The Volcker Rule

The final rule before the FDIC Board today would effectively undo the Volcker Rule prohibition on proprietary trading by severely narrowing the scope of financial instruments subject to the Volcker Rule. It would thereby allow the largest, most systemically important banks and bank holding companies to engage in speculative proprietary trading funded with FDIC-insured deposits. For that reason I will vote against this final rule.

Section 619 of the Dodd-Frank Act, known as the Volcker Rule, prohibits propriety trading in banks and bank holding companies. The Act defines proprietary trading as engaging as a principal for the trading account of a bank or bank holding company. The Act in turn defines trading account as any account used for acquiring or taking positions in financial instruments "principally for the purpose of selling in the near term (or otherwise with the intent to resell in order to profit from short-term price movements)", and any such other accounts as the appropriate federal agencies may, by rule, determine.

The definition of trading account thus determines the scope of financial instruments subject to the Volcker Rule prohibition on proprietary trading.

The current rule implementing the Volcker Rule was adopted by the federal financial regulatory agencies in 2013. The definition of trading account in the current rule encompasses all categories of financial instruments that are subject to fair value accounting regardless of how they are reported on bank financial statements because they may be freely traded.

The 2013 current rule recognized that proprietary trading occurs not only in financial instruments reported on the bank's balance sheet as "trading assets and liabilities", but in the accounts also denoted as available for sale (AFS), in equities held at fair value, and in derivatives not held for trading. The Notice of Proposed Rulemaking (NPR) adopted by the agencies in 2018 to make changes in the Volcker Rule included a definition of trading account that also captured all of these fair valued financial instruments.

The final rule before the FDIC Board today includes within the definition of trading account only one of these categories of fair valued financial instruments – those reported on the bank's balance sheet as trading assets and liabilities. This significantly narrows the scope of financial instruments subject to the Volcker Rule.

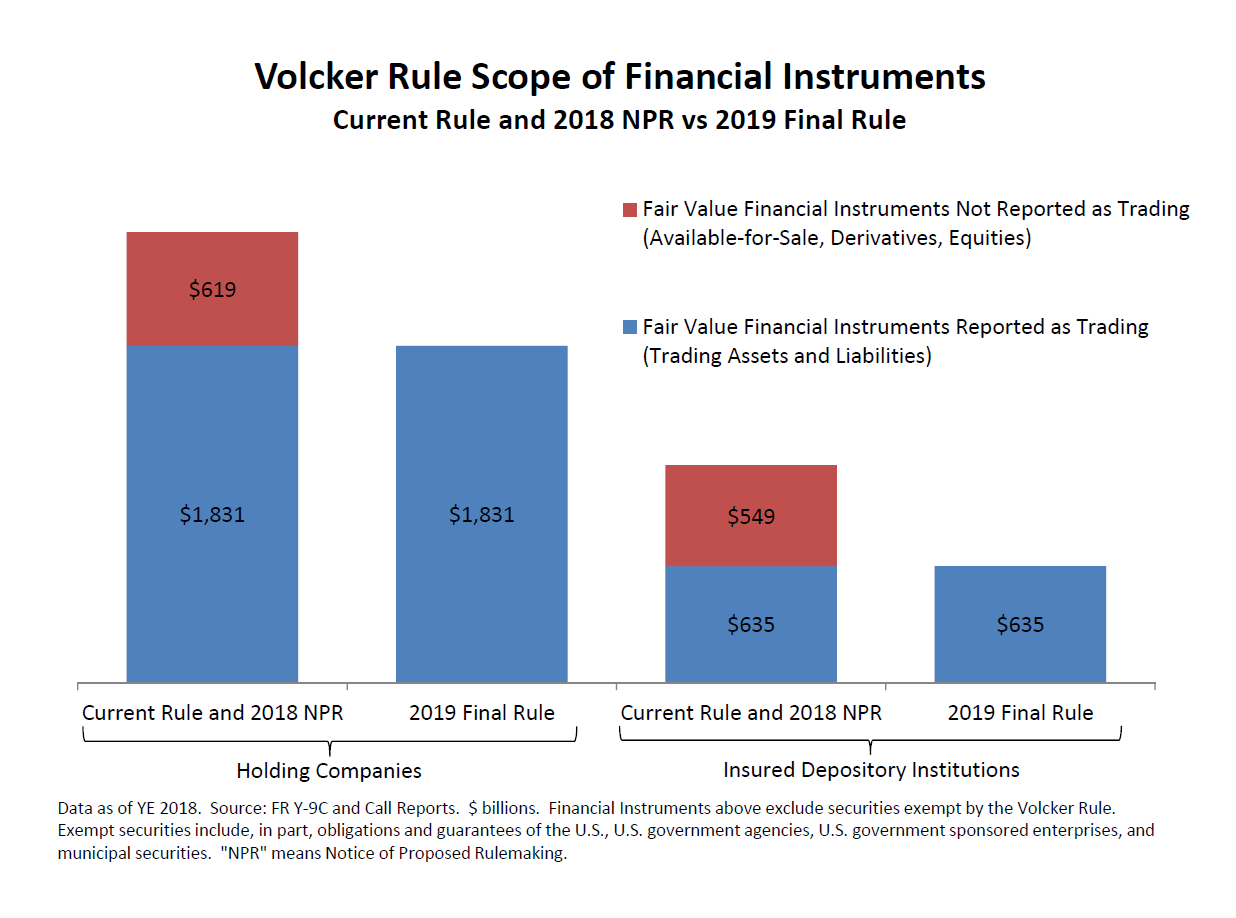

The chart demonstrates clearly the impact of the final rule before the FDIC Board today as compared to the 2013 current rule and the 2018 NPR.

At the holding company level, based on publicly available Y-9C data as of year-end 2018, the 2013 current rule and the 2018 NPR capture within the definition of trading account for purposes of the Volcker Rule over $2.4 trillion of financial instruments.

The final rule before the FDIC Board today, because of its narrower definition of trading account, captures over $1.8 trillion of financial instruments for purposes of the Volcker Rule. Thus, at the holding company level, about 25 percent of the financial instruments subject to the 2013 current rule and the 2018 NPR would no longer be subject to the prohibition on proprietary trading.

At the bank level, based on publicly available Call Report data as of year-end 2018, the impact of the final rule would be far more severe. Under the 2013 current rule and the 2018 NPR, a total of nearly $1.2 trillion of financial instruments would be subject to the Volcker Rule prohibition on proprietary trading at the bank level. Under the final rule before the Board today, $635 billion of financial instruments would be subject to the Volcker Rule. In other words, at the bank level, the final rule would exclude about 46 percent - nearly half - of financial instruments from the Volcker Rule that are subject under the 2013 current rule and the 2018 NPR.

The fact is that fair valued financial instruments, such as those recorded on the bank balance sheet as available for sale securities, equities, and derivatives not held for trading, were included within the scope of the Volcker Rule prohibition under both the 2013 current rule and the 2018 NPR because they are used for proprietary trading by banks and bank holding companies.

Available for sale securities and equities held at fair value, although not designated as trading assets for accounting purposes, are often bought and sold on a short-term basis for profit and the ability to do so is recognized in the accounting rules. Similarly, derivative contracts designated as not held for trading can be managed so as to profit from short-term price movements and still comply with the accounting standards.

By excluding these financial instruments from the Volcker Rule, the final rule before the Board today opens up vast new opportunity – hundreds of billions of dollars of financial instruments - at both the bank and bank holding company level, for speculative proprietary trading funded by the public safety net.

In addition, by excluding available for sale securities, fair value equity securities, and derivatives not held for trading from the Volcker Rule, the final rule creates an incentive for banks and bank holding companies to engage in proprietary trading in those activities. As the chart shows, since these financial instruments in particular are concentrated in banks, it creates an especially powerful incentive to engage in proprietary trading within the insured depository institution.

Further, excluding these financial instruments from the Volcker Rule makes it far more difficult for examiners to take supervisory action based on safety and soundness concerns if they observe highly risky trading activity in these financial instruments. A very high bar would have to be met because of their exclusion from the Volcker Rule.

I should note that the Volcker Rule provided for exemptions and exclusions, such as for liquidity management, to ensure that the portion of proprietary trading that was consistent with traditional banking activities and prudent safe-and-sound banking practices could continue.

It is also worth noting that as a result of the final rule before the FDIC Board today, the number of banks in the United States subject to the Volcker Rule will be drastically reduced. Currently 217 insured depository institutions remain subject to the Volcker Rule. Of those institutions, based on Call Report data as of year-end 2018, 104 have no trading assets and liabilities. As a result, they would effectively be excluded from the final rule's narrowed prohibition on proprietary trading, although they hold financial instruments currently subject to the Volcker Rule that can be used for such purposes.

There are additional changes made by this final rule that would weaken requirements under both the 2013 current rule and the 2018 NPR.

For example, by raising the threshold for a bank holding company or bank to be engaged in significant trading activity from $10 billion to $20 billion in consolidated trading assets and liabilities, the final rule narrows the application of the CEO attestation requirement to a smaller number of banking organizations than the 2013 current rule or the 2018 NPR. Since so many financial instruments currently subject to the Volcker Rule will be exempt under the final rule, it is not clear that CEO attestation and other prudential protections in the Volcker Rule will continue to be of consequence even for the institutions that remain subject to the Volcker Rule.

In conclusion, given the severe narrowing of the scope of financial instruments subject to the Volcker Rule under the final rule before the FDIC Board today, the Volcker Rule will no longer impose a meaningful constraint on speculative proprietary trading by banks and bank holding companies benefitting from the public safety net. For that reason I will vote against this final rule.

I should note that this final rule indicates that there will be a forthcoming rulemaking in regard to the Volcker Rule prohibition on investments in hedge funds and private equity funds by banks and bank holding companies. We will have to await that rulemaking when it is proposed and consider its consequences at that time.