DIF Balance Sheet - First Quarter 2022

| Balance Sheet | |||||

|---|---|---|---|---|---|

| Mar-22 | Dec-21 | Quarterly Change | Mar-21 | Year-Over-Year Change | |

| Cash and cash equivalents | $5,802 | $5,563 | $239 | $4,895 | $907 |

| Investment in U.S. Treasury securities | 114,230 | 114,551 | (321) | 110,680 | 3,550 |

| Assessments receivable | 1,818 | 1,711 | 107 | 1,941 | (123) |

| Interest receivable on investments and other assets, net | 776 |

718 |

58 |

969 |

(193) |

| Receivables from resolutions, net | 815 |

885 |

(70) |

1,220 |

(405) |

| Property and equipment | 326 |

327 |

(1) |

321 |

5 |

| Operating lease right-of-use assets | 80 |

85 |

(5) |

110 |

(30) |

| Total Assets | $123,847 |

$123,840 |

$7 |

$120,136 |

$3,711 |

| Accounts payable and other liabilities | 245 |

255 |

(10) |

255 |

(10) |

| Operating lease liabilities | 85 |

91 |

(6) |

117 |

(32) |

| Liabilities due to resolutions | 1 |

0 |

1 |

1 |

0 |

| Postretirement benefit liability | 332 |

332 |

0 |

336 |

(4) |

| Contingent liability for anticipated failures | 145 |

21 |

124 |

65 |

80 |

| Contingent liability for litigation losses | 0 |

0 |

0 |

0 |

0 |

| Total Liabilities | $808 |

$699 |

$109 |

$774 |

$34 |

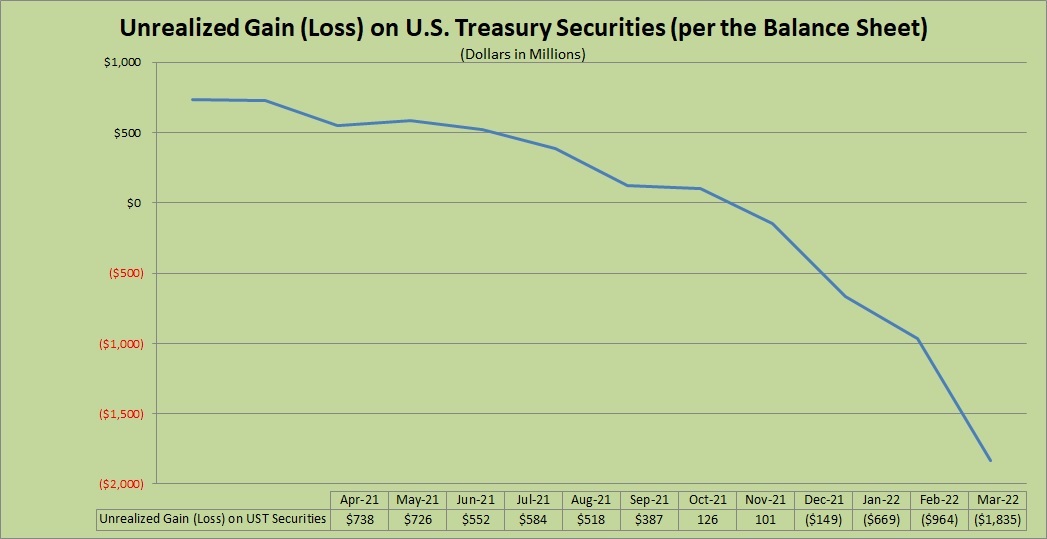

| FYI: Unrealized gain (loss) on U.S. Treasury securities, net | (1,835) |

(149) |

(1,686) |

785 |

(2,620) |

| FYI: Unrealized postretirement benefit (loss) gain | (83) |

(83) |

0 |

(98) |

15 |

| Fund Balance | $123,039 |

$123,141 |

($102) |

$119,362 |

$3,677 |

| Apr-21 | May-21 | Jun-21 | Jul-21 | Aug-21 | Sep-21 | Oct-21 | Nov-21 | Dec-21 | Jan-22 | Feb-22 | Mar-22 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Unrealized Gain (Loss) on UST Securities | $738 | $726 | $552 | $584 | $518 | $387 | $126 | $101 | ($149) | ($669) | ($964) | ($1,835) |

Throughout the first quarter, the treasury securities portfolio experienced continued mark-to-market losses as persistent high inflation drove the Federal Reserve’s decision to raise rates. Yields along the entire curve increased substantially, with some tenors exceeding prepandemic levels and gaining over 100 basis points. Market participants are expecting the Fed to continue with rate hikes for the majority of the FOMC meetings this year with a possible 50 basis points for both the May and June meetings. These unrealized losses may persist, depending on how much Fed action and inflation is already reflected in current rates.