Printable Version

Version imprimible en Español

Meet FDIC’s Electronic Deposit Insurance Estimator--EDIE

FDIC’s Electronic Deposit Insurance Estimator (EDIE) is an online tool that can be used to determine whether your accounts are fully insured at each bank where your deposits are held. EDIE allows you to input dollar amounts you have on deposit in a bank or use a hypothetical scenario to determine your coverage.

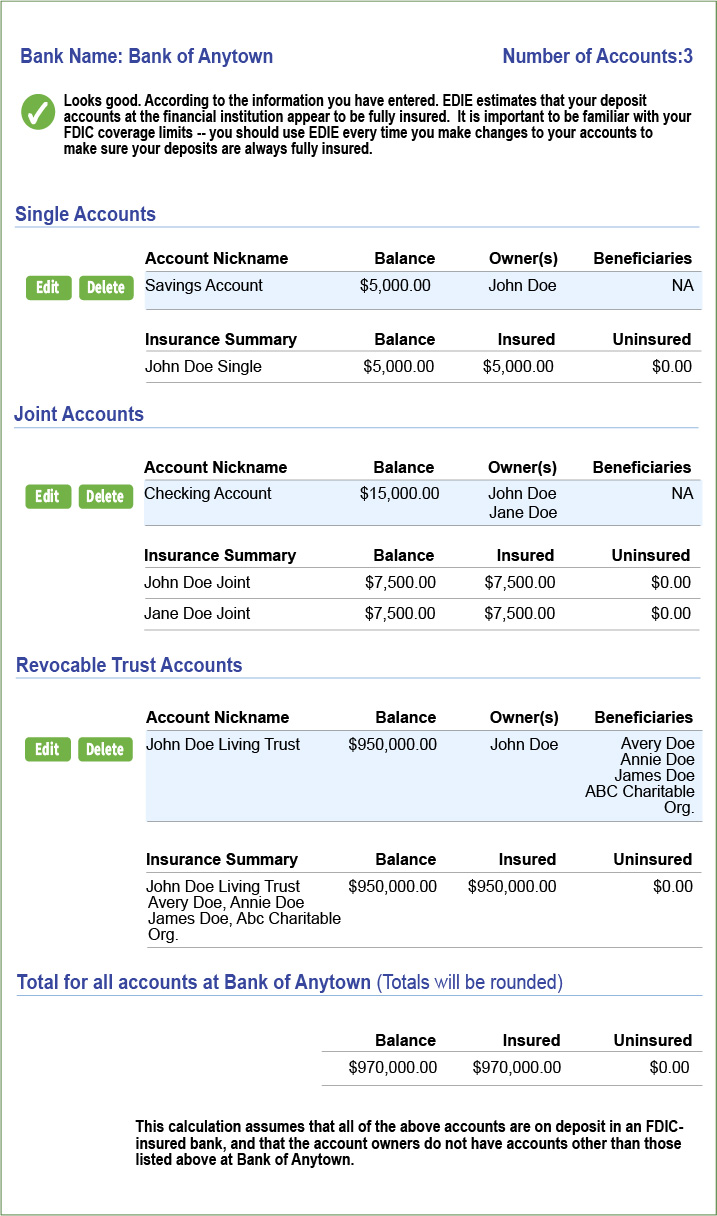

This is an example of John Doe, a depositor, with three deposit accounts all at the same hypothetical FDIC-insured institution, called the Bank of Anytown. John Doe has a savings account in his name (single account: deposit account owned by one person, without named beneficiaries), a joint checking account co-owned with his wife (joint account: deposit account owned by two or more people, without named beneficiaries), and his living trust account (revocable trust account: deposit account owned by one or more people that identifies one or more beneficiaries who will receive the deposits upon the death of the owner[s]). This includes both formal "Living" Trusts and informal In Trust For [ITF]/Payable On Death [POD] accounts). Based on John Doe’s scenario, EDIE’s calculation shows his total deposit of $970,000 is fully insured.

EDIE calculates the insurance coverage per category, and indicates the portion of deposit balance that is either insured or uninsured. Adequate deposit insurance coverage gives you the confidence that your funds are safe and sound in the unlikely event of a bank failure.

EDIE also allows you to enter scenario-based dollar amounts, so you can see if the funds will be insured as you plan where to place your deposits. If you have potentially uninsured funds, EDIE will display the amount and the category under which your funds are uninsured.

As a reminder, the deposit insurance coverage information provided by EDIE only applies to deposits held in FDIC-insured banks. Visit FDIC’s BankFind to see if your financial institution is FDIC-insured.

EDIE calculates the insurance coverage for deposits in:

- Single Accounts

- Joint Accounts

- POD/ITF Accounts

- Living Trust Accounts

- Individual Retirement Accounts (IRAs)

- Business Accounts (corporations, partnerships, and organizations, both for-profit and not-for-profit)

- Government Accounts (deposits held by public units such as school districts, cities, municipalities, counties, and states)

FDIC does NOT insure nondeposit investment products and EDIE is NOT an estimator for investments (even if the investments were purchased from an insured bank) such as:

- Mutual Funds

- Stocks

- Bonds

- Annuities

- ANY investment that is not a deposit

Will EDIE require me to provide my personal information?

EDIE is not connected to any FDIC-insured member bank’s database, and does not use your personal information like your name, Social Security number or account number. EDIE can help you confidentially calculate your deposit insurance coverage. After you calculate coverage, EDIE does not store your information. Once you close the EDIE window, the information is deleted and is not retained by the FDIC.

I’m unsure about how FDIC deposit insurance works, how will EDIE help me?

EDIE provides an explanation and a tutorial with comprehensive examples of how to enter your accounts into the various deposit account ownership categories. EDIE does not require you to understand deposit insurance rules before getting started.

I have additional questions about deposit insurance, who can I contact?

The EDIE site also has a page of frequently asked questions about deposit insurance that may answer your additional questions. However, you can write and receive a written response from the FDIC by visiting the FDIC Information and Support Center.

If you wish to speak to a deposit insurance specialist, you may call: 1-877-ASK-FDIC (1-877-275-3342).

The FDIC protects the funds depositors place in banks and savings associations in the unlikely event of a bank failure. Each depositor is insured to at least $250,000 per insured bank.

FDIC deposit insurance covers all types of deposits received at an insured bank. This includes deposits in a checking account, negotiable order of withdrawal (NOW) account, savings account, money market deposit account (MMDA), time deposit such as a certificate of deposit (CD), and official items issued by a bank such as a cashier's check or money order. FDIC insurance covers depositors' accounts at each FDIC-insured bank, dollar-for-dollar, including principal and any accrued interest through the date of the insured bank's failure, up to the insurance limit.

The FDIC does not insure money invested in stocks, bonds, mutual funds, life insurance policies, annuities or municipal securities, even if these investments are purchased at an FDIC-insured bank.

Additional Resources:

- Understanding Deposit Insurance

- FDIC BankFind

- How are my Deposits Insured by the FDIC

- Deposit Insurance Videos

- La Calculadora EDIE

For more help or information, go to FDIC.gov or call the FDIC toll-free at 1-877-ASK-FDIC (1-877-275-3342). Please send your story ideas or comments to ConsumerNews@fdic.gov