FDIC Quarterly Banking Profile First Quarter 2025

Today, the FDIC is releasing first quarter 2025 performance results for FDIC-insured institutions.

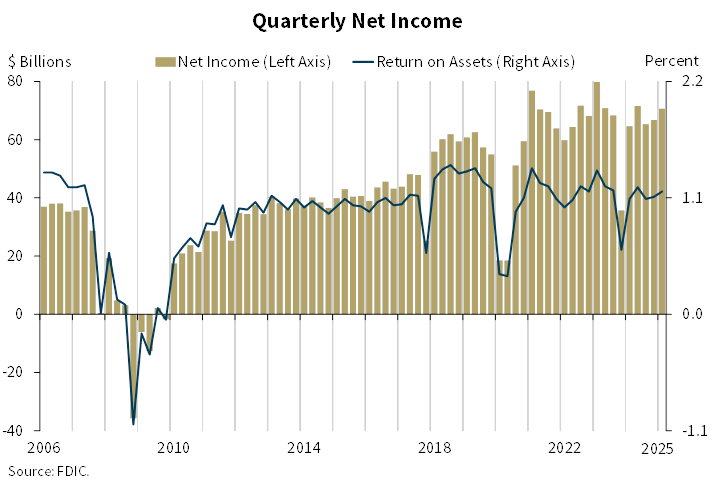

The banking industry finished the quarter with slightly higher earnings quarter over quarter, resulting in a return on assets (ROA) ratio of 1.16 percent. Domestic deposits increased for the third consecutive quarter, while loan growth remained modest. Asset quality metrics remained generally favorable despite continued weakness in certain portfolios, which we are monitoring closely.

With strong capital and liquidity levels to support lending and protect against potential losses, the banking industry continued to support the country’s needs for financial services while navigating the challenges presented by economic uncertainty, elevated inflation and interest rates, tighter credit, and elevated unrealized losses.

Chart 1:

This chart shows that the banking industry reported quarterly net income of $70.6 billion, an increase of $3.8 billion, or 5.8 percent, from the prior quarter. The quarterly increase in net income was led by higher noninterest income and lower losses on the sale of securities. The banking industry reported a ROA ratio of 1.16 percent in first quarter 2025, up six basis points from one quarter earlier and up eight basis points from one year earlier.

Community bank quarterly net income increased 10 percent from the prior quarter to $6.8 billion, driven by higher net interest income, lower losses on the sale of securities, coupled with lower provision expenses and noninterest expenses.

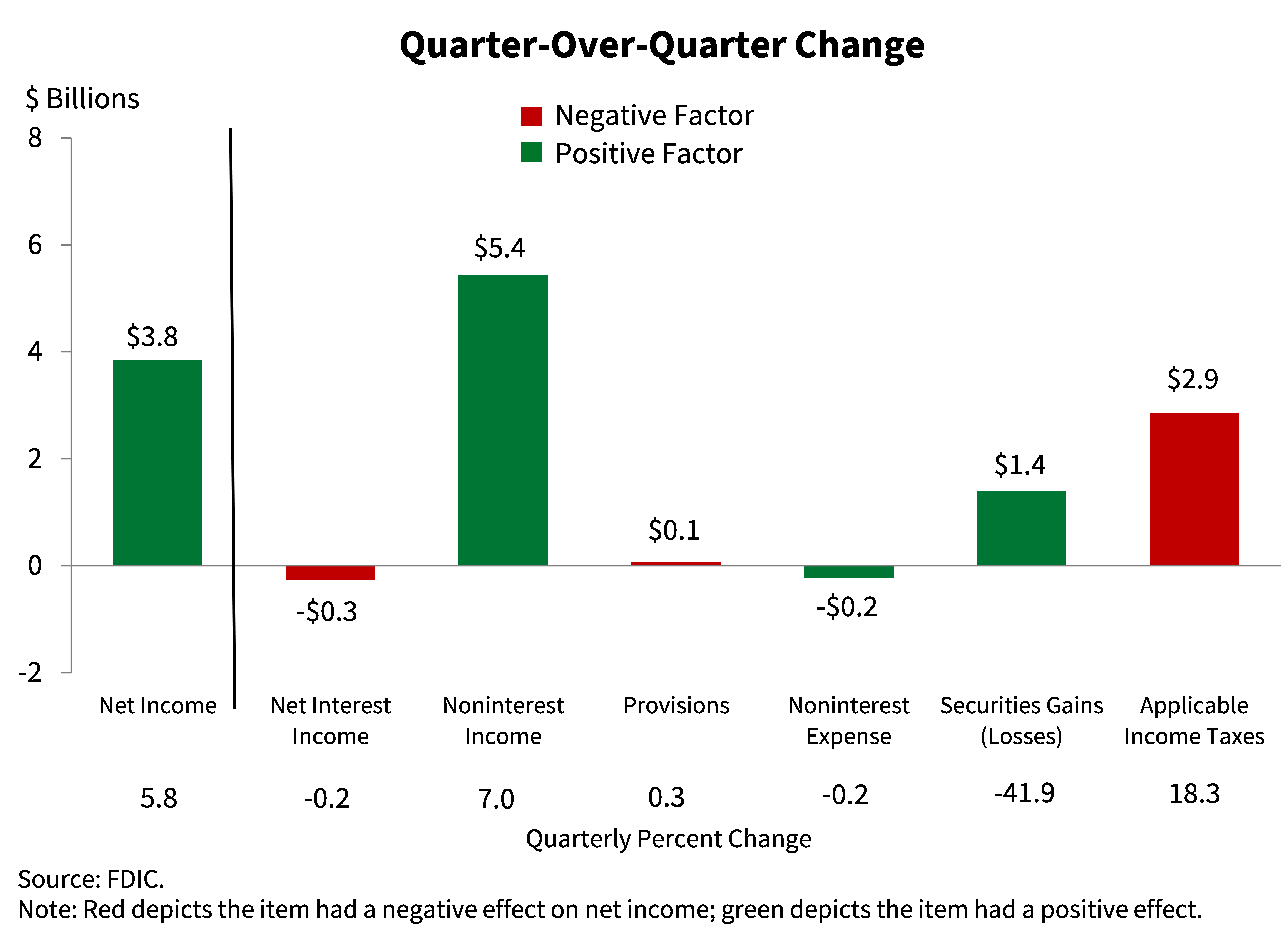

Chart 2:

This chart shows the breakdown of the changes in the industry’s net income quarter over quarter. The primary driver of the industry’s $3.8 billion increase in net income was higher noninterest income, which increased $5.4 billion, or 7.0 percent. Gains in noninterest income were due to market movements and volatility as several large firms reported mark-to-market gains on certain financial instruments in the quarter. Lower losses on the sale of securities also contributed to an increase in net income.

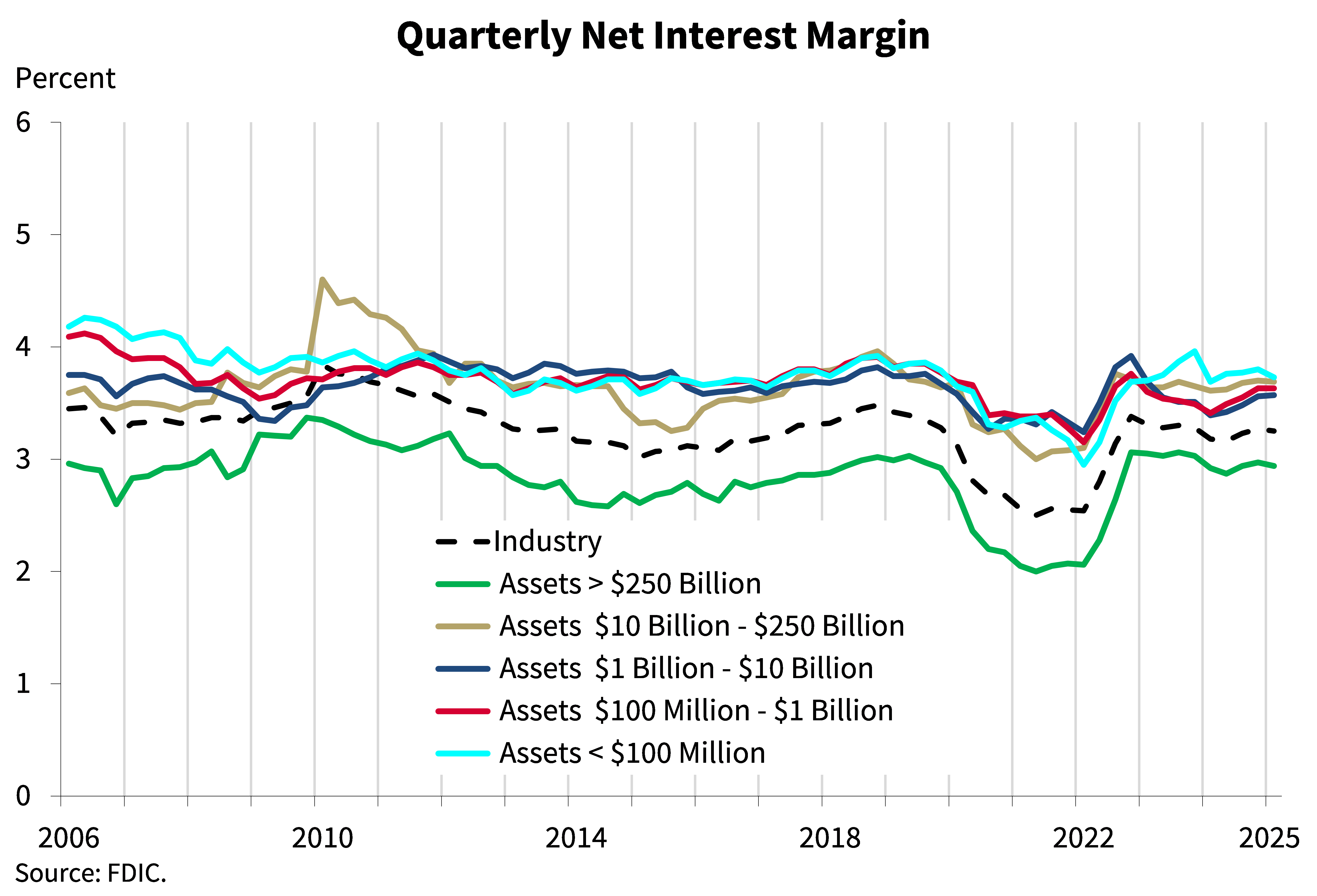

Chart 3:

This chart shows the average net interest margin (NIM) for the industry and for five asset size cohorts. The industry’s NIM declined modestly by two basis points from last quarter to 3.25 percent, equal to the pre-pandemic average.1

Conversely, community bank NIM increased for the fourth straight quarter to 3.46 percent, up two basis points from prior quarter. Despite the improvement, community bank NIM remained below the pre-pandemic average of 3.63 percent.

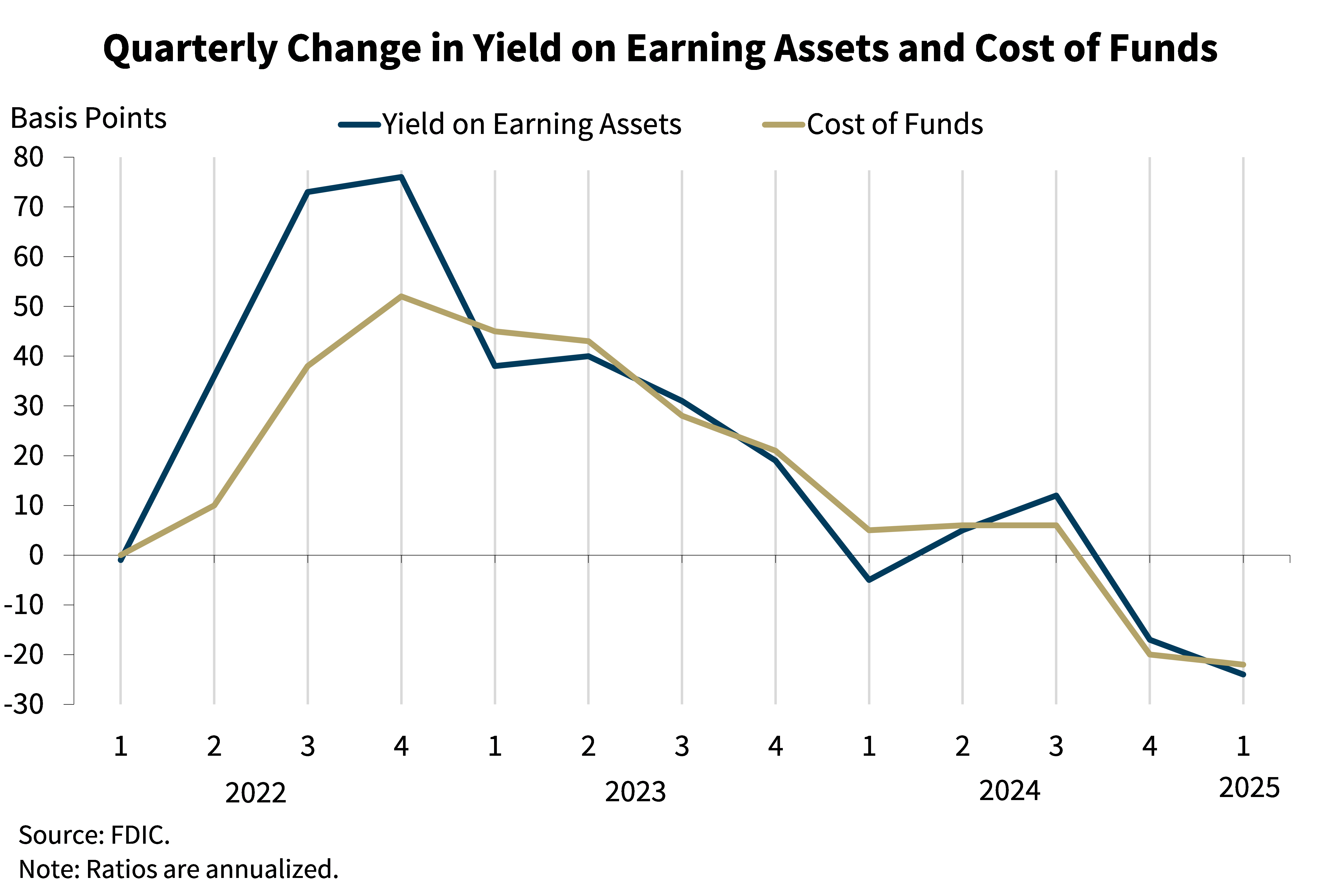

Chart 4:

The next chart shows the quarter-over-quarter changes in the industry’s average yield on earning assets and average cost of funds. During the quarter, the yield on earning assets decreased 24 basis points due partly to modest loan growth and generally declining longer-term rates during the first quarter. The cost of funds decreased 22 basis points due partly to lower deposit rates and fewer higher cost time deposits. The decline in the yield on earning assets outpaced the decline in the cost of funds, thus resulting in the decline in the industry’s NIM this quarter.

Community banks’ NIM increase in the first quarter was driven by a 15 basis-point decrease in the cost of funds, outpacing a 13 basis-point decrease in earning asset yields.

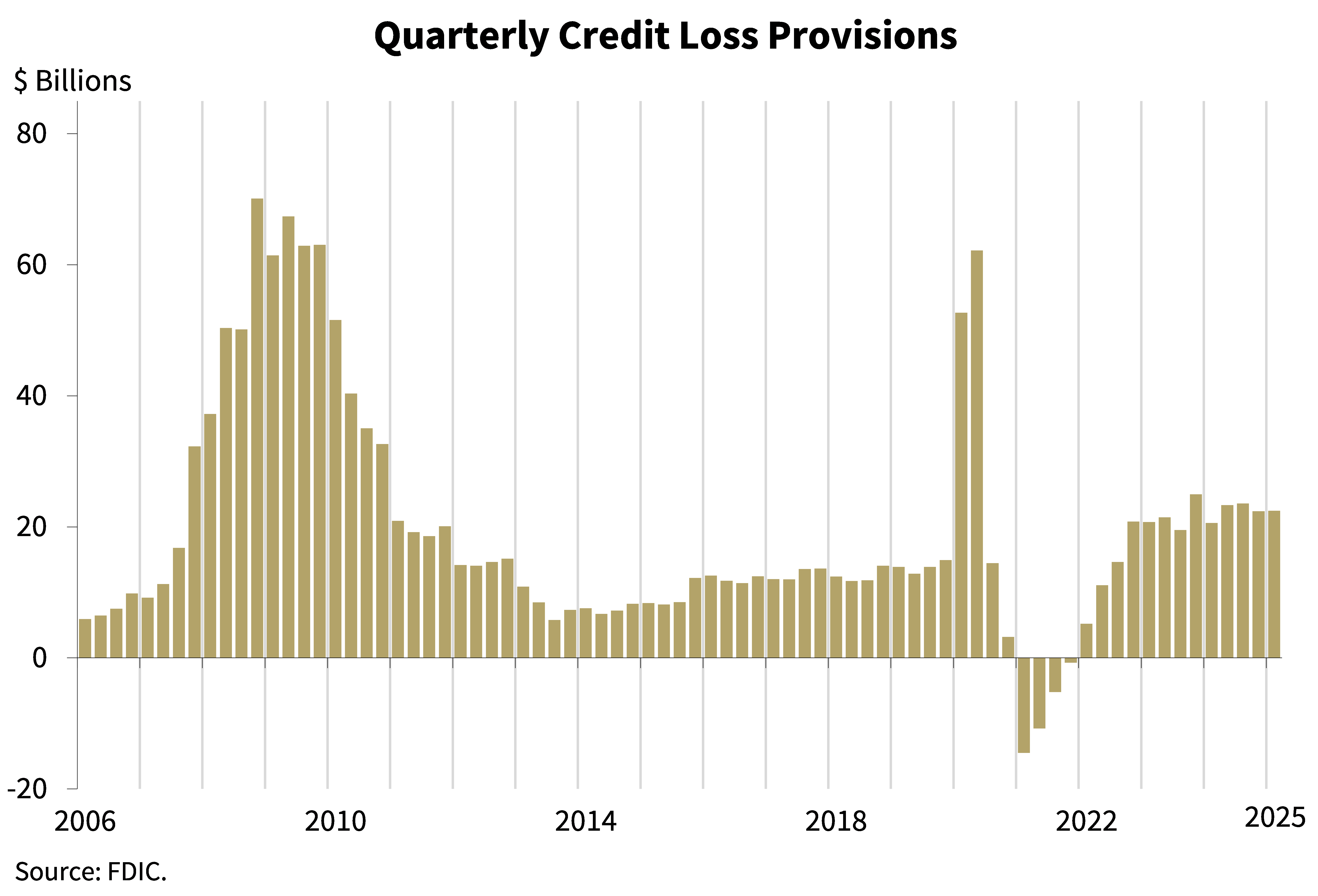

Chart 5:

The next chart shows that the industry’s provision expense was $22.5 billion in the first quarter, a modest increase of $66.5 million from the fourth quarter. The industry continued to build reserves, as provision expense exceeded net charge-offs by $1.2 billion for the quarter.

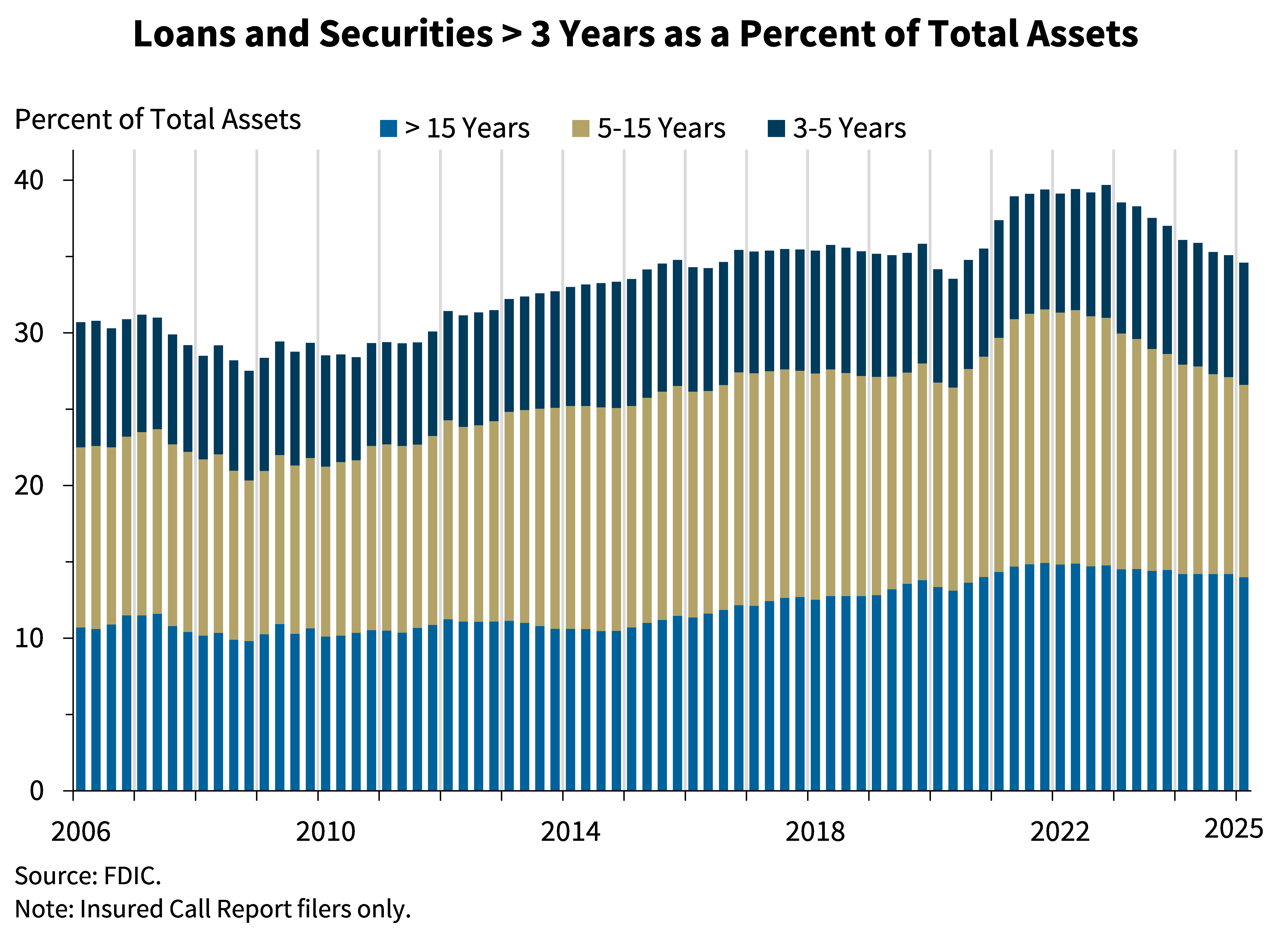

Chart 6:

This chart shows that the banking industry’s share of total assets made up of longer-term loans and securities fell for the ninth consecutive quarter to 34.6 percent after peaking at 39.7 percent in fourth quarter 2022. The industry’s longer-term assets as a share of total assets are now below the pre-pandemic average of 35.0 percent.

At community banks, longer-term loans and securities made up 44.2 percent of total assets in first quarter 2025, down from 45.0 percent last quarter and below the pre-pandemic average of 48.9 percent.

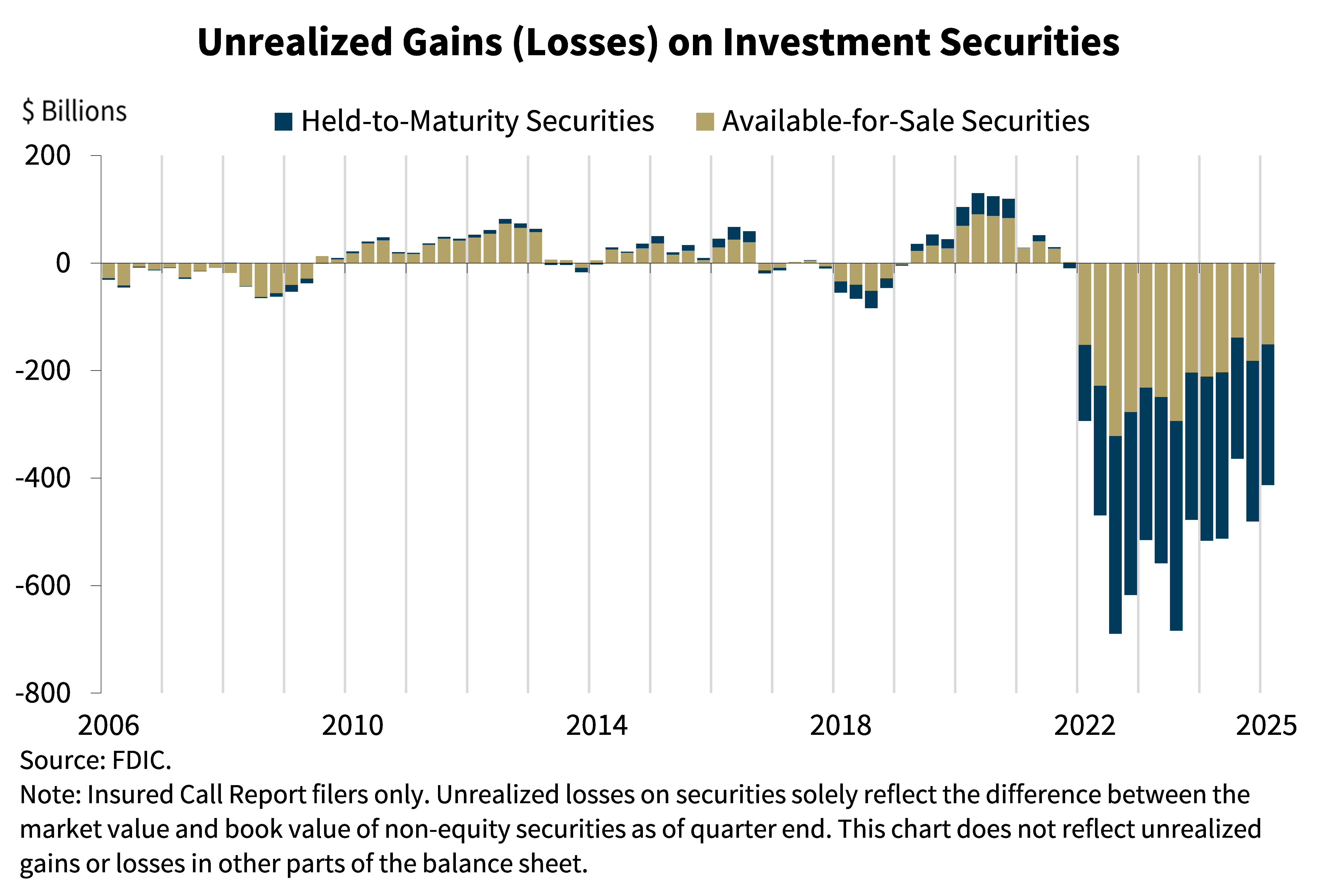

Chart 7:

The next chart shows the level of unrealized losses on held-to-maturity and available-for-sale securities portfolios. Total unrealized losses of $413.2 billion decreased $67.5 billion (14 percent) from the prior quarter. Longer-term interest rates such as the 30-year mortgage rate and the 10-year Treasury rate decreased in the first quarter, increasing the value of securities reported by banks and lowering unrealized losses. However, increases in longer-term interest rates since the end of the first quarter would likely reverse most of these improvements in unrealized losses if measured today.

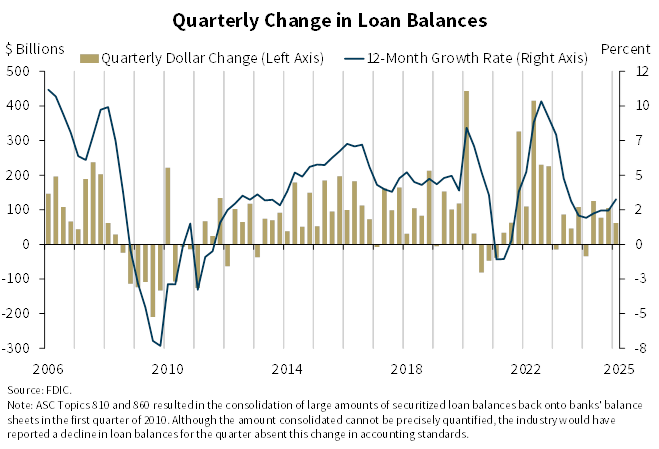

Chart 8:

The next chart shows the change in loan balances on a quarterly and annual basis. The industry’s total loans increased by $62.0 billion, or 0.5 percent, in the first quarter. Reporting of loans to non-depository financial institutions (NDFIs) increased the most in part due to continued reclassifications following the finalization of changes to how certain loan products to these types of institutions should be reported. In addition to these reclassifications, commercial and industrial (C&I), and multifamily CRE contributed to quarterly loan growth. The industry’s annual rate of loan growth in the first quarter was 3.0 percent, below the pre-pandemic average of 4.9 percent.

Total loans at community banks increased 0.8 percent from the prior quarter and 4.9 percent from the prior year, led by increases in nonfarm nonresidential CRE and 1-4 family residential mortgage portfolios.

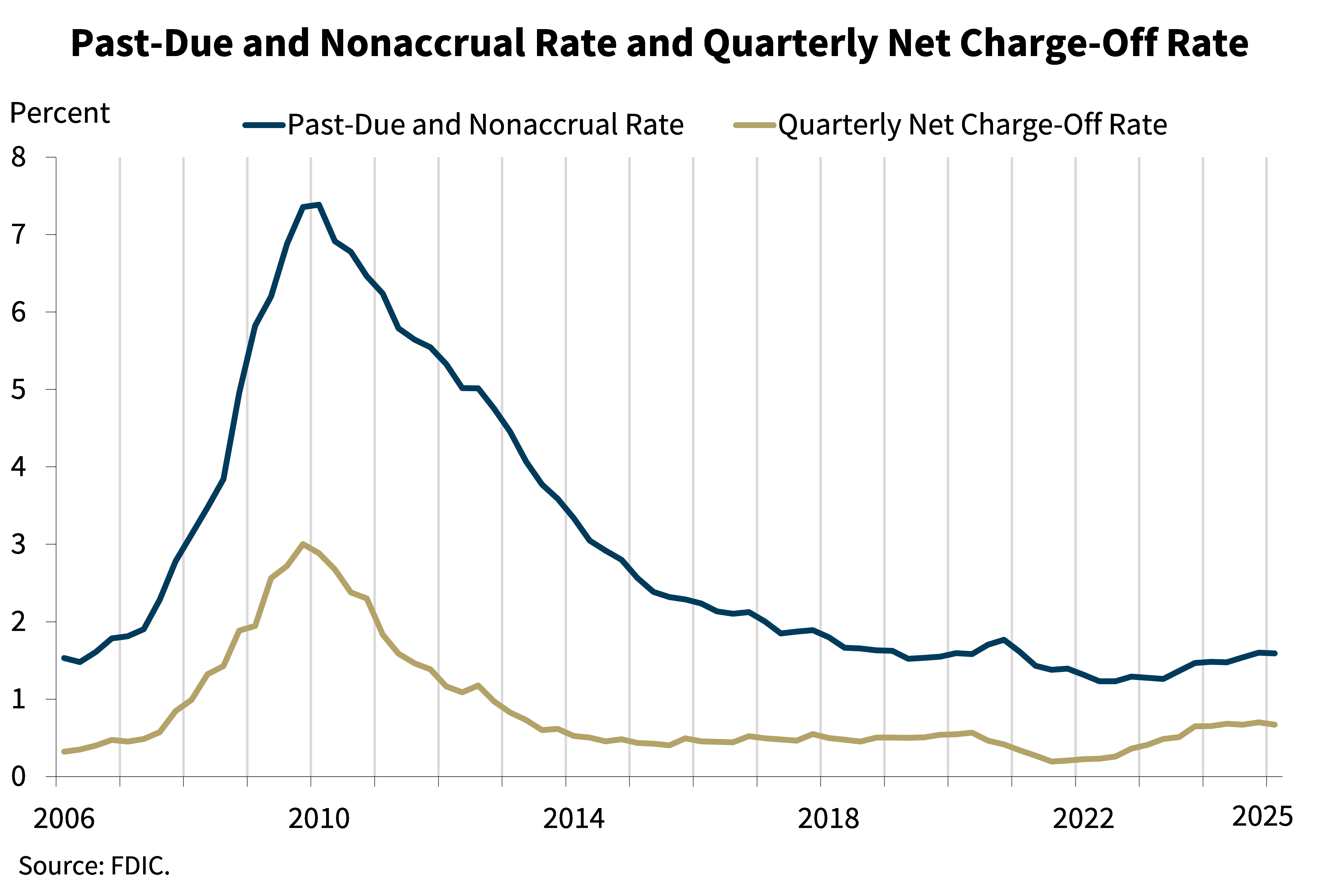

Chart 9:

The next chart shows that asset quality metrics for the industry remained generally favorable, though weakness in certain portfolios persisted. The overall past-due and nonaccrual (PDNA) rate fell one basis point from the prior quarter to 1.59 percent, a level still well below the pre-pandemic average rate of 1.94 percent.2 While banks reported quarterly decreases in PDNA of credit card loans and auto loans, the PDNA rate for commercial real estate (CRE) portfolios is the highest since the fourth quarter of 2014 and multifamily CRE PDNAs have grown the most in the past year.

The industry’s quarterly net charge-off rate of 0.67 percent decreased three basis points from last quarter and is one basis point higher than the year-ago quarter. The industry’s net charge-off rate was also 19 basis points higher than the pre-pandemic average. Nonfarm nonresidential CRE properties, C&I, and auto loans drove the quarterly decline in the total net charge-off rate. Most portfolios have net charge-off rates above their pre-pandemic averages including credit card loans, which are 123 basis points above the pre-pandemic average of 4.71 percent.

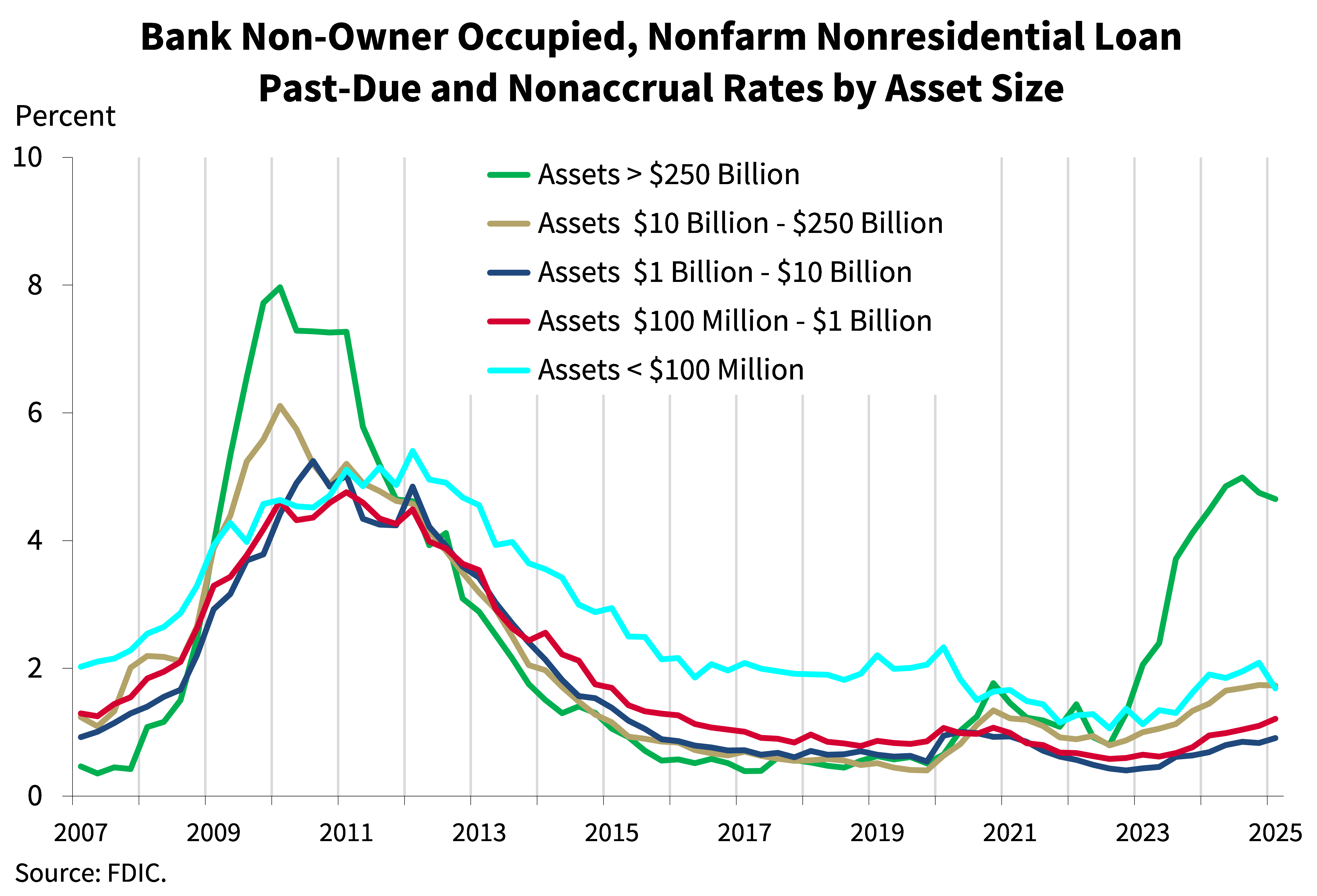

Chart 10:

Looking deeper into the CRE portfolio, the elevated PDNA rates of non-owner-occupied property loans persisted in the first quarter, driven by the portfolios of the larger institutions. The industry’s volume of PDNA non-owner-occupied CRE loans increased $13.0 million, or 0.1 percent, from the previous quarter.

As seen in this chart, the greatest weakness in non-owner-occupied CRE loans continued to be reported by the largest banks, or those with greater than $250 billion in assets. These banks reported a non-owner occupied CRE PDNA rate of 4.65 percent, down from 4.75 percent last quarter but well above their pre-pandemic average rate of 0.59 percent. However, these large banks have lower concentrations of such loans in relation to total assets and capital than smaller banks, mitigating the overall risk.

Banks with between $100 million and $10 billion in assets have greater concentrations in non-owner occupied CRE loans than the industry’s largest banks and reported an increase in non-owner occupied PDNA rates during the quarter, albeit from lower starting points.

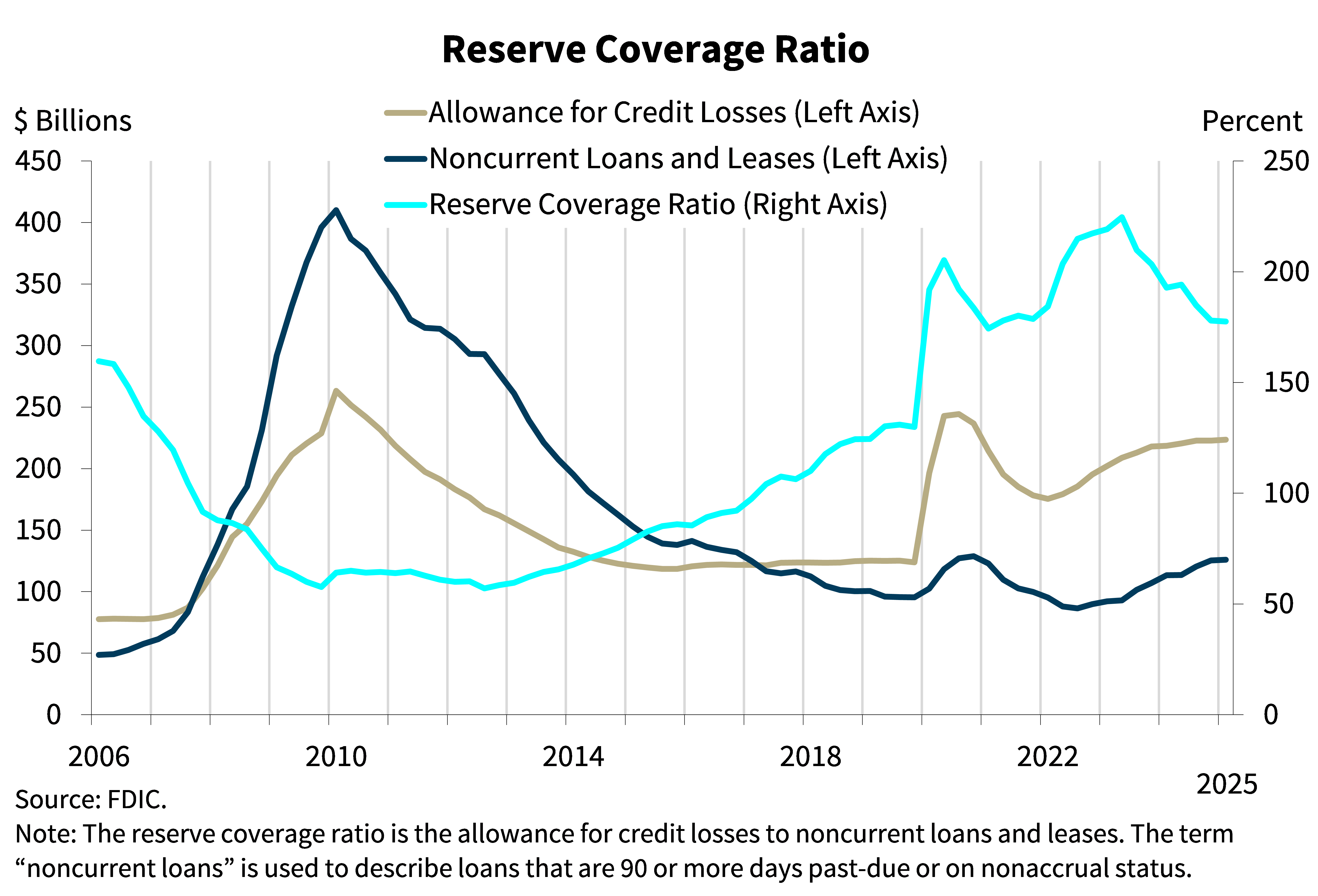

Chart 11:

The next chart shows that the allowance for credit losses had a modest increase relative to the previous quarter. The ratio of the allowance for credit losses to noncurrent loans slightly decreased from 177.9 percent in the fourth quarter to 177.5 percent this quarter. This is still a much higher coverage ratio than the pre-pandemic average.

The reserve coverage ratio at community banks declined from 179.9 percent in the fourth quarter to 168.8 percent this quarter, as noncurrent loan balances increased faster than the allowance for credit losses. Community banks’ pre-pandemic average reserve coverage ratio was 129.4 percent.

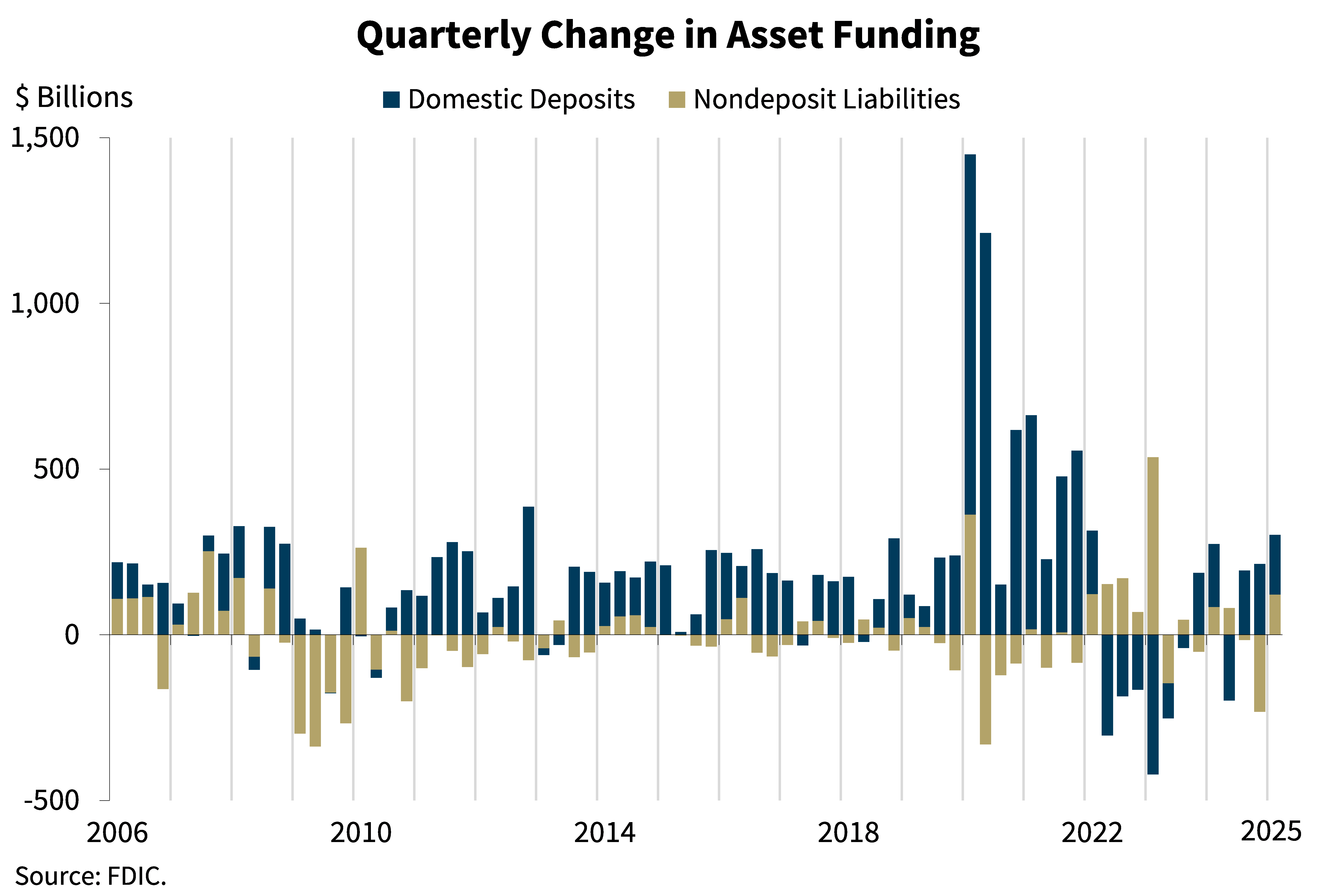

Chart 12:

The next chart shows that domestic deposits increased for the third consecutive quarter, rising $180.9 billion, or 1.0 percent, during the first quarter. Estimated insured domestic deposits increased $110.5 billion, or 1.0 percent, during the quarter. Brokered deposits decreased for the fifth straight quarter, down $14.9 billion (1.2 percent) from the prior quarter.

The industry’s nondeposit liabilities increased by $121.3 billion from the prior quarter, driven by growth in securities sold under agreement to repurchase.

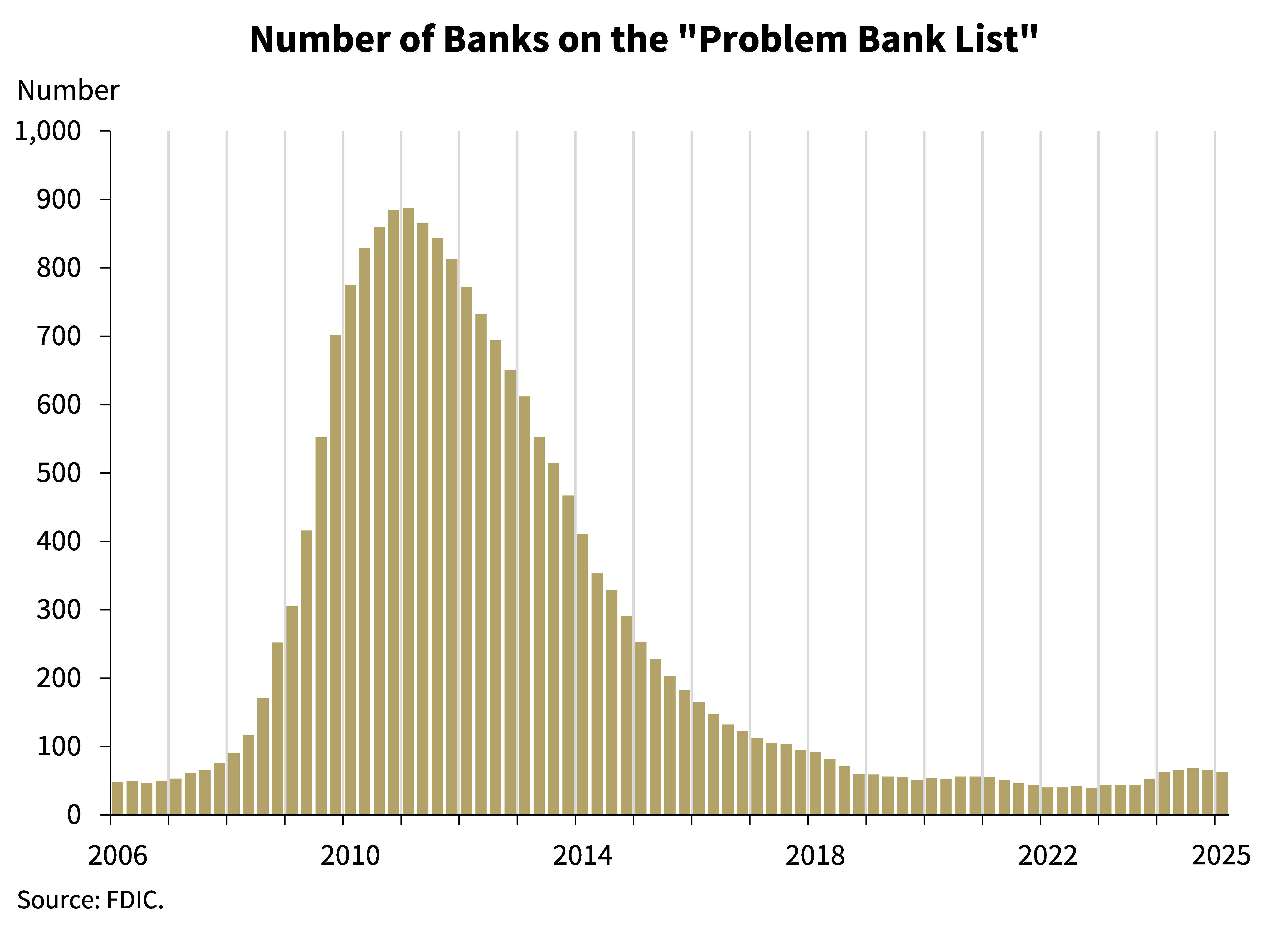

Chart 13:

This chart shows the number of banks on the FDIC’s “Problem Bank List.” Banks on this list have a CAMELS composite rating of “4” or “5”. The total number of banks on the list decreased by a net of three in the first quarter to 63 banks.3 The number of problem banks represent 1.4 percent of total banks, which is in the middle of the normal range for non-crisis periods of 1 to 2 percent of all banks. One bank failed during the first quarter.

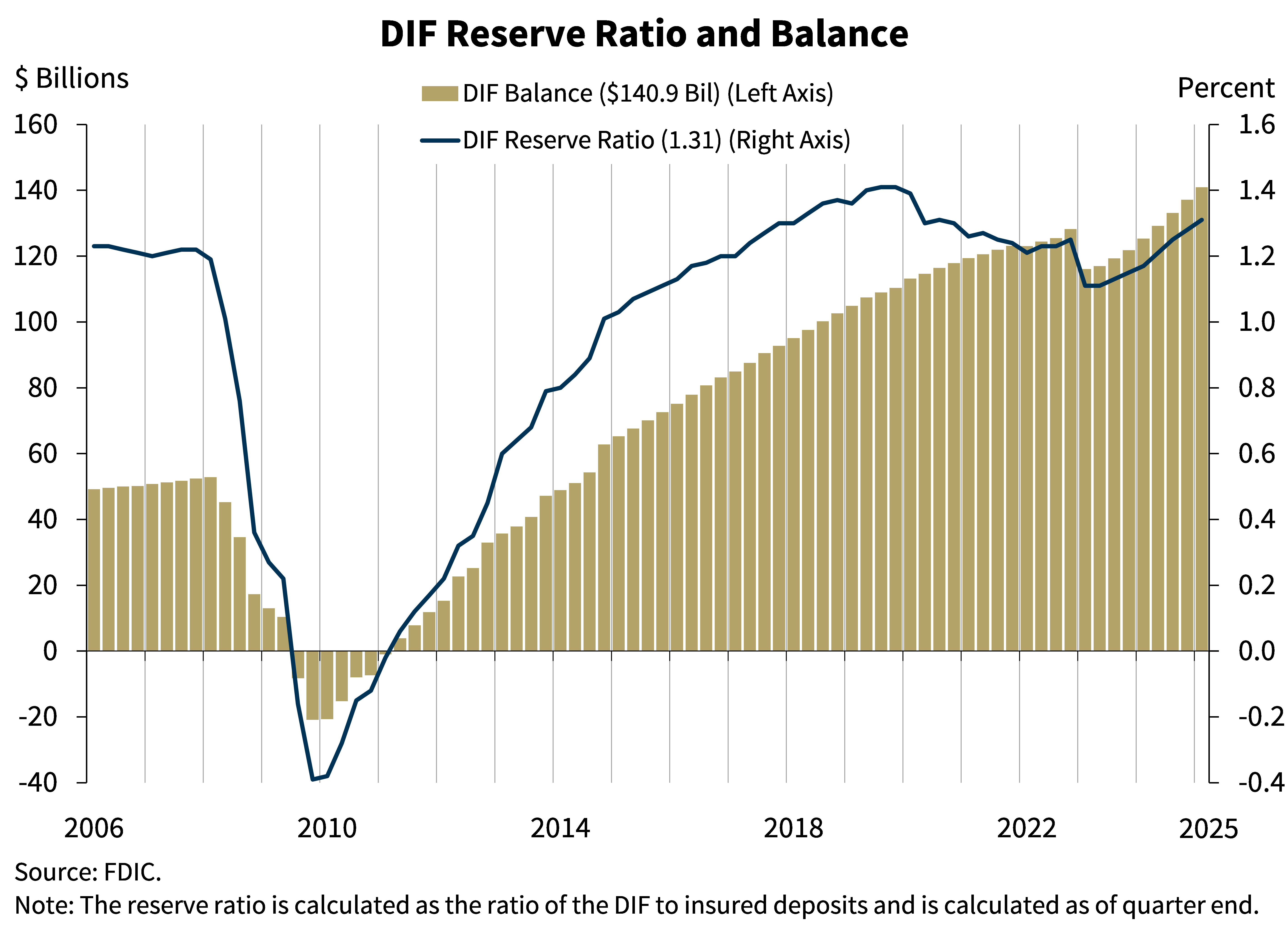

Chart 14:

This chart shows that the DIF balance was $140.9 billion on March 31, 2025, up $3.8 billion from the fourth quarter.4 Assessment revenue continued to be the primary driver of the increase, adding $3.2 billion to the DIF balance. Interest earned on investment securities, negative provisions for insurance losses, and unrealized gains on securities also contributed a combined $1.2 billion to the fund, partially offset by operating expenses of $617 million.

Insured deposits increased by 1.0 percent during the first quarter, while year-over-year insured deposit growth was 0.4 percent. The reserve ratio increased by three basis points in the first quarter to 1.31 percent and was 14 basis points higher than a year ago.

The FDIC adopted a DIF Restoration Plan on September 15, 2020, to return the reserve ratio to the statutory minimum of 1.35 percent by September 30, 2028, as required by law. Based on current trends, the reserve ratio is likely to reach the statutory minimum of 1.35 percent by year-end 2025. The FDIC will continue to monitor factors affecting the reserve ratio, including but not limited to, insured deposit growth and potential losses due to bank failures and related reserves.

In conclusion, the banking industry continued to show resilience in the first quarter with improvements in ROA. However, the industry still faces weakness in certain loan portfolios, economic uncertainty, elevated inflation and interest rates, tighter credit, and elevated unrealized losses. These issues will remain matters of ongoing supervisory attention by the FDIC.

| 1 | The “pre-pandemic average” is the average from first quarter 2015 through fourth quarter 2019. |

| 2 | In this statement, the terms “past-due and nonaccrual” or “PDNA” are used to describe loans that are 30 or more days past-due or on nonaccrual status. |

| 3 | In other words, the number of banks removed from the list exceeded the number of banks added to the list by three. |

| 4 | The net change in the DIF balance does not include the cost of protecting uninsured depositors pursuant to the systemic risk determination made for the two bank failures that occurred in March 2023, as the FDIC is required by statute to recover those losses through a special assessment. As of March 31, 2025, the total loss estimate for Silicon Valley Bank and Signature Bank was $22.3 billion, of which $19.1 billion is attributable to the protection of uninsured depositors pursuant to the systemic risk determination and will be recovered through the special assessment. As with all receiverships, loss estimates will be periodically adjusted as the FDIC as receiver of failed banks sells assets, satisfies liabilities, and incurs receivership expenses. |