The FDIC works with chartering authorities and federal regulators to resolve failing banks in the least costly manner. Banks meeting supervisory criteria can be invited to a failing bank acquisition.

At the time a failing bank is marketed, it is an open and operating entity. All aspects of marketing activities and information concerning the failing bank must be held in strict confidence. After executing a confidentiality agreement, interested bidders are granted access to failing bank information to conduct due diligence and review FDIC transaction terms. The FDIC conducts a sealed, competitive bid process and evaluates bids against FDIC’s cost of liquidation and the cost of other bids.

Banks may qualify for acquisition opportunities of potentially failing banks based on factors such as location, size, capital level, and supervisory ratings. Nonbank asset buyers may be offered the opportunity to acquire assets of certain failing banks marketed by the FDIC around the time of failure after completing a qualification process and receiving approval from the FDIC.

The resolution process may occur over a period of days or several weeks. Alternatively, solutions to the troubled condition may be found at any time during the marketing process, and the bank may not fail. A failing bank not able to improve its troubled condition is closed by its chartering authority. Once closed, the FDIC is appointed receiver for the failed bank and can immediately enter a Purchase and Assumption Agreement (P&A) with the winning bidder.

Acquisition Overview

The FDIC markets potentially failing banks.

Transaction Types

Transaction types used to purchase a failing bank.

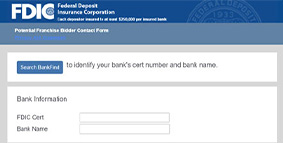

Bidder Qualification

Qualifications to be invited to acquisition opportunities.

Alliance Bidding

The FDIC may allow bidders to combine resources to acquire larger failing banks.

Bid Evaluation

The FDIC analyzes the cost of each bid to determine the least cost to its deposit insurance fund.

Loan Pools Offered to Asset Buyers Prior to Bank Failure

Qualified asset buyers may be offered the opportunity to acquire loans of larger potentially failing banks marketed by the FDIC.

Additional Resources