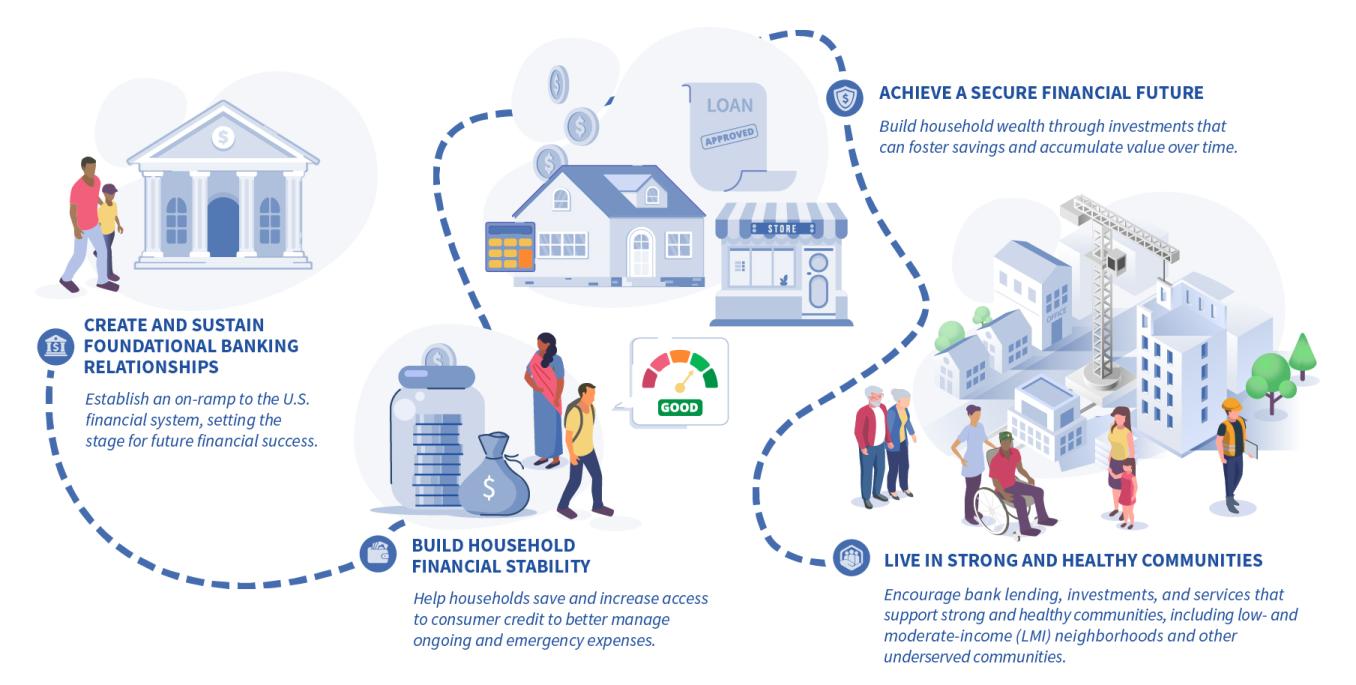

The FDIC promotes a state in which all U.S. households can establish, sustain, and benefit from banking relationships to create a strong financial foundation, manage their day-to-day finances, build wealth, and live in communities strengthened by bank lending, services, and investments.

Our work is guided by the Economic Inclusion Strategic Plan (the Plan) which builds on existing, successful programs like Money Smart, Get Banked, and regional community development initiatives. The Plan incorporates financial education across all opportunity areas as fundamental to successful utilization of financial products and services.

Opportunity Areas

Create and Sustain Foundational Banking Relationships

Increase the share of households that establish and sustain bank accounts, using them as their primary means to receive income, make payments, and keep their money safe.

Participation in the banking system also provides the protections of the insured, regulated banking system. Many banks offer accounts with low fees, and no overdraft or non-sufficient funds (NSF) fees, such as Bank On certified accounts. These accounts, and others, may also provide additional no-fee services such as ATM and branch withdrawals. Find additional information on these low-fee bank accounts at FDIC Get Banked!

Build Household Financial Stability

Increase the share of households that have access to, and benefit from, banking products and services to manage fluctuations in income and expenses, such as variable work earnings and unanticipated expenses.

The FDIC supports local efforts to bring additional populations into the financial mainstream through the Alliance for Economic Inclusion and other broad-based coalitions of financial institutions. These local initiatives focus on helping to promote the widespread availability and use of safe, affordable, and sustainable financial products from insured depository institutions that help people achieve financial stability and build wealth.

Achieve a Secure Financial Future

Increase the share of households that benefit from banking services and other programs that expand access to mortgage credit and small business financing and services, particularly for small and very small businesses.

The FDIC Affordable Mortgage Lending Center provides mortgage resources and helps financial institutions and consumers to compare a variety of current affordable mortgage programs. State, regional, and national program resources are also available.

The FDIC has a long-standing practice of supporting small business development by serving as a trusted resource, facilitator, and connector.

Live in Strong and Healthy Communities

Encourage financing and other resources available to low- and moderate-income (LMI) and other underserved communities from banks to improve conditions for residents, including improving community facilities, increasing affordable housing, and enhancing employment opportunities.

FDIC Community Affairs promotes economic inclusion and community development through collaboration with stakeholders committed to strategic initiatives that impact LMI individuals and communities.

Financial Education

Financial education is at the foundation of FDIC efforts to promote and expand economic inclusion. Effective financial education helps people gain the skills and confidence necessary to sustain banking relationships, achieve financial goals, and improve financial well-being. Through FDIC Money Smart and other consumer education efforts, the FDIC offers free, non-copyrighted, and high-quality financial education resources for banks, people of all ages, and small businesses.

For more information, visit Money Smart, subscribe to our monthly publications FDIC Consumer News and Money Smart News, play our suite of online games How Money Smart Are You?, or access our Consumer Resource Center.

Additional Resources

FDIC National Survey of Unbanked and Underbanked Households