DIF Balance Sheet - Third Quarter 2023

| Balance Sheet | |||||

|---|---|---|---|---|---|

| Sep-23 | Jun-23 | Quarterly Change | Sep-22 | Year-Over-Year Change | |

| Cash and cash equivalents | $30,230 | $25,353 | $4,877 | $5,767 | $24,463 |

| Investment in U.S. Treasury securities | 52,215 | 53,459 | (1,244) | 116,572 | (64,357) |

| Assessments receivable | 3,273 | 3,231 | 42 | 2,101 | 1,172 |

| Special Assessments receivable | 16,274 |

15,776 |

498 |

0 |

16,274 |

| Interest receivable on investments and other assets, net | 350 |

286 |

64 |

745 |

(395) |

| Receivables from resolutions, net | 158,395 |

159,468 |

(1,073) |

590 |

158,805 |

| Property and equipment | 368 |

366 |

2 |

355 |

13 |

| Operating lease right-of-use assets | 79 |

81 |

(2) |

98 |

(19) |

| Total Assets | $261,184 |

$258,020 |

$3,164 |

$126,228 |

$134,956 |

| Accounts payable and other liabilities | 401 |

256 |

145 |

259 |

142 |

| Operating lease liabilities | 100 |

101 |

(1) |

114 |

(14) |

| Liabilities due to resolutions | 140,311 |

140,242 |

69 |

0 |

140,311 |

| Postretirement benefit liability | 232 |

232 |

0 |

332 |

(100) |

| Contingent liability for anticipated failures | 801 |

220 |

581 |

65 |

736 |

| Contingent liability for litigation losses | 0 |

1 |

(1) |

1 |

(1) |

| Total Liabilities | $141,845 |

$141,052 |

$793 |

$771 |

$141,074 |

| FYI: Unrealized gain (loss) on U.S. Treasury securities, net | (667) |

(1,007) |

340 |

(3,459) |

2,792 |

| FYI: Unrealized postretirement benefit (loss) gain | 27 |

27 |

0 |

(83) |

110 |

| Fund Balance | $119,339 |

$116,968 |

$2,371 |

$125,457 |

($6,118) |

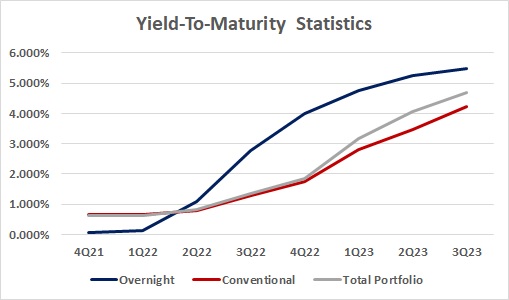

The portfolio’s yield has experienced a dramatic shift with rising interest rates over the last year. This quarter’s increase can be attributed to both the Federal Open Market Committee’s last rate hike, a heavy concentration of funds in the overnight portfolio, and taking an impairment on certain securities in the conventional portfolio.

| Overnight | Conventional | Total Portifio | |

|---|---|---|---|

| 4Q21 | 0.061% | 0.661% | 0.633% |

| 1Q22 | 0.132% | 0.667% | 0.641% |

| 2Q22 | 1.095% | 0.805% | 0.821% |

| 3Q22 | 2.758% | 1.282% | 1.351% |

| 4Q22 | 4.005% | 1.761% | 1.865% |

| 1Q23 | 4.755% | 2.811% | 3.163% |

| 2Q23 | 5.262% | 3.471% | 4.046% |

| 3Q23 | 5.475% | 4.234% | 4.689% |