6

- timing and content of new requirements for advance notice of interest rate increases and other significant changes for credit cards.

The most sweeping set of changes took effect February 22, 2010.7 Consumer protections include:

- limits on interest rate increases on existing balances generally and during the first year an account is open;

- requirements to analyze a consumer’s ability to pay, including special rules for young consumers;

- limits on marketing to college students;

- restrictions on fees during the first year an account is open;

- restrictions on over-limit transactions and fees;

- limits on payment due dates;

- requirements for payment allocation;

- required minimum payment warnings;

- elimination of double-cycle billing;

- limits on use of the term “fixed”;

- limits on fees for making payments other than certain expedited payments;

- the establishment of a cut-off time for crediting payments on payment due dates;

- time limits for responding to requests related to settlement of decedent cardholder estates; and

- requirements for Internet posting of credit card agreements.

The final Credit CARD Act rule, effective August 22, 2010, will implement the requirement that penalty fees and charges be reasonable and proportional in relation to the violation of the account terms. In addition, credit card issuers must begin reevaluating interest rate increases implemented on or after January 1, 2009.

Regulation Z amendments, outside those resulting from the Credit CARD Act, that will take effect July 1, 2010,8 relate to disclosures and format requirements for credit card applications and solicitations, account opening disclosures, periodic statements, change-in-terms notices, and advertisements.

Several provisions of the Credit CARD Act, such as those relating to the use of the term “fixed” and crediting of payments, apply to all open-end credit products. However, others apply only to certain types of open-end credit. Regulation Z has been amended to include a new term, credit card account under an open-end (not home-secured) consumer credit plan. Descriptions of significant changes to Regulation Z as a result of the enactment of the Credit CARD Act follow, and a tabular summary of Regulation Z amendments and the affected open-end products appears at the conclusion of this article.

Unless otherwise noted, the remainder of this article focuses on changes effective February 22, 2010, dealing with credit card accounts under an open-end (not home-secured) consumer credit plan and features examiner takeaways in response to each change.

Advance Notice

For all open-end (not home-secured) plans, creditors must provide a 45-day advance notice before a significant change in account terms occurs or when increasing the required minimum payment.9 Even if the notice is being provided for an increase in rate following a delinquency, default, or as a penalty, the notice must be provided at least 45 days before the effective date of the increase.

Limits on Increases in Annual Percentage Rates (APRs)10

Card issuers are prohibited from increasing the APR on existing balances except when:

- a temporary rate of at least six months expires;

- the increase is due to an increase in the variable rate controlled by an index outside the creditor’s control;

- A variable rate index is not considered outside a lender’s control if the lender imposes a floor. For example, the card issuer may disclose that the periodic rate and APR are based on a publicly available index plus a margin, but the issuer also may state the rate may not be less than a specified percentage. As the lender established a floor, the rate is within the lender’s control and, therefore, does not meet the variable rate exceptions to increase rates on existing balances. However, a lender can use a variable rate index with a ceiling and qualify for the variable exception because a variable interest rate ceiling was determined by the Federal Reserve Board to be universally beneficial to consumers.11

- the minimum payment has not been received within 60 days;12 or

- the consumer successfully completes, or fails to comply with the terms of, a workout arrangement.

For accounts where the interest rate has been reduced to the statutory maximum pursuant to the Servicemembers Civil Relief Act, the rate can be increased (for transactions incurred before the rate decrease) to the rate in effect before the period of active duty once 50 U.S.C. app. 527 no longer applies.13 However, a 45-day advance notice of the increase is required.

Lenders must provide notices regarding rate increases on future transactions at least 45 days before the effective date.14 Although a card issuer may apply the higher rate to transactions occurring more than 14 days after the notice was sent, the issuer may not apply the higher rate (i.e., accrue interest) until the 45th day. This restriction applies whether the bank uses the daily balance or average daily balance calculation method.

For example, a card issuer mails or delivers the notice on May 1, indicating the rate will increase from 15 percent to 18 percent on June 15. For transactions occurring on May 16 and after, the card issuer can begin accruing interest at the higher rate on these transactions starting on June 15. The creditor cannot apply the higher rate to days before June 1515 (see inset box below).

To illustrate: Assume the billing cycle starts on the first day of a month and ends on the last, and the change in terms notice was mailed or delivered on May 1. A consumer makes a $50 purchase on May 10 and a $100 purchase on May 18. Although the May 18 purchase is subject to the higher rate of 18 percent, the card issuer cannot begin accruing interest at 18 percent until June 15. Therefore, the rate applicable to purchases in the May billing cycle is 15 percent. During the June billing cycle, the 15 percent rate applies to balances from June 1 to June 14. From June 15 (the 45th day after the change in terms notice) to the end of the billing cycle, the 15 percent rate applies to the May 10 $50 purchase (as this transaction was made within 14 days of provision of the notice), and the 18 percent rate applies to the May 18 $100 purchase (this transaction occurred more than 14 days after the provision of the notice and, therefore, is subject to the rate increase on the 45th day).16

Creditors also are prohibited from increasing interest rates during the first year of a credit card, except under limited circumstances.

Examiner Takeaway

Examiners should review how rate increases are handled as detailed below:

- Compare information collected from interviews and review of software settings with information contained in disclosures and periodic statements.

- Review the timing and content of change-in-terms notices and compare the effective dates and balances to which the increases apply (as disclosed within the notice) to actual practices displayed on periodic statements covering the same time frame.

- Determine whether any APR increases on existing balances fall within the exceptions listed at the beginning of this section. (Review initial disclosures to determine if the account is variable and operating under an index outside the lender’s control.)

Periodic Statements 17

Mailing and Delivery

Card issuers must establish reasonable procedures to ensure periodic statements are mailed or delivered at least 21 days before the payment due date, and that payments are not treated as late if received within 21 days after mailing or delivery of the periodic statement. The time it takes to generate and mail the periodic statements should be added to the 21 days.18

Examiner Takeaway

To determine compliance with the timing requirement, examiners should compare the card issuer’s performance standards for mailing periodic statements to both the billing cycle close date and payment due date shown on periodic statements.

Payment Due Dates

For credit card accounts, the payment due date must now be the same numerical date, for example, the 4th, and generally cannot be the same relative date, such as the second Tuesday. There is an exception if the creditor states the payment due date is the last day of the month, as this is consistently identifiable to the consumer, whether the numerical day is the 28th, 30th, or 31st day.

For all open-end credit plans, if the due date falls on a date the creditor does not receive or accept payments by mail, the creditor shall treat the payment as timely if it is received the next business day. However, if a creditor accepts or receives payments by other means (such as electronic or telephone) on the due date, payments received via these methods on the business day following the due date are not required to be considered timely. Finally, the payment due date cut-off time cannot be earlier than 5 p.m. on the due date, with some exceptions.19

Examiner Takeaway

Examiners are encouraged to review when payments are received and credited to the account. To determine that a payment was not incorrectly treated as late, an examiner may review periodic statements where the payment was made on the business day following the due date.

Disclosures

Additional periodic statement requirements for credit cards include, but are not limited to:

- minimum repayment warnings,

- a repayment estimate, and

- a toll-free number for credit counseling services.

Periodic statements now must include information on how long it would take a consumer to repay the balance, assuming no additional advances, if the consumer makes only the minimum payment.20 Under most circumstances, periodic statements also must reflect a minimum payment estimate based on a 36-month repayment schedule and a savings estimate. If negative or no amortization will occur, a specific warning is required.

Exceptions to the minimum payment warnings include accounts where the previous two consecutive billing cycles were paid in full, had a zero outstanding balance, or had a credit balance; and situations where the minimum payment will pay-off the outstanding balance shown on the billing statement, including charged-off accounts where the entire balance is due immediately.21 These minimum payment warnings were designed to prominently display the effects of making only minimum payments.

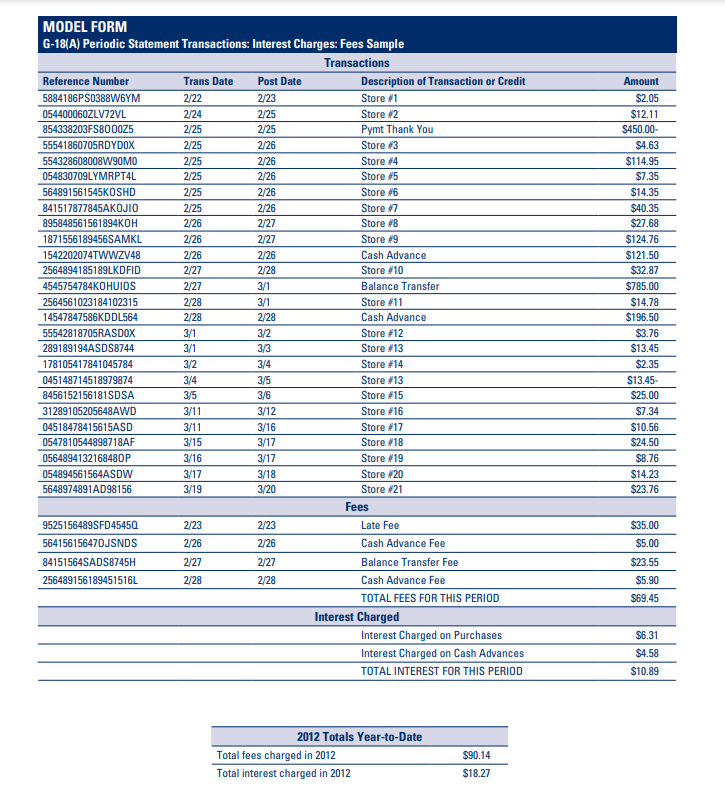

Effective July 1, 2010, use of the term “finance-charge” and disclosure of an “effective APR” are eliminated for open-end (not home-secured) consumer credit plans.22 However, creditors now must disclose the charges imposed, grouped together, in proximity to the related transactions, substantially as illustrated in the model form shown on page 17.23 Creditors must show the information for the statement period as well as calendar year-to-date totals.

Examiner Takeaway

Examiners are encouraged to review documentation that supports how a bank’s software system calculates the required minimum payment disclosures. After July 1, 2010, examiners also should verify the cycle and year-to-date interest and fee calculations. In addition, examiners may need to review periodic statements and verify the calculations on a sample of statements.

Double-Cycle Billing 24

Card issuers no longer may use the “double-cycle billing” or “two-cycle billing” balance calculation method on credit card accounts under an open-end (not home-secured) consumer credit plan.25 Although variations exist, this calculation method generally involved assessing interest on balances for the current billing cycle as well as balances on days in the preceding billing cycle, even those portions that were repaid.

In addition, card issuers are prohibited from imposing a finance charge on any portion of a balance subject to a grace period that is repaid before the expiration of the grace period. When a balance on a credit card account is eligible for a grace period and the card issuer receives payment for some, but not all, of that balance before the grace period expires, the card issuer may not impose finance charges on the paid portion of the balance26 (see inset box below).

To illustrate: Assume an account is eligible for a grace period, and the billing cycle is from the first day of the month to the last, with payment due on the 25th of the following month. If the consumer makes purchases totaling $300 in April and makes a $200 payment by May 25th, the card issuer may not assess interest during the May billing cycle on the $200 repaid by the payment due date that was eligible for a grace period. Before this change was implemented, creditors often would have imposed finance charges on the entire outstanding balance during the May billing cycle.

Examiner Takeaway

Examiners may determine compliance by reviewing the balance calculation methods in the application and initial disclosures as well as the software settings. Examiners also should ensure the balances used to assess the finance charges are not attributable to a prior billing cycle. And finally, to ensure finance charges were appropriately assessed, examiners may review a series of periodic statements where the account was subject to a grace period, and the consumer did not pay the balance in full by the payment due date.

Fees for Exceeding the Credit Limit 27

Over-limit fees may not be imposed for a consumer exceeding his or her limit on a credit card unless the consumer has been provided notice and opted-in to the program. A card issuer may approve transactions that exceed a cardholder’s credit limit; however, a fee cannot be imposed unless the consumer has opted-in. In addition, an over-limit fee may not be imposed more than once in a billing cycle and not for more than three consecutive cycles for the same occurrence. Even if a cardholder has opted-in, a card issuer cannot impose an over-limit fee solely as a result of the imposition of a fee or finance charge.

Examiner Takeaway

Examiners may review initial disclosures, applications/solicitations, and marketing materials to determine the institution’s over-limit practices. Examiners also should review opt-in procedures and periodic statements that may reflect an over-limit fee.

Allocation of Payments 28

Card issuers may apply minimum payments on credit card accounts as outlined in cardholder agreements. However, creditors must first allocate any amount in excess of the minimum payment to the balance with the highest APR and any remaining portion to the other balances in descending order based on the applicable APR. Special rules apply to a deferred interest or similar program during the last two billing cycles immediately preceding the expiration of the specified period.

Examiner Takeaway

Examiners are encouraged to review initial disclosures for any changes regarding payment allocations. Examiners may review periodic statements for accounts with balances at different APRs and where payments exceeded the minimum payment. If deferred interest or similar plans are offered, examiners also may review applicable periodic statements, including the two billing cycles before the expiration of the program, to determine if payments in excess of the minimum amount were handled properly.

Limitations on Fees 29

The total amount of fees that a consumer may be charged during the first year after an account is opened may not exceed 25 percent of the credit limit.30 If the card issuer increases the consumer’s credit limit during the first year, the consumer cannot be required to pay additional fees that would otherwise be prohibited. However, if a card issuer decreases the consumer’s credit limit during the first year, the card issuer may be required to remove or waive fees that would be in excess of 25 percent of the reduced credit limit.

Examiner Takeaway

Examiners are encouraged to review applications/solicitations and initial disclosures for fees that may be charged during the first year the account is opened. Examiners may review these documents along with periodic statements to determine what fees may be charged and how and when the fees are collected.

Card Issuers, Agents, Affinity Relationships

A bank may be involved in extending open-end consumer credit products directly or through agent relationships. Banks may participate in a “Rent-a-BIN” relationship with another party whereby the bank “rents” its right to offer credit card products and other services under an Association, commonly VISA® or MasterCard®, to a third party in return for a fee. Although these arrangements vary, the bank generally remains the creditor and card issuer and, therefore, is responsible for complying with applicable consumer protection regulations.

Banks also may participate in arrangements where the bank’s name is on the credit card, but the card issuer is another entity. Even though the card issuer may be responsible for compliance with Regulation Z, the bank should be aware of the potential for third-party risk as highlighted in the FDIC’s 2008 guidance.31

Examiner Takeaway

In light of the significant changes to Regulation Z, examiners are encouraged to discuss these arrangements with bank personnel, review available documentation, and consider whether the institution is appropriately mitigating any risks, including litigation and reputation risk.

Conclusion

Changes to Regulation Z as a result of the enactment of the Credit CARD Act strengthen consumer protections and seek to establish fair and transparent practices for open-end consumer credit plans. These changes, numerous and wide-ranging, will require careful scrutiny by bank management, particularly compliance professionals, and examiners to ensure effective implementation.

Denise R. Beiswanger

Review Examiner

Washington Office

dbeiswanger@fdic.gov

The author acknowledges the valuable assistance provided by these individuals in the preparation of this article:

Michael W. Briggs, Supervisory Counsel, Washington Office

Navid K. Choudhury, Senior Attorney, Washington Office

Deborah K. Hjelmeland, Supervisory Examiner, San Francisco Region

Colleen LeRoux, Senior Compliance Examiner, New York Region

Mira N. Marshall, Chief, Compliance Policy, Washington Office

Sources

Regulation Z, Truth in Lending, Final Rules, 75 Fed. Reg. 34 (Feb. 22, 2010), http://edocket.access.gpo.gov/2010/pdf/2010-624.pdf.

What You Need to Know: New Credit Card Rules

https://www.federalreserve.gov/consumerinfo/wyntk/wyntk_ccrules.pdf.

Kenneth J. Benton, “An Overview of the Regulation Z Rules Implementing the CARD Act,” Consumer Compliance Outlook, First Quarter 2010, at http://www.philadelphiafed.org/bankresources/publications/consumercompliance-outlook/2010/first-quarter/regulation-z-rules.cfm.

| Overview of Changes Effective February 22, 2010 | ||

|---|---|---|

| Section of Regulation Z 32 | Description* | Coverage |

| §226.5(a)(2)(iii) | The term fixed, or a similar term, may not be used unless the creditor specifies a time period the rate will be fixed and the rate will not increase during that period or, if no time period is provided, the rate will not increase while the plan is open. | All open-end (not home-secured) consumer credit plans |

| §226.5(b)(2)(ii) | Periodic statements Reasonable procedures designed to ensure periodic statements are mailed or delivered at least 21 days before the payment due date disclosed on the statement, and payments are not treated as late for any purpose if received within 21 days after mailing or delivery of the periodic statement. Interest grace periods Reasonable procedures designed to ensure periodic statements are mailed or delivered at least 21 days before the expiration of any interest grace period, and no finance charges are imposed if a payment satisfying the grace period is received within 21 days of mailing or delivery of the periodic statement. | §226.5(b)(2)(ii)(A) – Credit card accounts under an open-end (not home-secured) consumer credit plan §226.5(b)(2)(ii)(B) – All open-end consumer credit plans |

| §226.7(b)(11) | Due date same day of the month and disclosure of late payment costs, such as a late payment fee or increased periodic rate(s). Same day of the month can mean same calendar day (15th day) or the last day of the month. | Credit card accounts under an open-end (not home-secured) consumer credit plan |

| §226.7(b)(12) | Repayment disclosures such as minimum payment warnings, repayment estimate, and a toll-free number for credit counseling services | Credit card accounts under an open-end (not home-secured) consumer credit plan |

| §226.7(b)(13) | Format requirements of due date, late payment fees, and penalty rates | All open-end (not home-secured) consumer credit plans, except requirements relating to §226.7(b)(11) and (b)(12) which apply only to credit card accounts under an open-end (not home-secured) consumer credit plan |

| §226.9(c)(2) | Changes requiring advance notice (NOTE: the format requirements in §226.9(c)(2)(iv)(D) are effective July 1, 2010) | All open-end (not home-secured) consumer credit plans |

| §226.9(e) | Renewal of credit or charge card | Credit or charge card accounts subject to §226.5a |

| §226.9(g) | Increase in rates due to delinquency or default or as a penalty (NOTE: §226.9(g)(3)(ii) which covers tabular format requirements is effective July 1, 2010) | All open-end (not home-secured) consumer credit plans |

| §226.9(h) | Right to reject certain significant changes in terms | Credit card accounts under an open-end (not home secured) consumer credit plan |

| §226.10 | Payments including crediting, cut-off time, and payments due on dates the creditor does not receive or accept payments | All open-end consumer credit plans §226.10(b)(3), (e), & (f) - Credit card accounts under an open-end (not home-secured) consumer credit plan |

| §226.11(c) | Timely settlement of estates | Credit card accounts under an open-end (not home-secured) consumer credit plan |

| §226.16(f) | Use of the term “fixed” in advertising | All open-end consumer credit plans |

| §226.51 | Ability to pay (opening and increasing credit limits) on credit cards | Credit card accounts under an open-end (not home-secured) consumer credit plan |

| §226.52 | Limitations on fees during the first year after account opening | Credit card accounts under an open-end (not home-secured) consumer credit plan |

| §226.53 | Allocation of payments in excess of the minimum payment | Credit card accounts under an open-end (not home-secured) consumer credit plan |

| §226.54 | Limitations on the imposition of finance charges – “double-cycle” billing | Credit card accounts under an open-end (not home-secured) consumer credit plan |

| §226.55 | Limitations on increasing APRs, fees, and charges | Credit card accounts under an open-end (not home-secured) consumer credit plan |

| §226.56 | Opt-in requirements and other limitations regarding overlimit transactions | Credit card accounts under an open-end (not home-secured) consumer credit plan |

| §226.57(a), (b), & (d) | Reporting and marketing rules for college student open-end credit | Credit card accounts under an open-end (not home-secured) consumer credit plan |

| §226.57(c) | Restrictions on offering college students inducements to apply for an open-end consumer credit plan | All open-end consumer credit plans |

| §226.58 | Internet posting of credit card agreements | Credit card accounts under an open-end (not home-secured) consumer credit plan |

| *Refer to the regulation for a complete description and requirements. | ||

1 Recent IT examination results and Shared Application Software Review reports also may contain relevant information.

2 Pub. L. 111-24 (May 22, 2009).

3 In January 2009, before enactment of the Credit CARD Act, the Federal Reserve Board (FRB) issued changes to Regulation Z and Regulation AA that were to take effect July 1, 2010. http://edocket.access.gpo.gov/2009/pdf/E8-31185.pdf. http://edocket.access.gpo.gov/2009/pdf/E8-31186.pdf. Many of the consumer protection concerns addressed in the January 2009 amendments were then addressed by the Credit CARD Act, such as the allocation of payments that exceed the minimum payment amount, time to make payments, increasing interest rates, double-cycle billing, and limitations of fees during the first year an account is open.

4 In November 2009, the Credit CARD Technical Corrections Act of 2009 (Technical Corrections Act) amended the Truth in Lending Act (TILA) to narrow the application of the new periodic statement requirement (mailing or delivery 21 days before the payment due date) of Section 163(a) of TILA to credit card accounts. See FIL-74-2009 – Regulation Z – Open-End Consumer Credit Changes Notice of Statutory Amendment; Additional Guidance. https://www.fdic.gov/news/inactive-financial-institution-letters/2009/fil09074.html.

5 “Grace period” is defined as a period within which any credit extended may be repaid without incurring a finance charge due to a periodic interest rate. Although the regulation requires that creditors adopt reasonable procedures to mail or deliver periodic statements for all open-end plans before the expiration of the grace period, the Preamble to the February 2010 Final Rule notes that the requirement to mail or deliver a periodic statement 21 days before the expiration of the grace period is largely inapplicable to products such as overdraft and home equity lines of credit as these products do not usually have a grace period.

6 In addition, payments may not be treated as late for any purpose if received within 21 days after mailing or delivery of the periodic statement. See Official Staff Commentary Section 226.5(b)(2)(ii).

7 The comprehensive rule published on that date incorporates new Credit CARD Act provisions, rules issued in January 2009 (Regulation Z and Regulation AA) that were not superseded by the Credit CARD Act, and the Credit CARD Act provisions that took effect in August 2009. This rule also incorporated the Technical Corrections Act provisions and amended the August 2009 provisions regarding the advance notice of interest rate. http://www.federalreserve.gov/newsevents/press/bcreg/20100112a.htm.

8 These Regulation Z amendments are the portions of the January 2009 amendments to Regulation Z and Regulation AA not superseded by the Credit CARD Act. They were incorporated in the February 2010 rule with an effective date of July 1.

9 Refer to Section 226.9(c)(2) for additional information on significant changes in terms and when a notice is not required.

10 Section 226.55.

11 This applies to all open-end (not home-secured) consumer credit plans.

12 See Section 226.9(c)(2)(iv)(C) and Section 226.55(b)(4). Although the card issuer may raise rates and fees on existing and new transactions, a 45-day advance notice must be provided. This notice may not be provided until the triggering event. Therefore, the card issuer cannot increase the rate based on this delinquency exception for 105 days.

13 See Official Staff Commentary Section 226.55(b)(6).

14 Sections 226.55(b) & 226.9(b), (c) or (g).

15 See Official Staff Commentary Section 226.55(b) – 2.

16 The card issuer is permitted to delay the rate increase on the applicable new transactions until the next billing cycle without relinquishing the right to impose the higher rate on applicable transactions in future billing cycles.

17 Sections 226.5(b)(2)(ii) & 226.7(b).

18 See the Official Staff Commentary. For example, if the creditor has established reasonable procedures to generate and mail periodic statements within three days of the closing date, the creditor should add the three days to the 21-day requirement, and payments should not be due before the 24th day.

19 See Section 226.10.

20 How this information must be illustrated depends on how many years it will take to pay-off the account. See Section 226.7(b)(12).

21 Section 226.7(b)(12)(v) also outlines an exception related to charge cards.

22 Section 226.7(a) outlines rules for home-equity plans subject to Section 226.5b. See footnote 8.

23 See Regulation Z - Appendix G-18(A).

24 Section 226.54.

25 Exceptions to this rule for billing disputes or returned payments are outlined in Section 226.54(b).

26 See Official Staff Commentary Section 226.54(a)(1) – 5.

27 Section 226.56.

28 Section 226.53.

29 Section 226.52.

30 Fees not subject to the limitation are outlined in Section 226.52(a)(2). Also see the Official Staff Commentary.

31 FIL-44-2008: Third Party Risk: Guidance for Managing Third-Party Risk at http://www.fdic.gov/news/news/financial/2008/fil08044.html. Kevin W. Hodson and Todd L. Hendrickson, “Third-Party Arrangements: Elevating Risk Awareness,” Supervisory Insights, Summer 2007 at http://www.fdic.gov/regulations/examinations/supervisory/insights/sisum07/sisum07.pdf.

32 Although Subpart B – Open-End Credit contains most Regulation Z provisions governing open-end credit, Subpart G – Special Rules Applicable to Credit Card Accounts and Open-end Credit Offered to College Students includes additional provisions relating to credit card accounts.