Recent turmoil in U.S. residential mortgage markets has shattered the long-held belief that home mortgage lending is inherently a low-risk activity. During the early part of this decade, a confluence of events contributed to the highest level of homeownership in our nation’s history.1 Low interest rates, a strong domestic economy, rapid rates of home price appreciation, and greater access to the capital markets created almost ideal conditions for the residential mortgage market to expand. This environment generated tremendous demand for, and supply of, home loans, prompting lenders to relax underwriting standards and offer adjustable-rate mortgages (ARMs) with risk-layering features to a broader spectrum of borrowers.

Many mortgage originators inundated consumers with misleading advertisements that touted low “fixed” interest rates or payment amounts. The combination of potentially deceptive marketing claims and extremely favorable lending conditions fueled unprecedented growth in subprime mortgages, especially hybrid ARMs that enabled many borrowers who did not otherwise qualify for a mortgage to obtain a loan.2 However, these products were fundamentally flawed as long-term financing vehicles. In many instances, failure to assess borrowers’ repayment ability according to the actual loan terms forced many homeowners to refinance, as they could not afford the payment after the rates reset. This departure from prudent underwriting standards has contributed to an increasing number of foreclosures and rising credit losses, and is generally believed to have contributed to a house price bubble that is now deflating.

The ramifications of the lending and marketing practices described in this article have been profound, and extend far beyond the practice of bank supervision. Most of the policy responses that have been proposed or are being considered remain under active debate and are beyond the scope of this article. In addition to the supervisory guidance that is the focus of this article, a partial list of other initiatives includes proposed legislation to strengthen protections to mortgage borrowers, proposed changes to Federal Reserve Regulation Z,3 public and private sector initiatives to encourage loan modifications, and initiatives by rating agencies and other proposals to strengthen due diligence and enhance transparency in the rating of securities.

There also have been proposals for governmental intervention to stabilize the current situation in the mortgage market. These include Federal Deposit Insurance Corporation (FDIC) Chairman Sheila C. Bair’s recent proposal for Home Ownership Preservation loans to pay down a portion of unaffordable loans to prevent unnecessary foreclosures, while avoiding any taxpayer losses or new bureaucracies. The scope and fundamental nature of many of these proposals underscore the gravity of the problems that widespread deficiencies in lending practices can bring, and the importance of supervisory guidance in keeping such practices in check.

This article describes misleading marketing practices and underwriting weaknesses that heightened the risks that hybrid ARM products pose to borrowers and lenders.4 It also discusses the principles, policies, and practices that protect consumers and underpin an effective risk management and monitoring system. The article concludes with an overview of the considerable financial damage attributable to the subprime mortgage crisis, and a brief summary of interagency guidance and encouragement for financial institutions to work constructively with borrowers to modify loans or otherwise mitigate losses, and preserve home ownership.

Risks to Borrowers

Between 2004 and 2007, significant volumes of hybrid ARMs were originated to borrowers who did not have the ability to repay the loans according to their terms. In many cases, the viability of these loans was contingent on the borrower refinancing (typically with a substantial prepayment penalty) or selling the property. The wave of foreclosures that ensued raised credit risk issues for lenders, but also raised concerns about the appropriateness of these loans for some borrowers.

The experience with hybrid ARMs illustrates the close nexus that can exist between safe-and-sound lending and lending that complies with applicable laws, regulations, and supervisory guidance. Specifically, lending that results in significant credit losses also generates significant compliance issues, reputation risk, and litigation.

It is important to emphasize that the bank regulatory agencies’ (agencies) concerns in this respect are not with lending to subprime borrowers per se. The Statement on Subprime Mortgage Lending and the Interagency Guidance on Nontraditional Mortgage Product Risks (interagency guidance) explicitly recognize that subprime mortgage lending is not synonymous with predatory lending.

The term subprime is often misused to refer to certain “predatory” or “abusive” lending practices. The agencies have previously expressed their support for lending practices designed to responsibly service customers and enhance credit access to borrowers with special credit needs. Subprime lending that is appropriately underwritten, priced, and administered can serve these goals. However, the agencies also recognize that some forms of subprime lending may be abusive or predatory. Such lending practices appear to have been designed to transfer wealth from the borrower to the lender/loan originator without a commensurate exchange of value. This is sometimes accomplished when the lender structures a loan to a borrower who has little or no ability to repay the loan from sources other than the collateral pledged. When default occurs, the lender forecloses or otherwise takes possession of the borrower’s property (generally the borrower’s home or automobile). In other cases, the lender may threaten the borrower with foreclosure/repossession to elicit payment.

Accordingly, the interagency guidance warns institutions against engaging in the types of predatory lending practices discussed in Expanded Guidance for Subprime Lending Programs. Predatory lending involves at least one of the following elements:

- Making loans based predominantly on the foreclosure or liquidation value of a borrower’s collateral rather than on the borrower’s ability to repay the mortgage according to its terms;

- Inducing a borrower to repeatedly refinance a loan to charge high points and fees each time the loan is refinanced (“loan flipping”); or

- Engaging in fraud or deception to conceal the true nature of the mortgage loan obligation, or ancillary products, from an unsuspecting or unsophisticated borrower.

The interagency guidance states that a fundamental consumer protection principle relative to the underwriting and marketing of mortgage loans is to approve loans based on the borrower’s ability to repay the loans according to its terms. As discussed in more detail in the next section, many subprime hybrid ARMs were not underwritten in accordance with this fundamental principle. The interagency guidance also states that another fundamental consumer protection principle is to provide information that enables consumers to understand material terms, costs, and risks of loan products at a time that will help the consumer select a product.

Consumers need clear, balanced, and timely information on mortgage loan terms to make informed decisions at crucial points in the product selection and loan application process. Unfortunately, adequate disclosures about the material terms, costs, and risks of hybrid ARM loans have not always been provided. For example, many advertisements described hybrid ARMs as having a “fixed” interest rate or payment amount. The term “fixed” typically describes an interest rate or payment amount that will remain unchanged for the term of the loan. However, using this term to describe adjustable-rate products, which have “fixed” rates or payment amounts for only a few years, is misleading.

In September 2007, the Federal Trade Commission (FTC) determined that “many mortgage advertisers are making potentially deceptive claims about incredibly low rates and payments.”5 The FTC warned mortgage brokers and lenders that some advertising claims appearing in Web sites, newspapers, magazines, direct mail, and unsolicited e-mails and faxes may violate federal law. The agency determined that many marketing materials failed to indicate clearly that the stated rate and low advertised payments were in effect for a short time and concluded that “some ads promoted only incredibly low monthly payments, but failed to disclose adequately the terms of repayment, including payment increases (payment shock) and a final balloon payment.”6

To help ensure that consumers understand that their interest rate or payment amount may change, communications—including advertisements and mortgage product descriptions—should provide clear and balanced information about the terms of hybrid ARM products with any of these features:

- Payment shock: disclosing when the introductory fixed interest rate expires, how the monthly payment amount will be calculated, and the dollar amount of potential payment increases.

- Balloon payment: specifying when it will be due and how much will be owed.

- Responsibility for taxes and insurance: explaining whether these required housing-related expenses will be escrowed and, if not, that the consumer is responsible for their payment and that the amount due can be substantial.

- Cost for a reduced documentation or “stated income” loan: informing borrowers if they will be charged a pricing premium for a reduced documentation or stated income loan program.

- Prepayment penalties (PPPs): indicating the existence of these penalties, how they will be calculated, and when they will be imposed. In general, PPPs should expire 60 days before the reset date and should not exceed the initial reset period.

Mortgage originators should provide information about these features during the product selection process—not only when an application is submitted or a loan is consummated. The FDIC is monitoring institutions’ efforts to ensure that consumers are receiving adequate disclosures in an appropriate timeframe through the supervisory review process. Many of the aforementioned misleading and potentially deceptive loan marketing practices served to mask some of the lax underwriting features in these hybrid ARM products.

Underwriting Weaknesses

The mortgage loan industry has offered hybrid ARM products to meet the financing needs of certain prime borrowers for some time. However, the extremely strong demand for subprime mortgages from late 2004 through the first half of 2007 heightened competition among originators to generate greater volume. In retrospect, this emphasis on quantity over quality clearly reflects that neither investors nor originators were sufficiently concerned with due diligence or the ramifications of risk-layering practices in an adverse economic environment. These practices included the following:

- Offering hybrid ARM loans to individuals who may have had limited repayment capacity or little experience with credit as a means of expanding the pool of potential loan candidates.

- Relaxing ability to repay standards to qualify borrowers based on the low introductory payment (rather than the fully indexed, fully amortizing payment required once the loan reset) and without consideration of other housing-related expenses, such as real estate taxes and insurance.

- Creating payment shock when the low introductory payments increased substantially after the reset, forcing many subprime borrowers to refinance their loans, as they could not afford the new higher payment amount.

- Allowing interest-only or payment-option terms that heightened payment shock by deferring the repayment of principal.

- Using simultaneous second-lien loans, or piggyback loans, that permitted borrowers to make a minimal or no down payment, resulting in their having little, if any, equity in their home.

- Permitting reduced documentation or No Doc loans, causing lenders to rely on unverified income information to analyze a borrower’s repayment capacity.7 Lenders offering these No Doc loans often charged borrowers a higher rate of interest for this service. Borrowers could have avoided this fee by providing copies of pay stubs, tax returns, bank statements, or other similar, readily available documentation.

- Imposing prepayment penalties that kept borrowers from refinancing their loans at a reasonable cost.

These weak underwriting practices enabled more borrowers to obtain loans that they could not afford to repay. The increased volume of hybrid ARMs contributed to record levels of net income at financial institutions, which were attributable, at least in part, to high levels of fee income from originating high-risk assets sold into the secondary market.8 However, these short-term profits are quickly dissipating. As of March 14, 2008, financial institutions have written off more than $195 billion in losses stemming from subprime loans, and most observers expect further losses as the subprime mortgage crisis works its way through the financial markets.9

Risk Management Practices for Hybrid ARMs

The interagency guidance specifies that an institution’s analysis of a borrower’s repayment capacity should include an evaluation of the borrower’s ability to repay the debt by its final maturity at the fully indexed rate, assuming a fully amortizing repayment schedule. When risk-layering features are combined with a mortgage loan, an institution should demonstrate the existence of effective mitigating factors that support the decision and the borrower’s repayment capacity. Typical situations where mitigating factors might exist could include a borrower with a strong performance history, whose financial condition has not deteriorated, and who is seeking to refinance with a similar loan, or a borrower with substantial liquid reserves or assets that support the prospect of repaying.10 However, a higher interest rate is not considered an acceptable mitigating factor. Reliance on any mitigating factors should be documented, and policies should govern the use of reduced documentation, which generally should not be accepted for subprime borrowers.

Institutions that engage in hybrid ARM lending activities need robust risk management practices and written policies that establish acceptable underwriting standards, including protocols governing risk-layering features. The written policies should establish the internal parameters that will be used for categorizing loans as subprime, if such parameters differ from those specified in regulatory guidance. For example, many institutions classify borrowers as subprime based on a Fair Isaac Company (FICO) credit score of 620 or less; however, regulatory guidance describes a FICO credit score of 660 or less as a characteristic of a subprime borrower.11

In addition, the interagency guidance states that hybrid ARM lending activities warrant an enhanced management information system (MIS) that proactively identifies and alerts the user of increasing risk given changing market conditions. The MIS should generate reports that segment the hybrid ARM portfolio by key characteristics, such as loans with high debt-to-income ratios, high combined loan-to-value ratios, the potential for negative amortization, low credit scores, non-owner-occupied investors, or a combination of these or other risk-layering features.

The probability of default and potential for loss should be measured across portfolio categories. Risk assessments based solely on recent historical performance may not adequately measure the risk in the segmented pools, given the strong housing market conditions experienced a few years ago. To help ensure an accurate assessment of portfolio risk, analyses should be based on current performance trends and local economic conditions. Loan segments characterized by weak underwriting standards and unreasonable credit risk may warrant adverse classification regardless of the delinquency status.12

Risk exposure may not be limited to the loan portfolio. The securities portfolio may harbor investments supported by pools of subprime hybrid ARMs. Bond rating agencies recently have downgraded the ratings of many mortgage-backed securities. For example, a national bond rating agency downgraded or placed a negative CreditWatch on 6,389 classes of securities and 1,953 collateralized debt obligations backed by subprime residential mortgages during the course of a single day.13 If a rating falls below investment grade, the security should be classified according to existing regulatory policy.14

Hybrid ARM lending activities can negatively affect other performance criteria. Earnings may be significantly lower because of impairments in the investment portfolio, reduced fee income, compressed interest margins, or increased loan provisions. The interagency guidance specifies that institutions should maintain the allowance for loan and lease losses and capital levels that are commensurate with the risk characteristics of the portfolio.

Contingency planning, counterparty risk assessments, and back-up lines of credit are critical to ensure adequate funding is available if product demand weakens in the secondary market. Ultimately, the failure to recognize or properly manage any of the associated risks of assets backed by hybrid ARM loans could reflect negatively on management. Robust risk management protocols consistent with the size and complexity of the operation are critical to properly managing the risks in hybrid ARM lending activities. The FDIC is closely reviewing management’s efforts to implement and adhere to prudent guidelines and procedures at institutions that engage in hybrid ARM lending activities.

Measuring and Managing the Fallout from Deficiencies in Mortgage Lending Practices

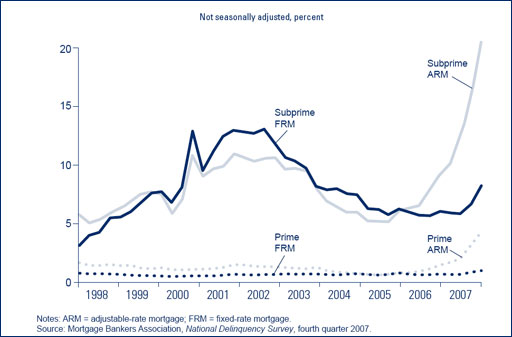

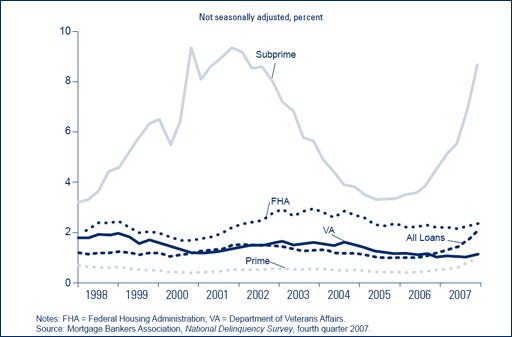

In 2007, hundreds of billions of dollars in subprime hybrid ARM debt began to reset. Almost 1.3 million subprime hybrid loans are scheduled to undergo their first reset during 2008, with an additional 422,000 subprime hybrid loans to reset in 2009.15 As reflected in Chart 1, the subprime ARM delinquency rate had risen to 20.4 percent in 2007, which was more than double the rate from one year earlier. The rising delinquency rate and continued deterioration in home prices have caused a surge in foreclosures. As shown in Chart 2, the rate of subprime ARMs in foreclosure also almost doubled from the prior year. Although subprime ARMs accounted for only 7 percent of total outstanding residential mortgage loans as of December 31, 2007, these products represented 42 percent of foreclosure starts.16

One report estimates that a foreclosure costs a lender about $50,000.17 However, the cost extends beyond a lender’s credit losses. Foreclosures inflict financial and less quantifiable costs on individual homeowners and their families and negatively affect neighborhoods and communities. A study of the external costs of foreclosure found that a single-family home foreclosure lowers the value of homes within one-eighth of a mile (or one city block) by an average 0.9 percent, and more so—as much as 1.4 percent—in a low- to moderate-income community.18 A contagion effect also may develop. As more foreclosures occur in close proximity, the value of nearby properties drops, resulting in even more foreclosures in the same community.19

Chart 1: Seriously Delinquent Subprime ARMs Soar to Record High

Chart 2: The Rate of Subprime ARMs in Foreclosure Almost Doubled from the Prior Year

An increase in foreclosure activity could contribute to escalating credit losses. In July 2007, a Merrill Lynch study forecast subprime credit losses of $146 billion and Alt-A credit losses of $25 billion.20 In December 2007, Merrill Lynch raised this projection to $300 billion, with subprime credit losses aggregating about $250 billion and Alt-A credit losses totaling about $50 billion.21 These figures approximate Standard & Poor’s January 2008 estimate that hybrid ARMs will result in more than $265 billion in losses for financial institutions.22 Unfortunately, asset quality has continued to decline significantly. On May 14, 2008, FitchRatings issued a report that estimates total losses of $400 billion to $550 billion.23 In comparison, aggregate losses sustained from the savings and loan crisis are estimated at $199 billion.24 These statistics bring into sharp focus the seriousness of the situation caused by weak underwriting and deceptive marketing practices.

The agencies and the Conference of State Bank Supervisors have encouraged federally regulated institutions and state-supervised entities that service mortgage loans to pursue loss mitigation strategies that preserve homeownership.25 The agencies issued guidance that describes prudent risk management practices and loss-mitigation strategies that institutions and servicers should consider in workout arrangements, as well as in loan modifications for residential mortgage borrowers (see Interagency Guidance inset box).

The agencies support other loan modification programs. The American Securitization Forum and the Hope Now Alliance developed industry guidance titled Streamlined Foreclosure and Loss Avoidance Framework for Securitized Subprime Adjustable Rate Mortgage Loans, which establishes a framework that the industry can use to modify certain securitized subprime mortgage loans.26 This guidance strongly encourages institutions that retain subprime hybrid ARMs in their loan portfolio or service these loans to incorporate streamlined loan modification procedures as part of loss-mitigation strategies.

Institutions generally should consider implementing streamlined loan modification procedures for mortgages that meet the Hope Now Alliance program eligibility criteria (see inset box on page 22).27 The FDIC also urges institutions to consider developing streamlined loss-mitigation strategies for borrowers who do not qualify under the Hope Now Alliance program, but face payment shock when their hybrid ARMs reset.

Further, the agencies will not penalize institutions that pursue streamlined loan modifications or reasonable workout arrangements with borrowers who cannot afford their payments after their loans reset. Institutions that engage in a significant volume of hybrid ARM activity should adopt reporting mechanisms that detail the types and success rates of these strategies. Institutions are encouraged to discuss the correct reporting of loss-mitigation strategies with accounting consultants, as some loan modifications could result in a troubled debt restructuring.

Conclusion

Approximately 1.5 million foreclosures occurred in 2007, an increase of 62 percent from a year earlier.28 Current market conditions suggest this negative trend will continue, as housing prices are unlikely to rebound in the near term. Much attention has focused on the negative impact that the payment shock in hybrid ARMs will have on subprime borrowers and the compounding effect of declining home prices. A second wave of credit distress could occur when other nontraditional mortgages, such as interest-only or payment-option loans, begin to reset or recast in 2009. Losses could increase as more borrowers have negative equity in their homes or are unable to make their payments.

Beverlea (Suzy) Gardner

Senior Examination Specialist

Division of Supervision and Consumer Protection

BGardner@fdic.gov

Dennis C. Ankenbrand

Senior Examination Specialist

Division of Supervision and Consumer Protection

San Francisco Region

DAnkenbrand@fdic.gov

1 United States Department of Commerce, Census Bureau Reports on Residential Vacancies and Homeownership, April 27, 2007, p. 4.

2 According to Inside Mortgage Finance (2007), subprime mortgages increased from 6 percent of total originations in 2002 to 20 percent in 2006.

3 Section 129(h) of TILA, 15 U.S.C. 1639(h); 12 C.F.R. § 226.34(a)(4).

4 Hybrid ARMs do not have a fixed or variable interest rate for the entire term of the loan. Instead, they start with a fixed rate for an introductory period, often two to three years, then reset to a variable rate.

5 “FTC Warns Mortgage Advertisers and Media That Ads May be Deceptive,” press release, September 11, 2007.

6 Payment shock refers to a significant increase in the amount of the monthly payment that generally occurs when hybrid ARMs reset to a fully indexed, fully amortizing repayment basis.

7 Mortgage Asset Research Institute, Eighth Periodic Mortgage Fraud Case Report to the Mortgage Bankers Association, April 2006, reported that one lender that reviewed a sample of 100 No Doc loans (for which it subsequently verified the borrowers’ income) found that almost 60 percent of the stated amounts were exaggerated by more than half.

8 “Insured Banks and Thrifts Report Record Earnings in 2006,” press release, February 22, 2007; and Quarterly Banking Profile, “All Institutions Performance Fourth Quarter 2006.”

9 Bloomberg, “Subprime Losses Reach $195 Billion,” March 14, 2008.

10 Interagency Statement on Subprime Mortgage Lending, July 10, 2007; and the Interagency Guidance on Nontraditional Mortgage Product Risks, October 4, 2006.

11 Statement on Subprime Mortgage Lending, July 10, 2007; Interagency Guidance on Nontraditional Mortgage Product Risks, October 4, 2006; Expanded Guidance for Subprime Lending Programs, January 31, 2001; and the Interagency Guidance on Subprime Lending, March 1, 1999.

12 Uniform Retail Credit Classification and Account Management Policy, June 12, 2000.

13 Standard & Poor’s, Ratings Direct, “Projected Losses for U.S. RMBS Transactions Affected by Jan. 30, 2008, Rating Actions,” February 4, 2008.

14 Interagency Uniform Agreement on the Classification of Assets and Appraisal of Securities Held by Banks and Thrifts, June 15, 2004.

15 Estimates are based on the Loan Performance Securities database. They reflect data collected through August 2007 on first-lien mortgages secured by owner-occupied properties where the mortgage has been securitized in private mortgage-backed securities issues. These figures have been adjusted to include an estimate of subprime securitized loans that are not included in the Loan Performance Securities database.

16 Mortgage Bankers Association, National Delinquency Survey, Fourth Quarter 2007. The seriously delinquent rate includes loans that are 90 days or more delinquent or in the process of foreclosure.

17 Special Report by the United States Congress Joint Economic Committee, Sheltering Neighborhoods from the Subprime Foreclosure Storm, April 17, 2007, p. 16.

18 Dan Immergluck and Geoff Smith, “The External Costs of Foreclosure: The Impact of Single-Family Mortgage Foreclosures on Property Values,” Housing Policy Debate 17, no.1 (2006).

19 NeighborWorks America, Effective Community-Based Strategies for Preventing Foreclosures, September 2005.

20 Merrill Lynch, “Economic Analysis: Credit Crunch Update: $500 Billion in Total Losses,” December 18, 2007, pp. 8–9. Alt-A loans are those made under expanded underwriting guidelines to borrowers with marginal to very good credit. Alt-A loans are riskier than prime loans because of the underwriting standards of the loans, not necessarily the credit quality of the borrowers.

21 Merrill Lynch, “Industry Overview: Magnitude, Distribution, and Timing of Losses,” July 20, 2007, p. 9.

22 Reuters, “S&P Sees Mortgage-Related Bank Losses Topping $265 Billion,” January 30, 2008.

23 FitchRatings, Special Report, Subprime Mortgage-Related Losses: A Moving Target, May 14, 2008.

24 Timothy Curry and Lynn Shibut, “The Cost of the Savings and Loan Crisis: Truth and Consequences,” FDIC Banking Review 13, no. 2 (2000): 26–35. The report estimates losses from the savings and loan crisis at $153 billion in 1995, which equals about $199 billion in 2007 on an inflation-adjusted basis.

25 The term “federally regulated institutions” refers to state- and nationally chartered banks and their subsidiaries, bank holding companies and their nonbank subsidiaries, savings associations and their subsidiaries, savings and loan holding companies and their subsidiaries, and credit unions.

26 The American Securitization Forum (ASF) is a broad-based professional forum through which participants in the U.S. securitization market can advocate their common interests on important legal, regulatory, and market practice issues. Hope Now is an alliance between counselors, mortgage market participants, and mortgage servicers to create a unified, coordinated plan to reach and help as many homeowners as possible.

27 American Securitization Forum, Streamlined Foreclosure and Loss Avoidance Framework for Securitized Subprime Adjustable Rate Mortgage Loans, “Executive Summary,” December 6, 2007.

28 FDIC estimate based on the fourth quarter 2007 Mortgage Bankers Association National Delinquency Survey.