The following frequently asked questions and answers are intended to help records entities interpret the Part 371 data requirements. They were prepared by, and represent the views of, the staff of the Federal Deposit Insurance Corporation (the “FDIC”). They are not rules, regulations, or statements of the FDIC, and do not have the approval or disapproval of the Board of Directors of the FDIC. They are not legally binding on records entities or the FDIC. The staff may update these questions and answers periodically based on the experience gained in the implementation of Part 371 by various records entities.

Technical Points Questions

Stay Current

You may subscribe to receive email notice of updates to these frequently asked questions and answers, although FDIC shall have no legal responsibility to provide such notice or for the sufficiency thereof.

1. Where do I get answers for questions not provided below that are related to data requirements under Part 371?

Please email part371qfc@fdic.gov

Last updated: Dec. 12, 2017

2. How do I send the data files to the FDIC?

FDIC uses GlobalScape Secure File Transfer to transfer files. You will provide the FDIC with a Point Of Contact for the file transfer process. The POC will receive an email with a User ID for the file transfer session. The password for the session will be provided over the phone – for security reasons this password cannot be emailed. The session stays open for 7 days. You will upload the data files and email FDIC once the files are available for download. FDIC will email back once the files have been downloaded. Once downloaded, the files are deleted from the portal.

Last updated: Dec. 12, 2017

3. I forgot my password. How do I retrieve it?

We cannot retrieve passwords. We have to create a new file transfer session.

Last updated: Dec. 12, 2017

4. What is the file format?

The files should be flat file with columns separated by “~” (tilde-delimited flat file)

Last updated: Dec. 12, 2017

5. What is the file naming structure?

For Part 371 (Full Scope entities)

Input Files:

If the Part 371 entity (XYZ Bank) is part of a Part 148 family (HoldCo):

- A1 file: “HoldCo_XYZ Bank-A1.csv”

- A2 file: “HoldCo_XYZ Bank-A2.csv”

- A3 file: “HoldCo_XYZ Bank-A3.csv”

- A4 file: “HoldCo_XYZ Bank-A4.csv”

- CO file: “HoldCo_XYZ Bank-CO.csv”

- CP file: “HoldCo_XYZ Bank-CP.csv”

- BL file: “HoldCo_XYZ Bank-BL.csv”

- SA file: “HoldCo_XYZ Bank-SA.csv”

- DD file: “Data Dictionary (if provided): “HoldCo_XYZ Bank-DD.xlsx””

If the Full Scope Part 371 entity (XYZ Bank) is not a part of a Part 148 family -

- A1 file: “None_XYZ Bank-A1.csv”

- A2 file: “None_XYZ Bank-A2.csv”

- A3 file: “None_XYZ Bank-A3.csv”

- A4 file: “None_XYZ Bank-A4.csv”

- CO file: “None_XYZ Bank-CO.csv”

- CP file: “None_XYZ Bank-CP.csv”

- BL file: “None_XYZ Bank-BL.csv”

- SA file: “None_XYZ Bank-SA.csv”

- DD file: “Data Dictionary (if provided): “None_XYZ Bank-DD.xlsx””

For Part 371 (Limited Scope entities)

- A1 file: “None_XYZ Bank-A1.csv”

- A2 file: “None_XYZ Bank-A2.csv”

- CO file: “None_XYZ Bank-CO.csv”

- CP file: “None_XYZ Bank-CP.csv”

- CP file: “Data Dictionary (if provided): “None_XYZ Bank-DD.xlsx””

Output Log Files: Please note that the Output Files columns will be comma “,” separated and YYYYMMDD_hhmmss in the file name is the date and timestamp:

If the Part 371 entity (“XYZ Bank”) is part of a Part 148 family (“HoldCo”) –

- A1 Output Log file: “HoldCo_XYZ Bank-A1_Output_YYYYMMDD_hhmmss.csv”

- A2 Output Log file: “HoldCo_XYZ Bank-A2_Output_YYYYMMDD_hhmmss.csv”

- A3 Output Log file: “HoldCo_XYZ Bank-A3_Output_YYYYMMDD_hhmmss.csv”

- A4 Output Log file: “HoldCo_XYZ Bank-A4_Output_YYYYMMDD_hhmmss.csv”

- CO Output Log file: “HoldCo_XYZ Bank-CO_Output_YYYYMMDD_hhmmss.csv”

- CP Output Log file: “HoldCo_XYZ Bank-CP_Output_YYYYMMDD_hhmmss.csv”

- BL Output Log file: “HoldCo_XYZ Bank-BL_Output_YYYYMMDD_hhmmss.csv”

- SA Output Log file: “HoldCo_XYZ Bank-SA_Output_YYYYMMDD_hhmmss.csv”

If the Full Scope Part 371 entity (XYZ Bank) is not a part of a Part 148 family -

- A1 Output Log file: “None_XYZ Bank-A1_Output_YYYYMMDD_hhmmss.csv”

- A2 Output Log file: “None_XYZ Bank-A2_Output_YYYYMMDD_hhmmss.csv”

- A3 Output Log file: “None_XYZ Bank-A3_Output_YYYYMMDD_hhmmss.csv”

- A4 Output Log file: “None_XYZ Bank-A4_Output_YYYYMMDD_hhmmss.csv”

- CO Output Log file: “None_XYZ Bank-CO_Output_YYYYMMDD_hhmmss.csv”

- CP Output Log file: “None_XYZ Bank-CP_Output_YYYYMMDD_hhmmss.csv”

- BL Output Log file: “None_XYZ Bank-BL_Output_YYYYMMDD_hhmmss.csv”

- SA Output Log file: “None_XYZ Bank-SA_Output_YYYYMMDD_hhmmss.csv”

For Part 371 (Limited Scope entities)

- A1 Output Log file: “None_XYZ Bank-A1_Output_YYYYMMDD_hhmmss.csv”

- A2 Output Log file: “None_XYZ Bank-A2_Output_YYYYMMDD_hhmmss.csv”

- CO Output Log file: “None_XYZ Bank-CO_Output_YYYYMMDD_hhmmss.csv”

- CP Output Log file: “None_XYZ Bank-CP_Output_YYYYMMDD_hhmmss.csv”

Last updated: Jan. 17, 2019

6. Should there be a header row in the data files?

Yes. The field names should be used for the first row (or the header row). For example for A1 file, the first row should be as follows –

A1.1~A1.2~A1.3~A1.4~ … and so on

Last updated: Dec. 12, 2017

7. Should there be an end-of-file indicator at the bottom of each file?

No. The last row should be the last data row.

Last updated: Dec. 12, 2017

8. What values should be used for fields that are not applicable for a given class of QFCs or product type?

All fields should have value. All “null” or empty fields are flagged as error. Please use the following values for fields that are not applicable –

Text fields or AlphaNum fields – NA

Numeric – 0

Date – 2099-12-31

Last updated: Dec. 12, 2017

9. Is YYYY/MM/DD a valid date format?

No. YYYY-MM-DD is the only acceptable date format.

Last updated: Dec. 12, 2017

10. For the top-level entity, what should be in the Immediate Parent Entity Identifier?

As stated in FAQ#19, for a standalone or top-level entity in a corporate group, list the entity identifier in (CO.2 or CP.2) as the immediate parent identifier (CO.5 or CP.7) and ultimate parent identifier (CP.10). Percent ownership of immediate parent in the entity (CO.8) will be 100.00.

Last updated: Aug. 19, 2019

11. I have inter-affiliate trades. My counterparty on the trade is in the CO table (Corporate Organization Master). Should it also be in the CP table (Counterparty Master)?

Yes. All counterparties – third parties and affiliates - should be in the CP table

Last updated: Dec. 12, 2017

12. What can I enter in the field A1.7 – Type of QFC? Is it Interest Rate Swaps or IRS or Int Rt Swp?

A1.7 is a free form field. Interest Rate Swaps, IRS and Int Rt Swp are all valid values. However, you will have to pick one and use it consistently across all submissions. Also, if your product type is unique or the value is difficult to understand, you will be asked to provide a data dictionary with QFC Type definitions.

Last updated: Dec. 12, 2017

13. I am short a position. Do I report A1.19 (for Full Scope entities and A1.18 for Limited Scope entities) – Notional or principal amount of the position in local currency and A1.20 – Notional or principal amount of the position in U.S. dollars, as negative?

No, notional amount should always be reported as positive

Last updated: Dec. 12, 2017

14. How do I use the field A1.22 – Related position of records entity?

Let’s say you have five QFCs that are somehow tied together for some business reason or risk management reason, etc. You would tag these QFCs with the same value in the field A1.22. The actual value itself is not important – you could start with a sequential counter - grouping from 1, the next group of related QFCs would be tagged “2” in field A1.22, and so on.

Last updated: Dec. 12, 2017

15. What is the difference between field A1.8 (Agreement Identifier) and field A1.9 (Netting Agreement Identifier)? Are they required fields? Can they be "NA"?

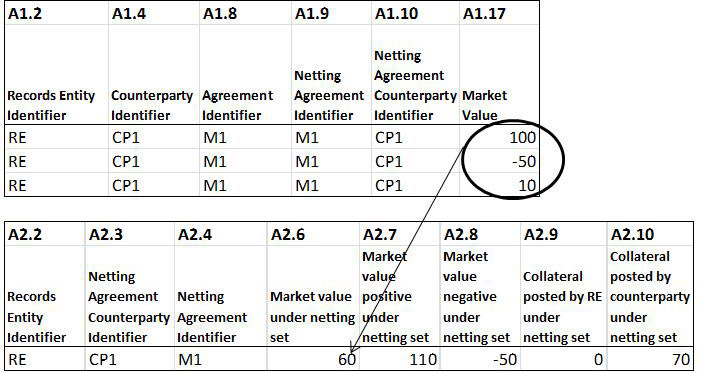

Field A1.8 is the primary governing agreement for the QFC, e.g., an ISDA Master, a Master Repurchase Agreement, a Guarantee Agreement, etc. Field A1.9 is used to identify the netting set that includes that QFC. If the netting set for a QFC is all the QFCs under the same master agreement, then the netting set is the master agreement and field A1.9 will show the same value as field A1.8. In the schematic below, there are 3 QFCs netted under the same master agreement.

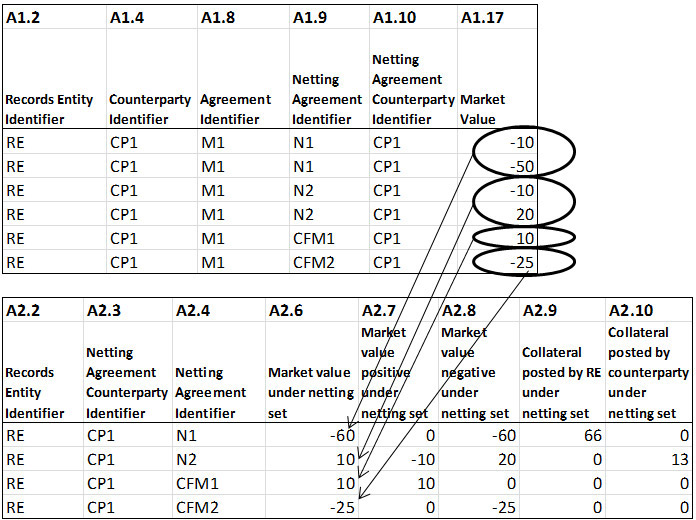

However, if there are multiple netting sets under a master agreement, then each netting set must be assigned its own unique identifier. If there is a QFC under that master agreement that is not part of any netting set under that master agreement then the QFC’s QFC-confirmation should be used as the netting agreement identifier. In the schematic below, there are 6 QFCs under a master agreement - 2 netting sets with 2 QFCs each, and the other 2 QFCs that are standalone, not netted and unsecured.

It should be noted that on Table A2 the fields for Records Entity Identifier, Netting Agreement Counterparty Identifier, and Netting Agreement Identifier should all be filled in. These are required fields and cannot be “NA.”

Last updated: May 21, 2018

16. What is the difference between field A1.4 (Counterparty Identifier) and field A1.10 (Netting Agreement Counterparty Identifier)? Are they the same? If not, when will they be different?

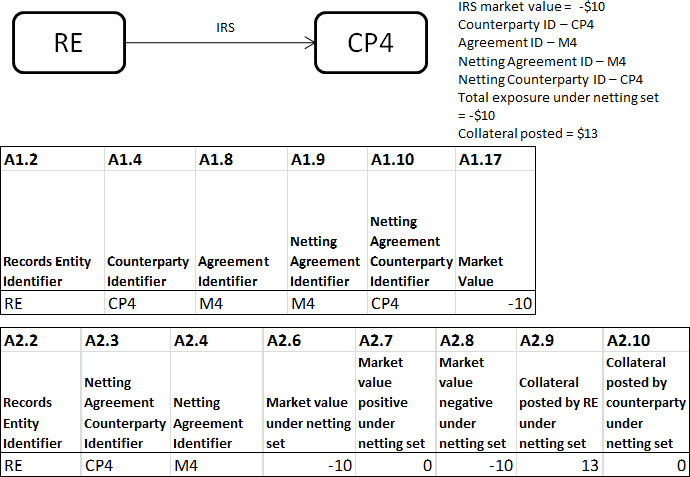

Fields A1.4 and A1.10 will be the same if the counterparty to the QFC is also the only party to the netting agreement (i.e. the netting agreement counterparty) and provides the collateral support to the netting agreement (if required). This is likely to be the case in the majority of situations, and is shown in the schematic below.

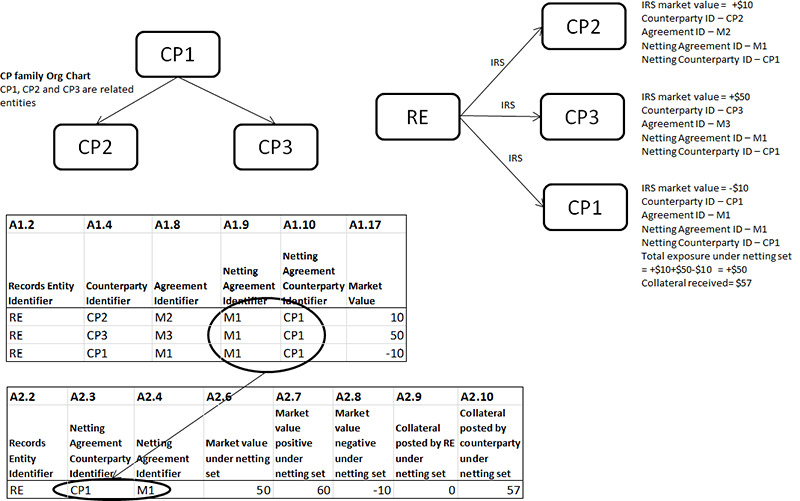

In some cases, however, the party to the netting agreement (and the provider of collateral under the netting agreement) is not the QFC counterparty itself. In these cases, the QFC counterparty’s identifier is used to populate field A1.4 and the Netting Agreement Counterparty Identifier is used to populate field A1.10

In the schematic below, CP1, CP2, and CP3 are related entities and all have QFCs with RE. All CP1, CP2, and CP3 QFCs are netted under the terms of the relevant Netting Agreement. In addition, CP1 provides the collateral for all of its QFCs and its family’s QFC exposure with RE.

Although this example is intended to enable a records entity to reflect the existence of such cross-party netting arrangements, if any, this should not be construed as any endorsement or approval of — or any opinion regarding the enforceability of — any such arrangements by the FDIC acting in any capacity.

Last updated: May 21, 2018

17. My QFC has more than one local currency. How do I show multiple currencies in fields A1.15, A1.16 and A1.19?

Report multiple local currency fields delimited by colon (“:”) – e.g., field A1.15 could look like EUR:CHF. Note that the field definition would now apply to individual sub-field, i.e., for the A1.15 example, each subfield (EUR and CHF) has to be 3 characters and has to be an ISO currency code. For fields A1.16 and A1.19, each sub-field has to be of the format Num(25,5) separated by “:”.

Last updated: May 21, 2018

18. How is(are) the guarantee(s) of a guaranteed QFC shown in fields A1.21 through A1.21.5 of table A1?

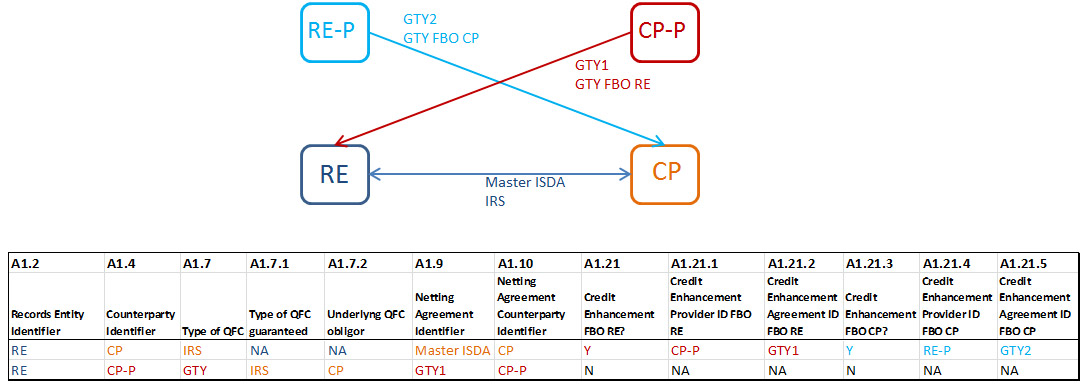

Certain Information about the guarantee(s) relating to a guaranteed QFC is captured in fields A1.21, A1.21.1, A1.21.2, A1.21.3, A1.21.4 and A1.21.5 (please see field descriptions for additional details). Note that the guarantees of QFCs are themselves QFCs and should be shown as separate QFCs on Table A1.

In the schematic below, an Interest Rate Swap (transacted under a Master ISDA) between RE and CP is guaranteed by CP-P (agreement ID GTY1) for the benefit of RE. In addition, RE-P has guaranteed the Interest Rate Swap (agreement ID GTY2) for the benefit of CP. In this example, the Interest Rate Swap and the related guarantees would be reported as follows:

Last updated: May 21, 2018

19. How are entities with multiple immediate parents reported in the Corporate Organization Master Table (“CO Table”) and the Counterparty Master Table (“CP Table”)? What should we list as the Immediate Parent Identifier (CO.5, CP.7) and Ultimate Parent Identifier (CP.10) for a standalone entity or top-level entity in a corporate group?

Entities with multiple immediate parent entities should be reported in two (or more) separate rows – each row will capture one immediate parent. The schematic below shows an entity (ABC4 Inc. – entity ID ABC4) with two immediate parents and the corresponding CO Table entries.

For a standalone entity or a top-level entity in a corporate group, list the entity identifier of the entity (CO.2 or CP.2) as the immediate parent identifier (CO.5 or CP.7) and ultimate parent identifier (CP.10). Percent ownership of immediate parent in the entity (CO.8) will be 100.00. Please see entry for entity ABC1 below.

Last updated: January 25, 2019

20. What are the valid values for location fields (A3.7, A4.14, CO.10, CO.11, CP.5, CP.6)? Can the field length exceed the 50-characters limit?

All location fields are validated against the UN/LOCODE Code List - https://www.unece.org/cefact/locode/service/location

The preferred format is “City, State, Country” or “State, Country” or “Country” as appropriate. Location field lengths are validated against a maximum field length of 150 characters.

Last updated: October 19, 2018

21. How is collateral excess or collateral deficiency calculated (applies to A2.13 & A2.14)?

A2.13 and A2.14 show the value of collateral excess or collateral deficiency after application of all haircuts and relevant collateral posting requirements. This concept can be best explained by an example. Let’s say the market value of QFCs under a Netting Set is $100 (A2.6) and the CSA calls for posting $110 in collateral. Assume that the market value of the collateral posted is $120 (A2.9 or A2.10). If after application of all haircuts, the value of the collateral is $108, then the collateral deficiency is $108 -$110 = -$2. However, if the value of the collateral after application of all haircuts is $115, then the collateral excess is $115 - $110 = $5. The -$2 or the $5 is what goes in A2.13 or A2.14. Please note that collateral deficiency is negative and collateral excess is positive.

Last updated: October 19, 2018

22. Are fields A2.9 (collateral posted by records entity) and A2.10 (collateral posted by counterparty) complements of one another? – if counterparty posted $100 (A2.10 is $100), then records entity received $100 (A2.9 is -$100).

A2.9 and A2.10 are not complements. Due to timing mismatch, it is possible that a records entity posts collateral with the counterparty on the same netting set on which the counterparty has posted collateral with the records entity. The collateral posted by the records entity is shown in A2.9 and the collateral posted by the counterparty is shown in A2.10. Note that A2.9 and A2.10 cannot be negative.

Last updated: October 19, 2018

23. What validations are performed on the data files?

The following are some of the checks performed on the data files. Please note the list is not a complete list of all the validations performed on the data. In order to pass these validation checks all data must be accurate and in particular:

- There cannot be any nulls in any fields. If a particular field is not applicable then please enter the default value for the field – 0 for numeric fields, NA for character fields and 2099-12-31 for date fields.

- Fields must be of the correct data type and length.

- As of Date (A1.1, A2.1, A3.1, A4.1, CO.1, CP.1, BL.1, SA.1) must be within 3 days of the submission date. Note that the Rule requires records based on values and information that are no less current than previous end-of-day values and information.

- Records Entity Identifier in fields A1.2, A2.2, A3.2, A4.2 and BL.2 must have a corresponding entry in the CO table (CO.2).

- Counterparty Identifier (A1.4, A4.4), Agreement Counterparty Identifier (A3.6) and Netting Agreement Counterparty Identifier (A1.10, A2.3) must have corresponding entries in the CP table (CP.2).

- Agreement Identifier (A1.8) and Netting Agreement Identifier (A1.9, A2.4, A4.5) must have corresponding entries in A3 table (A3.3).

- A1.2 + A1.5 + A1.6 must have corresponding entries in BL - BL.2 + BL.3 + BL.4.

- Notional and Principal amounts in A1.19 and A1.20 must be 0 or a positive number.

- Type of QFC (A1.7) must be a valid type in the QFC data dictionary (this assumes the Records Entity has a data dictionary).

- Location/domicile/jurisdiction (A3.7, A4.14, CO.10, CO.11, CP.5, CP.6) must be a valid location in the UN/LOCODE dictionary and in the format “City, State, Country” or “State, Country” or “Country”, as appropriate.

- Type of QFC (A1.7.1) is required if A1.7 is a guarantee or other third party credit enhancement.

- If not ‘NA’, Underlying QFC obligor identifier (A1.7.2, A2.4.1 and A3.6.1) must be in CO.2 or CP.2.

- Underlying QFC obligor identifier (A1.7.2) is required if A1.7 is a guarantee or other third party credit enhancement. This field is validated against CO.2 (for affiliates) or CP.2 (for non-affiliates).

- Trade Date (A1.11) cannot be later than the submission date.

- Termination Date (A1.12) cannot be earlier than the submission date.

- Next call, put or cancellation date (A1.13) cannot be earlier than the submission date. If not applicable, please use the default date of 2099-12-31.

- Next payment date (A1.14) cannot be earlier than the submission date. If not applicable, please use the default date of 2099-12-31.

- Next margin payment date (A2.15) cannot be earlier than the submission date. If not applicable, please use the default date of 2099-12-31.

- Current market value of the position in local currency (A1.16) and Current market value of the position in US dollars (A1.17) must both be positive, negative or 0.

- Asset classification (A1.18, A4.11) must be 1 or 2 or 3.

- Covered by third-party credit enhancement agreement (for the benefit of the records entity) (A1.21, A2.5, A3.10) and Covered by third-party credit enhancement agreement (for the benefit of the counterparty) (A1.21.3, A2.5.3, A3.12.1) must be ‘Y’ or ‘N’.

- If A1.21 is ‘Y’, A1.21.1 is validated against CP.2 and A1.21.2 is validated against A3.3.

- If A1.21.3 is ‘Y’, A1.21.4 is validated against CP.2 or CO.2 and A1.21.5 is validated against A3.3.

- If A2.5 is ‘Y’, A2.5.1 is validated against CP.2 and A2.5.2 is validated against A3.3.

- If A2.5.3 is ‘Y’, A2.5.4 is validated against CP.2 or CO.2 and A2.5.5 is validated against A3.3.

- If A3.10 is ‘Y’, A3.11 is validated against CP.2 and A3.12 is validated against A3.3.

- If A3.12.1 is ‘Y’, A3.12.2 is validated against CP.2 or CO.2 and A3.12.3 is validated against A3.3.

- If A1.21 is ‘N’, A1.21.1 and A1.21.2 must be ‘NA’. If A1.21.3 is ‘N’, A1.21.4 and A1.21.5 must be ‘NA’. If A2.5 is ‘N’, A2.5.1 and A2.5.2 must be ‘NA’. If A2.5.3 is ‘N’, A.2.5.4 and A2.5.5 must be ‘NA’. If A3.10 is ‘N’, A3.11 and A3.12 must be ‘NA’. If A3.12.1 is ‘N’, A3.12.2 and A3.12.3 must be ‘NA’.

- Local Currency (A1.15, A4.8) must be a valid ISO currency code.

- If A1.24 is not NA, entry must have a corresponding entry in CO.2.

- Percentage ownership of immediate parent (CO.8) must be greater than 0.0 and less than or equal to 100.0.

- Immediate parent entity identifier (CO.5) must have a corresponding entry in CO.2, and the corresponding entity name (CO.7) must match CO.4.

- If not ‘NA’, Safekeeping agent identifier for records entity (A2.17) and Safekeeping agent identifier for counterparty (A2.18) must have corresponding entries in SA table in SA.2.

- Sum of QFC exposure (A1.17) by A1.2, A1.10 and A1.9 must match the sum of QFC exposure (A2.6) by A2.2, A2.3 and A2.4.

- Sum of all positive QFC exposure (A1.17) by A1.2, A1.10 and A1.9 must match the sum of positive QFC exposure (A2.7) by A2.2, A2.3 and A2.4.

- Sum of all negative QFC exposure (A1.17) by A1.2, A1.10 and A1.9 must match the sum of negative QFC exposure (A2.8) by A2.2, A2.3 and A2.4.

- Sum of all QFC exposure (A2.6) by A2.2, A2.3 and A2.4 must match the sum of all positive exposure in A2.7 and all negative exposure in A2.8.

- A2.9, A2.10, A2.11, A2.12, A4.7 and A4.9 must be greater than or equal to 0.

- A2.13 must be less than or equal to A2.9 by records entity, netting counterparty and netting agreement (A2.2, A2.3 and A2.4).

- A2.14 must be less than or equal to A2.10 by records entity, netting counterparty and netting agreement (A2.2, A2.3 and A2.4).

- Sum of collateral posted by records entity (A2.9) by A2.2, A2.3 and A2.4 must match the sum of collateral in A4.9 by A4.2, A4.4 and A4.5, where A4.3 is ‘P’.

- Sum of collateral received by records entity (A2.10) by A2.2, A2.3 and A2.4 must match the sum of collateral in A4.9 by A4.2, A4.4 and A4.5, where A4.3 is ‘R’.

- If A3.8 is “Y”, all entries in A3.9 must have a corresponding entry in CO table (CO.2) or CP table (CP.2).

- Because the following fields are primary keys, foreign keys or part of composite keys, they cannot be “NA” – A1.2, A1.4, A1.5, A1.6, A1.8, A1.9. A1.10, A2.2, A2.3, A2.4, A3.2, A3.3, A3.6, A4.2, A4.4, A4.5, CO.2, CO.5, CP.2, CP.7, CP.10, BL.2, BL.3, BL.4 and SA.2.(Note: This is not intended to be an exhaustive list of fields where “NA” is not appropriate.)

Last updated: December 18, 2018

24. How do we schedule time for testing?

In order to support all institutions in their testing needs, and to manage testing resources efficiently, we request that all testing requests be made as far in advance as possible. Please note that the FDIC will hold up to 3 test days for each institution at any given time. If a previously scheduled test day is no longer needed, please let FDIC staff know so that we can release it to another institution. While FDIC staff will try to honor all requests for testing, testing resources that have not been scheduled in advance are not guaranteed to be available, and an institution may be requested to book a test day to submit its test files. FDIC staff might reschedule any previously scheduled test request due to unexpected circumstances.

Last updated: October 26, 2018

25. The column delimiter "~" is part of a field value. What escape character should we use to make sure this "~" is treated as part of the field and not a column delimiter? What if comma "," is part of the field that also uses "," as a delimiter within the field?

If the delimiter tilde "~" is part of the field value then the entire field should be enclosed in double quotes.

For example, if -

date = 2019-01-01

address = 123 Main ~ Street

name = John Doe & Co

then to preserve the "~" in the address field, date~address~name should be entered as:

2019-01-01~"123 Main ~ Street"~John Doe & Co

In general, the same approach is used to pass any character value without triggering the delimiter action.

For example, if comma "," is used to delimit values within the fields entities and ids and these fields have the following values -

entities = ABC, Inc. and XYZ, Corp

ids = id123 and id456

then to preserve the "," in the fields entities~ids, they should be entered as:

"ABC, Inc.","XYZ, Corp"~id123,id456

Last updated: January 22, 2019

26. We use different safekeeping agents, depending on the type of collateral (cash vs. corporate bonds vs. treasuries), including when multiple types of collateral comprise a single netting set. How do we capture multiple safekeeping agents for a single netting set – fields A2.17 and/or A2.18?

Enter multiple safekeeping agent identifiers separated by comma “,” – e.g. if, for a single netting set, there are 3 safekeeping agents with identifiers SA123, SA456 and SA789, field A2.17 (or A2.18) will have the value – SA123,SA456,SA789. Each safekeeping agent identifier delimited by “,” will be validated against SA.2. In the current example, SA123, SA456 and SA789 should have separate entries in the SA table. To accommodate multiple safekeeping agent identifiers, the field length for A2.17 and A2.18 will be validated against field definition of Varchar(500).

Last updated: January 22, 2019

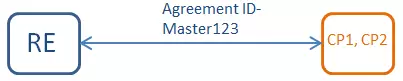

27. How do we report multiple counterparties that are jointly and severally liable on a trade with RE?

Let’s walk through an example with multiple counterparties. RE has a Master Agreement with agreement identifier “Master123” with 2 joint and several counterparties – CP1 and CP2 – as signatories. There are 3 open trades under this agreement. Below is the schematic of this trading relationship and the corresponding entries in tables A1, A2, A3 and A4.

The validation rules look for the “DUP” indicator in A1.22 and collapse the trades by the composite keys – A1.2 and A1.3. Therefore, even though there are 6 line items in A1, the 6 trades are reduced to 3 trades (with composite keys “RE”+”Trade1”, “RE”+”Trade2” and “RE”+”Trade3”) with CP1 and CP2 as joint and several counterparties on these trades and the total exposure reduced from 2 x ($15 - $5 + $10) to $20 (total exposure / number of counterparties). Also, note the duplicate netting sets in A2 (with different counterparties) and duplicate collateral in A4 (again, with different counterparties). Though there are no “DUP” indicators in tables A2 and A4, they are reduced in similar manner by the validation rules by using the “DUP” indicator from A1.22 in table A1. The number of times a QFC entry in table A1 is repeated with DUP entries depends upon the number of joint and several counterparties on the trade – 2 CPs will have trades repeated 2 times, 3 CPs will have trades repeated 3 times, and so on.

Please note that if A1.22 is used to indicate “DUP” and also to indicate “related positions”, then the “DUP” flag has to be to the first entry followed by comma “,” delimiter followed by the related position value – e.g. if A1.22 is used to indicate “DUP” but also needs to indicate a related position with some other QFC with a related position value of “XYZ111” then A1.22 would be DUP,XYZ111

Last updated: January 22, 2019

28. How do we report multiple counterparties that are severally (i.e. proportionately) liable on a trade with RE?

Since the counterparties are severally liable under the same Master Agreement (with agreement identifier “Master123), their trade exposures are independent of one another. If CP1 and CP2 have 50-50 exposure to the above 3 trades with an aggregate exposure of $20, each counterparty has an exposure of $10 as shown below. Note that the “DUP” indicator should not be entered in A1.22 since these are not joint and several liabilities.

Last updated: January 22, 2019

29. How do we report multiple guarantees and/or multiple guarantors of the same QFC?

Enter multiple guarantees and/or multiple guarantors separated by comma “,”. The value(s) for each credit enhancement provider identifier field (A1.21.1, A1.21.4, A2.5.1, A2.5.4, A3.11 and A3.12.2) and each credit enhancement agreement identifier field (A1.21.2, A1.21.5, A2.5.2, A2.5.5, A3.12 and A3.12.3) will be validated against a field definition of Varchar(500). Note that each credit enhancement agreement provider identifier has to have a corresponding credit enhancement agreement identifier and vice versa – i.e. the number of credit enhancement provider identifiers has to match the number of credit enhancement agreement identifiers. The composite key of RE + credit enhancement provider identifier + credit enhancement agreement identifier should have an entry in A3.

Also, note that Underlying QFC Obligor Identifier (A1.7.2, A2.4.1 and A3.6.1) will have comma “,” separated QFC obligor IDs if the underlying QFC that’s guaranteed has multiple counterparties. Each of these fields will also have field definition of Varchar(500) – see next question for a schematic of this example.

In the schematic below, IRS trades between RE and CP1 are covered by 2 guarantees - GTY1 and GTY2. Guarantee GTY1 has 2 guarantors - GT1 and GT2- and Guarantee GTY2 has 1 guarantor - GT3.

Last updated: January 22, 2019

30. Can you show schematic and reporting tables for QFCs with multiple counterparties, multiple guarantees, multiple guarantors and multiple safekeeping agents?

Last updated: January 22, 2019