“The FDIC has long recognized the importance of minority depository institutions in the financial system and their unique role in promoting the economic viability of minority and under-served communities.”

FDIC Statement of Policy Regarding Minority Depository Institutions

June 23, 2021

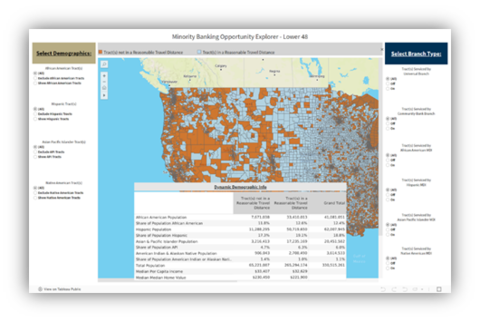

Announcing the FDIC’s Banking Opportunity Explorer

The FDIC developed a new tool to support its statutory mission to promote minority depository institutions by assisting financial institution organizing groups in identifying potential business opportunities in areas that may meet the "community served" part of an MDI designation. The tool also supports existing MDIs’ growth by identifying geographic areas for management to explore when considering new branch locations or advertising opportunities. The FDIC provides this tool for informational and research purposes only. Please click here to open the Banking Opportunity Explorer.

Introducing the MDI Program Newslink!

The Office of Minority and Community Development Banking (OMCDB) is thrilled to introduce our new quarterly newslink! In this publication, the OMCDB will share timely and effective updates on MDI Program resources, regulatory guidance, news, and events. While the OMCDB operates as small team at FDIC Headquarters in Washington, D.C., our reach is expansive given the resources available through the various FDIC Divisions and Offices and our partners in the six regional offices. The OMCDB looks forward to enhancing our communication efforts through this newslink by sharing pertinent information and highlighting MDI activity.

To receive updates on future MDI Program Newslink publications, please click HERE to subscribe.

Maggie Lena Walker: America’s National Treasure in Banking

In 1903, Maggie Walker became the first African American woman to found and charter a bank in the United States, serving as its president and using her standing to foster self-sufficiency and economic empowerment in her community. Learn more about her accomplishments.