DIF Balance Sheet - Third Quarter 2019

|

|

| Quarterly |

| Year-Over-Year |

|---|---|---|---|---|---|

| Balance Sheet | |||||

| Cash and cash equivalents | $4,268 | $8,795 | ($4,527) | $2,790 | $1,478 |

| Investment in US Treasury securities | 100,873 | 94,524 | 6,349 | 92,211 | 8,662 |

| Assessments receivable | 1,115 | 1,060 | 55 | 2,702 | (1,587) |

| Interest receivable on investments and other assets, net | 582 | 694 | (112) | 539 | 43 |

| Receivables from resolutions, net | 2,801 | 3,204 | (403) | 2,897 | (96) |

| Property and equipment, net | 317 | 320 | (3) | 322 | (5) |

| Total Assets | $109,956 | $108,597 | $1,359 | $101,461 | $8,495 |

| Accounts payable and other liabilities | 212 | 241 | (29) | 204 | 8 |

| Liabilities due to resolutions | 427 | 530 | (103) | 654 | (227) |

| Postretirement benefit liability | 236 | 236 | 0 | 259 | (23) |

| Contingent liability for anticipated failures | 108 | 111 | (3) | 106 | 2 |

| Contingent liability for guarantee payments and litigation losses | 33 | 33 | 0 | 34 | (1) |

| Total Liabilities | $1,016 | $1,151 | ($135) | $1,257 | ($241) |

| FYI: Unrealized gain (loss) on US Treasury securities, net | 586 | 500 | 86 | (1,371) | 1,957 |

| FYI: Unrealized postretirement benefit (loss) gain | (14) | (14) | 0 | (46) | 32 |

| Fund Balance | $108,940 | $107,446 | $1,494 | $100,204 | $8,736 |

| Dollars | |

|---|---|

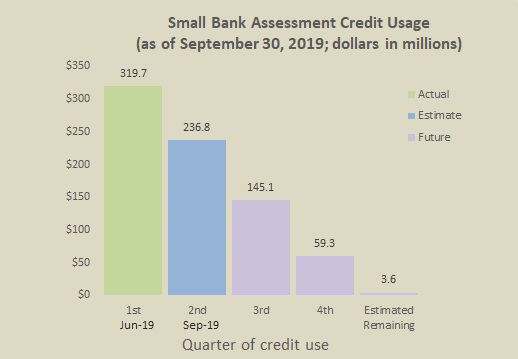

| 1st Quarter June 2019 | 319.7 |

| 2nd Qtr September 2019 estimate | 236.8 |

| 3rd Qtr future | 145.1 |

| 4th Quarter future | 59.3 |

| Estimated Remaining | 3.6 |

Pursuant to FDIC rulemaking in response to the Dodd-Frank Act increase of the minimum reserve ratio to 1.35 percent, small banks were awarded credits for the portion of their assessments that contributed to growth in the reserve ratio from 1.15 percent to 1.35 percent. The total amount of available credits is $765 million. As of June 30, 2019, the reserve ratio exceeded 1.38 percent by reaching 1.40 percent, and small bank credits in the amount of $320 million were applied. In addition, the 3rd quarter assessment revenue estimate was reduced by $237 million for expected credit usage. The chart presents the actual and estimated credit usage by quarter; 73% of the credits are expected to be used in just two quarters of offset.