An Introduction to Some FDIC Money Smart Alliance Members…and Their Successes

In this edition of Money Smart News, we highlight some of our Alliance members (organizations that agree to use or promote the Money Smart curriculum). Through one-on-one interviews with representatives of these organizations, we learned a lot about their experiences using Money Smart in their communities.

- Red River Bank in Alexandria, Louisiana, has used Money Smart since the program was created by the FDIC in 2001. The bank teaches financial education to seniors, adults, and bank employees. Its educators have found that making short versions of the modules available online has been well-received by high school students and teachers. The bank’s Community Reinvestment Act (CRA) Officer, F. Jannease Seastrunk, said, “We also recognize that our younger generation may not sit for a financial education seminar, but if they have a desire to learn about a specific topic, they will view a short explanation online.”

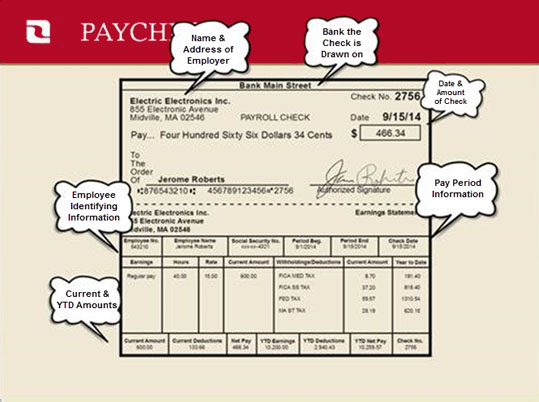

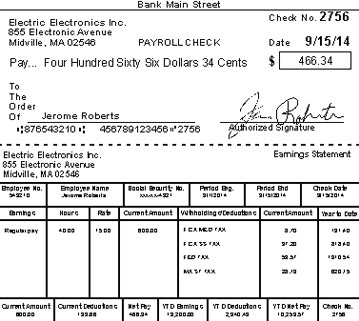

In addition, the bank has found the benefits of combining parts of Money Smart with other financial education programs. For example, to conduct financial education training for homeschooled students who are about to go to college or start working, the Red River Bank team tweaked Money Smart for Young People by combining the modules “Bread and Butter (Managing Your Paycheck)” and “Convertible or Clunker (Automobile Purchase).” Seastrunk added: “We shortened the presentation and created resources such as a sample paycheck. Teaching financial education helps to fulfill our efforts to serve people in underbanked communities. It would be great to have more Alliance members in the Central Louisiana area.”

To provide financial education training for a homeschool class, Red River Bank produced a revised version of a Money Smart for Young People handout from the “Bread and Butter (Managing Your Paycheck)” module (see example above).

- The University of Maryland Extension (UME) Western Maryland Cluster has been teaching Money Smart for more than two years. About half of the teaching time is geared toward older adults at senior centers using the Money Smart for Older Adults curriculum. Time is also spent teaching financial education at four local elementary schools. Through an invitation from Allegany County, UME provides financial literacy during afterschool programs. Educators use Money Smart for Young People lessons for grades Pre-K to Grade 2 and Grades 3 to 5. Jesse M. Ketterman, Jr., the Extension Educator, noted, “Money Smart resources allow me to provide engaging activities in the community I serve.”

- First Savings Bank of Hegewisch, headquartered in Chicago, Illinois, has been using Money Smart for more than five years by partnering with other organizations in need of financial education instructors. Partnerships have included municipalities, libraries, and community groups that host meetings for local citizens. Depending on the audience, the bank’s employees may present on topics such as budgeting and saving, how to purchase a home, credit and credit recovery, and elder abuse and identity theft.

“Since Money Smart provides modules on all of these topics, it’s simple for the bank to accommodate the requests of our community partners,” said CRA Officer Cherilyn Parker. For example, she said one branch manager will soon be presenting modules from Money Smart for Older Adults to a community group on the southeast side of Chicago, and another branch manager will be presenting the “Your Own Home” module from Money Smart for Adults to potential homebuyers through a housing community partnership. “I’m excited to see the coming updates to Money Smart for Adults,” Parker added. - Limestone Bank in Louisville, Kentucky, has used all versions of Money Smart for more than 10 years through partnerships with nonprofits, churches, workforce centers, housing authorities, adult education centers, and schools. According to Jim Watkins, CRA Officer, “The material as a whole is fantastic and has all that I need.”

As one example of the bank’s financial education services, it teaches Money Smart for Young People at an eight-week summer camp program for more than 200 low-income K-12 students. Parents of the campers who attend at least two of the four financial education workshops receive a $100 discount off the cost of the camp. In addition, adults who complete Money Smart classes that the bank offers through partnerships with housing authorities and adult education centers are eligible to have the fee for their GED examination (to earn a high school diploma) paid by the bank. Lastly, the bank works with workforce development groups to help people open bank accounts and learn how to use online mobile banking.

Tips for Financial Educators from Money Smart Alliance Members

Preparing to teach financial education? Here are a few tips that can help you use Money Smart more effectively.

Know your audience. “With advance knowledge of who your audience will be, prepare accordingly and enjoy the opportunity to have a positive impact on your communities.”

–Cherilyn Parker, CRA Officer, First Savings Bank of Hegewisch, Homewood, IL

Partner with local organizations. “As a financial institution, we have found that partnering with local organizations to provide financial education allows us to maximize our resources and have a greater impact.”

–F. Jannease Seastrunk, CRA Officer, Red River Bank, Alexandria, LA

Plan ahead. “Knowing what resources are available at the location you will be presenting helps to ensure engaging activities with your audience.”

–Jesse M. Ketterman, Jr., Extension Educator, University of Maryland Extension, Western Maryland Center, Cumberland, MD

It’s not in the numbers. “If you help just one person improve their financial situation, you have accomplished success.”

–Jim Watkins, CRA Officer, Limestone Bank, Louisville, KY

See more success stories from Money Smart News.

For help or information on how to use the Money Smart curriculum, contact communityaffairs@fdic.gov.