Selected Financial Data - Third Quarter 2019

| Sep-19 | Jun -19 | Quarterly Change | Sep -18 | Year-Over-Year Change |

|---|---|---|---|---|---|

| FSLIC Resolution Fund | |||||

| Cash and cash equivalents | $918 | $912 | $6 | $896 | $22 |

| Accumulated deficit | (124,570) | (124,576) | 6 | (124,593) | 23 |

| Total resolution equity | 919 | 913 | 6 | 897 | 22 |

| Total revenue | 17 | 11 | 6 | 11 | 6 |

| Operating expenses | 0 | 0 | 0 | 0 | 0 |

| Losses related to thrift resolutions | 0 | 0 | 0 | 0 | 0 |

| Net Income (Loss) | $17 | 11 | 6 | $11 | $6 |

| $ in millions | DIF | FRF | ALL FUNDS | ||||||

|---|---|---|---|---|---|---|---|---|---|

Sep-19 | Sep-18 | Change | Sep-19 | Sep-18 | Change | Sep-19 | Sep-18 | Change | |

| Total Receiverships | 252 | 282 | (30) | 0 | 0 | 0 | 252 | 282 | (30) |

| Assets in Liquidation | $575 | $1,245 | ($670) | $ 2 | $ 2 | $ 0 | $577 | $1,247 | ($670) |

| YTD Collections | $1,113 | $1,333 | ($220) | $2 | $ 0 | $ 2 | $1,115 | $1,333 | ($218) |

| YTD Dividend/Other Pmts - Cash | $1,374 | $3,185 | ($1,811) | $ 0 | $ 0 | $ 0 | $1,374 | $3,185 | ($1,811) |

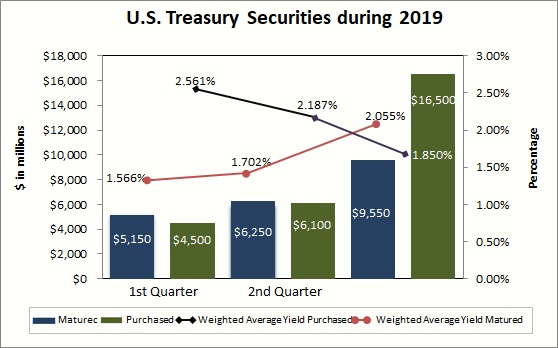

Matured | Purchased | Weighted Average Yield Purchased | Weighted Average Yield Matured | |

|---|---|---|---|---|

| 1st Quarter | $5,150 | $4,500 | 2.561% | 1.566% |

| 2nd Quarter | $6,250 | $6,100 | 2.187% | 1.702% |

| 3rd Quarter | $9,550 | $16,500 | 1.850% | 2.055% |

For the first three quarters of 2019, the DIF portfolio has been impacted first by an inverted yield curve and then by two Federal Reserve rate cuts. As a result, the weighted average yield for purchases has gradually declined over each quarter. At the same time, the weighted average yield of maturities has risen over the year as higher-yielding securities have rolled off the portfolio. As a result, the overall yield of the DIF portfolio has fallen from 2.05% on December 30, 2018 to 1.80% on September 30. During 2019, 29 securities with a total par value of $27.1 billion were purchased with a weighted average yield of 2.04%. At the same time, 41 securities with a par value of $21.0 billion and weighted average yield of 1.83% have matured.