Chapter VII. – Commercial Paper Backed by Credit Card Receivables

Introduction

Principals and Their Roles

Asset-Backed Commercial Paper Conduit

Sponsoring Bank/Administrative Agent

Seller

Investors and the Market

Support Providers

Rating Agencies

Program Structures

Multi-Seller Program

Single-Seller Program

Fully Supported

Partially Supported

Unsupported

Program Credit Enhancement Facilities

Transaction-Specific

Program-Wide

Liquidity Facilities

Seller-Specific

General (Program-Wide)

Structural Termination Triggers

ABCP Programs and FIN 46-R

Regulatory Capital Requirements for ABCP Programs

Liquidity Facility Providers and Risk-Based Capital

VII COMMERCIAL PAPER BACKED BY CREDIT CARD RECEIVABLES

INTRODUCTION

Asset-backed commercial paper (ABCP) conduits issue short-term notes backed by trade receivables, credit card receivables, or medium-term financial assets with an original maturity of 270 days or less. A specific pool of assets collateralizes the paper. The conduit usually acquires an undivided interest in revolving pools of assets rather than the assets themselves. The paper is repaid by the cash flow generated by the underlying assets and the issuance of new commercial paper. Since most commercial paper conduits mature in less than 90 days, the primary repayment source comes from the roll-over or the re-issuance of existing paper. In addition, the conduit may draw on liquidity facilities to repay maturing paper if there is a cash flow shortfall or timing issue. As with other securitization activities, ABCP enables the bank to utilize existing balance sheet receivables to provide funding and improve financial indices. Larger banks often sell credit card receivables through commercial paper conduits to warehouse excess receivables until another issue can be executed within the master trust.

ABCP conduits are similar to asset-backed securitizations but they have certain very important differences. These differences include investing in revolving assets that fluctuate in size; investing in various types of assets, creating a more diversified collateral pool; and funding longer-term assets with short-term liabilities, which can create a cash flow mismatch and a need to rely on other liquidity facilities for repayment of the commercial paper. In addition, there are no scheduled amortizations for the paper issued by the conduit since the issuance of additional paper can, and is often expected, to be used.32

This chapter describes the principals and their roles, various program structures, program credit enhancement facilities, liquidity facilities, structural termination triggers, accounting requirement impacts, and regulatory capital rules.

PRINCIPALS AND THEIR ROLES

Asset-Backed Commercial Paper Conduit

An ABCP conduit is an entity established by the sponsor for the purpose of issuing commercial paper backed by credit card receivables and other asset types. ABCP conduits are usually minimally capitalized SPEs that are structured to be bankruptcy remote. The ABCP conduit's activities are limited by the legal documents that established the conduit. The conduit serves as a shell company and contracts out for trustee, depository, commercial paper placement, and administrative agent services. It uses the cash proceeds from the issuance of the commercial paper to purchase and acquire legal title to the underlying assets. In a commercial paper program, there may be several SPEs, as noted in Exhibit I. Typically, the transfer of assets involves an intermediate SPE and then this SPE assigns the receivables or its rights to the receivables to the conduit (similar to the two-step process that occurs in a securitization). As with securitizations, this set up is designed to isolate the assets from the seller in the event of the bankruptcy of the seller. The SPE that actually issues the commercial paper is referred to as the ABCP conduit.

Sponsoring Bank/Administrative Agent

For the purposes of this section and for regulatory capital rules, a bank is considered the sponsor of an ABCP program if it establishes the program; approves the sellers permitted to participate in the program; approves the asset pool to be purchased by the program; or administers the program by monitoring the assets, arranging for debt placement, compiling monthly reports, or ensuring compliance with the program documents and with the program's credit and investment policy.

Seller

Commercial paper backed by assets, including credit card receivables, is issued by the ABCP conduit. The bank sells the underlying receivables to the conduit (or an intermediate SPE) but, as with other securitization activities, retains ownership of the accounts and usually retains the servicing rights. The bank remits to the conduit all finance charges and principal receivables associated with the credit card receivables, and the conduit uses those funds to pay interest, to purchase more credit card receivables, or to retire maturing paper. The bank may use commercial paper backed by credit card receivables as a revolving line of credit and/or use it as a mechanism to warehouse excess receivables until another securitization can be executed.

Investors and the Market

Commercial paper is usually sold in denominations of millions of dollars to meet the requirements of the money markets and large institutional investors, but it may be sold in denominations as small as $10,000.

Support Providers

Credit risk and liquidity risk are inherent in any ABCP program. Credit risk is the risk that credit losses on the underlying assets will create inadequate collections to retire the maturing paper. Liquidity risk is the risk that cash flows on the underlying assets will not be received in a timely manner to retire the issue. Support providers eliminate or reduce those risks by supplying liquidity and credit enhancement facilities in a commercial paper transaction. Support providers are generally unrelated third parties selected by the bank. The liquidity facility and the credit enhancement facility may be provided by the same or different entities.

Rating Agencies

Rating agencies are responsible for assigning an initial rating and for monitoring the commercial paper throughout its life. The structure of the transaction determines what the rating agencies will evaluate when assigning a rating. For instance, in a fully-supported transaction, the rating agencies will evaluate the creditworthiness of the support provider rather than the creditworthiness of the underlying assets. As such, the rating of a fully-supported issue usually parallels the short-term rating of the support provider. For a partially-supported structure, the rating agencies:

- Determine if the underlying assets will support repayment of the paper at maturity.

- Evaluate the bank and its relationship with the conduit.

- Assess the allocation of risk between the liquidity facility and the credit enhancement facility.

Regardless of the type of structure or the focus of the evaluation, the rating assigned will be based on a determination as to whether the investor(s) will receive full and timely payment on their investment, at maturity, without the aid of rolling-over an existing issue. Fully-supported and partially-supported issues are discussed in the next section.

PROGRAM STRUCTURES

Generally there are three types of program structures: a multi-seller, a single seller, and a securities-backed program. The first two types of programs are discussed in this manual. The third program, the securities-backed program, encompasses a more complex situation where the sponsor, typically a financial institution, is seeking arbitrage opportunities or capital relief by moving assets off its balance sheet. These programs invest in existing securities, including ABS, corporate bonds, and MBS, rather than directly in credit card receivables.

Multi-Seller Program

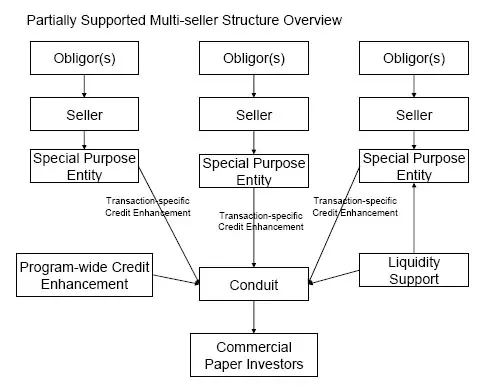

In a multi-seller program, the conduit purchases a variety of assets from many different entities for one specific asset-backed commercial paper issue. A multi-seller program may be fully supported, partially supported, or unsupported. Exhibit I illustrates a partially-supported, multi-seller structure:33

Exhibit I

Single-Seller Program

In a single-seller program, the conduit purchases receivables from one entity for one specific asset-backed commercial paper issue. A single-seller program may be fully supported, partially supported, or unsupported.

Fully Supported

A fully-supported commercial paper program ensures that the investors will receive full and timely payment on their investment at maturity without regard to the cash flows or the value of the credit card receivables. In a fully-supported program, the liquidity facility and the credit enhancement facilities are housed as one vehicle and the support provider bears all the credit and liquidity risk. A fully-supported program may be directly or indirectly supported, but both insure full and timely payment on the issue. Investors seek payment directly from the support provider in the event the issue cannot be retired at maturity under the directly supported program while an indirectly supported program only requires the support provider to purchase the credit card receivables in the program at a price to fully retire the issue, or to make loans to the conduit secured by the credit card receivables in an amount to fully retire the issue.

Partially Supported

A partially-supported program is designed so the investors bear a portion of the credit risk in the transaction. The credit enhancement facility in a partially-supported structure will cover losses up to a certain percentage of the total credit card receivables in the program. Credit losses in excess of that percentage are borne by the investors. Some programs have structural termination triggers that require a payout should more than a specific percentage of the credit enhancement facility be exhausted. This percentage usually ranges between 20 percent and 50 percent. The credit enhancement facility may also be designed to address liquidity risk, but in no event is the liquidity facility used to address credit risk. The liquidity facility is expected to fund only the amount of the non-defaulted receivables in the event of insufficient cash flows.

Unsupported

ABCP may also be unsupported. An unsupported program has neither a liquidity facility nor a credit enhancement facility, and the investors directly bear all the risk. According to Moody's published standards, an unsupported structure can receive a Prime-1rating if the conduit has assets of 10 or fewer borrowers who are Prime - 1 rated and the commercial paper issued are maturity matched to the assets.

PROGRAM CREDIT ENHANCEMENT FACILITIES

Credit enhancements provide investors with protection against credit losses stemming from the underlying receivables. Credit enhancements can either be transaction-specific, program-wide, or a combination of both. Either of these enhancements can be provided internally or externally. When a program has both transaction-specific and program-wide credit enhancements, the transaction-specific enhancements absorb the first loss while the program-wide enhancements absorb losses that exceed the amount of the transaction-specific credit enhancement.

Transaction-Specific

Transaction-specific credit enhancements provide the first layer of protection against a specific transaction and cannot be used to provide protection against credit losses on other transactions within the conduit. The ratings agencies will usually size these enhancements based on the risk characteristics of the underlying assets. The higher the credit risk in the underlying receivables, such as with subprime receivables, the higher the required credit enhancements. Transaction-specific credit enhancements consist of over collateralization, recourse to the seller, loss reserves, third-party guarantees, or any other type of enhancement that is acceptable to the rating agencies.

Over collateralization represents the excess amount of credit card receivables held or transferred to the conduit over the face amount of the outstanding commercial paper. The amount of over collateralization required will vary depending on the asset quality of the credit card receivables and is often specified as a multiple of historical losses, adjusted for current market conditions.

Program-Wide

A program-wide credit enhancement facility is designed to cover all assets sold into the commercial paper program. This type of facility is typically provided by a letter of credit, surety bond, irrevocable loan facility, or other similar facility acceptable to the rating agencies in which a third party agrees to absorb credit losses attributed to the assets. The facility is typically sized to obtain a minimal acceptable rating for the commercial paper (typically A1 or P-1).34

In a multi-seller program, the program-wide credit enhancement facility cross collateralizes all assets and, therefore, may be larger than any one sellers' exposure in the program. A credit enhancement facility may also be used for liquidity purposes. However, in most instances, the liquidity facility must be exhausted or otherwise become unavailable prior to the credit enhancement's use for liquidity purposes.

LIQUIDITY FACILITIES

The purpose of the liquidity facility is to fund cash flow shortfalls on the commercial paper when mismatches occur in the underlying assets or when there is a disruption in the capital markets. Unlike credit enhancements, liquidity facilities are generally not associated with or used to compensate for credit risk in the underlying receivables. The liquidity facility may take many forms, such as a revolving loan agreement or an unfunded loan commitment, but the size of the liquidity facility is generally structured to provide the investors with 100 percent liquidity coverage. There are two types of liquidity facilities, a seller-specific liquidity facility (also known as a parallel purchase agreement) and a general liquidity facility (also known as a program-wide liquidity or liquidity asset purchase agreement). For either arrangement, these types of external liquidity support may exist in the form of a liquidity loan agreement, where the liquidity provider agrees to lend money to the conduit on a predetermined basis, or a liquidity asset purchase agreement, where the liquidity provider agrees to purchase assets on a predetermined basis. Liquidity facilities are usually for 364 days but are renewable at the option of the provider.

Seller-Specific

A seller-specific liquidity facility is a third-party's commitment to lend to a particular seller or sellers. In practice, a seller-specific liquidity facility is used to provide funding when the conduit does not want to fund a specific seller. This type of facility is typically structured so that the liquidity provider will not fund on defaulted or ineligible assets, bankrupt conduit, or investments greater than the commitment. The liquidity facility-providing bank must have the same minimum desired rating as the minimum desired rating on the commercial paper since the liquidity provider is obligated to provide funds to meet maturing commercial paper. In addition, once assets are transferred to the seller-specific liquidity facility, they cannot be transferred back to the conduit.

General (Program-Wide)

In theory, the program-wide liquidity facility provides liquidity in the event of a commercial paper market disruption or any other circumstances in which the conduit has discontinued funding. A program-wide liquidity facility provides funding for 100 percent of the outstanding commercial paper and is typically for a 364-day term. The program-wide liquidity facility is structured so it will not fund on defaulted assets, bankrupt conduit, or investment greater than the commitment. Liquidity facility-providing banks must have A1/P-1 ratings to get an A1/P-1 rating on the commercial paper facility.

STRUCTURAL TERMINATION TRIGGERS

Structural termination triggers, also referred to as stop-issuance and wind-down triggers, are aimed at protecting the investors from a deteriorating pool of credit card receivables and their corresponding losses. These triggers can be set at either the transaction-specific or program-wide level. Commercial paper backed by credit card receivables may include one or more of the following structural termination triggers:

- Change of control.

- The seller's failure to maintain an investment grade rating.

- Downgrade in the support provider's rating.

- The use of the credit enhancement facility beyond a specified level.

- Deteriorating administration of the securitization trust.

- Insolvency or bankruptcy of the seller/servicer.

- Portfolio deterioration below certain predetermined thresholds.

- Default or breach of any covenants, representations, or warranties.

- Net worth of the conduit falls below a predetermined threshold.

- Failure of the conduit to repay its obligations (maturing paper or liquidity advances).

ABCP PROGRAMS AND FIN 46-R

In January 2003, the FASB issued FASB Interpretation No. 46, "Consolidation of Variable Interest Entities'' (FIN 46). FIN 46 requires the consolidation of variable interest entities (VIEs) onto the balance sheets of companies deemed to be the primary beneficiaries of those entities. FIN 46 was revised in December 2003 (that is, FIN 46–R). FIN 46–R requires the consolidation of many ABCP programs onto banks' balance sheets. In contrast, under pre-FIN 46 accounting standards, the sponsors of ABCP programs normally were not required to consolidate the assets of these programs. Banks that are required to consolidate ABCP program assets must include all of the program assets (mostly receivables and securities) and liabilities (mainly commercial paper) on their balance sheets for Call Report purposes. If the Federal banking agencies had not amended the regulatory capital standards (as discussed next), the resulting increase in the asset base would lower the tier 1 leverage and risk-based capital ratios of banks that must consolidate the assets held in ABCP programs.

Regulatory Capital Requirements for ABCP Programs

The Federal banking agencies amended the risk-based capital rules to permit sponsoring banks to exclude from their risk-weighted asset base those assets in ABCP programs that are consolidated on the banks' balance sheets as a result of FIN 46-R. Sponsoring banks generally face limited risk exposure to ABCP programs. This risk usually is confined to the credit enhancements and liquidity facility arrangements that sponsoring banks provide. In addition, operational controls and structural provisions, along with over collateralization or other credit enhancements provided by the companies that sell assets into ABCP programs, mitigate the risks to which sponsoring banks are exposed. However, this exclusion only pertains to risk-based capital ratios and does not affect the denominator of the tier 1 leverage ratio, which is based primarily on on-balance sheet assets as reported under GAAP. Thus, as a result of FIN 46-R, banks must include all assets of consolidated ABCP programs as part of on-balance sheet assets for purposes of calculating the tier 1 leverage ratio.

The leverage ratio is intended to work in conjunction with the risk-based capital standards by providing a simple, GAAP-based measure of capital adequacy. Under the amended rules, minority interests related to a sponsoring bank's ABCP program assets consolidated as a result of FIN 46-R are not to be included in tier 1 capital. Since the program's assets are not consolidated for risk-based capital purposes, the minority interest that supports those assets should not be included in the bank's consolidated regulatory capital. Thus, the reported tier 1 leverage capital ratio for a sponsoring bank would likely be lower than it would be if the ABCP program assets were consolidated and related minority interest were permitted to remain in the capital calculation.

A bank is only able to exclude FIN 46-R related assets from its risk-weighted asset base only with respect to programs that meet the regulatory capital rule's definition of an ABCP program. If the bank sponsoring a program issues ABCP that does not met the rule's definition of an ABCP program, it must continue to include the program's assets in its risk-weighted asset base. The regulatory capital rule defines ABCP program to be a program that primarily issues (that is, more than 50 percent) externally-rated commercial paper backed by assets or other exposures held in a bankruptcy-remote, SPE.

LIQUIDITY FACILITY PROVIDERS AND RISK-BASED CAPITAL

In addition to the exclusion of consolidated ABCP program assets from risk-weighted assets and related minority interest from tier 1 capital, the regulatory capital requirements with respect to liquidity facilities that support ABCP were also amended in 2004. As noted previously, liquidity facilities supporting ABCP often take the form of commitments to lend to, or purchase assets from, the ABCP programs in the event that funds are needed to repay maturing commercial paper. Typically, this need for liquidity is due to a timing mismatch between cash collections on the underlying assets in the program and scheduled repayments of the commercial paper issued by the program.

A bank that provides liquidity facilities to ABCP programs is exposed to credit risk regardless of the term of the liquidity facilities. For example, an ABCP program may require a liquidity facility to purchase assets from the program at the first sign of deterioration in the credit quality of an asset pool, thereby removing such assets from the program. In such an event, a draw on the liquidity facility exposes the bank to credit risk. Although the liquidity facilities expose banks to credit risk, the short-term nature of commitments with an original maturity of one year or less exposes banks to a lower degree of credit risk than longer-term commitments, provided the liquidity facility meets certain asset quality requirements discussed next. This difference in degree of credit risk should be reflected in the risk-based capital requirement for the exposure.

The amended risk-based capital rule imposes a 10 percent credit conversion factor on eligible short-term liquidity facilities supporting ABCP and a 50 percent credit conversion factor to eligible long-term ABCP liquidity facilities. These credit conversion factors apply regardless of whether the structure issuing the ABCP meets the definition of an ''ABCP program.'' For example, a capital charge would apply to an eligible short-term liquidity facility that provides liquidity support to ABCP where the ABCP constitutes less than 50 percent of the securities issued causing the issuing structure not to meet rule's definition of an ''ABCP program.'' However, if a bank (1) does not meet the rule's definition of an ''ABCP program'' and must include the program's assets in its risk-weighted asset base, or (2) otherwise chooses to include the program's assets in risk-weighted assets, then there will be no risk-based capital requirement assessed against any liquidity facilities that support that program's ABCP. In addition, ineligible liquidity facilities will be treated as recourse obligations or direct credit substitutes.35

The resulting credit equivalent amount is risk-weighted according to the underlying assets of the obligor, after considering any collateral or guarantees, or external credit ratings, if applicable. For example, if an eligible short-term liquidity facility providing liquidity support to ABCP covered an ABS externally-rated triple-A, then the notional amount of the liquidity facility would be converted at 10 percent to an on-balance sheet credit equivalent amount and assigned to the 20 percent risk-weight category appropriate for triple-A rated ABS.

In order for a liquidity facility, either short-or long-term, that supports ABCP not to be considered a recourse obligation or a direct credit substitute, it must meet the rule's definition of an ''eligible ABCP liquidity facility.'' The primary function of an eligible liquidity facility is to provide liquidity and, accordingly, such a facility should not be used to fund assets with the higher degree of credit risk typically associated with seriously delinquent assets. As a result, the liquidity facility, in order to be an eligible liquidity facility, must meet a reasonable asset quality test that, among other things, precluded funding assets that are 90 days or more past due or in default. The funding of assets past due 90 days or more using a liquidity facility exposes the bank to a greater degree of credit risk than the funding of assets that are less delinquent. In the case of a government guarantee, the past due limitation is not a relevant asset quality test. As a result, the risk-based capital rule does not apply the ''days past due'' limitation in the asset quality test with respect to assets that are either conditionally or unconditionally guaranteed by the United States government or its agencies, or another Organization for Economic Cooperation and Development (OECD) central government subsequent to a draw on a liquidity facility.

In August 2005, the Federal banking agencies issued guidance (FIL-74-2005) to clarify the requirement for the asset quality test to determine the eligibility or ineligibility of an ABCP liquidity facility and the resulting risk-based capital treatment for banks that provide liquidity facilities to ABCP conduits, entitled Interagency Guidance on the Eligibility of Asset-Backed Commercial Paper Liquidity Facilities and the Resultant Risk-Based Capital Treatment. As noted previously, eligibility is determined based on whether a liquidity facility contains contractual provisions that preclude the purchase of certain low credit quality assets. In order to clarify the requirements of the asset quality test, the interagency guidance states that an ABCP liquidity facility would be in compliance with the asset quality test if both of the following criteria are met:

- The liquidity provider has access to certain types of acceptable credit enhancements.

- The notional amount of such credit enhancements available to the liquidity facility provider exceeds the amount of underlying assets that are 90 days or more past due, defaulted, or below investment grade (in the case of a securities-backed program), that the liquidity provider may be obligated to fund under the facility.

In this circumstance, the liquidity facility may be considered eligible for risk-based capital standards because the provider of the credit enhancement generally bears the credit risk of the assets that are 90 days or more past due, in default, or below investment grade, rather than the bank providing the liquidity.

The following forms of credit enhancements are generally acceptable for purposes of satisfying the asset quality test:

- Funded credit enhancements that the bank may access to cover delinquent, defaulted, or below investment grade assets, such as over collateralization, cash reserves, subordinated securities, and funded spread accounts.

- Surety bonds and letters of credit issued by a third party with a nationally-recognized statistical rating organization rating of single A or higher that the bank may access to cover delinquent, defaulted, or below investment grade assets, provided that the surety bond or letter of credit is irrevocable and legally enforceable.

- One month's worth of excess spread that the bank may access to cover delinquent, defaulted, or below investment grade assets if the following two conditions are met: excess spread is contractually required to be trapped when it falls below 4.5 percent (measured on an annualized basis), and there is no material adverse change in the bank's ABCP underwriting standards. The amount of available excess spread may be calculated as the average of the current month's and the two previous months' excess spread.

Recourse directly to the seller, other than the funded credit enhancements enumerated above, regardless of the seller's external credit rating, is not an acceptable form of credit enhancement for purposes of satisfying the asset quality test. Seller recourse, for example, a seller's agreement to buy back nonperforming or defaulted loans or downgraded securities, may expose the liquidity provider to an increased level of credit risk. A decline in the performance of assets sold to an ABCP conduit may signal impending difficulties at the seller itself.

If the amount of acceptable credit enhancement associated with the pool of assets is less than the amount of assets that are 90 days or more past due, in default, or below investment grade that the liquidity facility provider may be obligated to fund against, the liquidity facility should be treated as recourse or a direct credit substitute. The full amount of assets supported by the liquidity facility would be subject to a 100 percent credit conversion factor. The examiners, however, can deem an otherwise eligible liquidity facility to be, in substance, a direct credit substitute if a bank uses the liquidity facility to provide credit support.

Bank management is responsible for demonstrating whether acceptable credit enhancements cover the 90 days or more past due, defaulted, or below investment grade assets that the bank may be obligated to fund against in each seller's asset pool. If management cannot adequately demonstrate satisfaction of the conditions in the interagency guidance, the examiners will then determine if a credit enhancement is unacceptable for purposes of the requirement for an asset quality test and, therefore, is an ineligible liquidity facility for risk-based capital purposes.

- 32

Source: Fitch Ratings, Asset-Backed Criteria Report: "Asset-Backed Commercial Paper Explained," November 8, 2001.

- 33

Source: Fitch Ratings, Asset-Backed Criteria Report: "Asset-Backed Commercial Paper Explained," November 8, 2001.

- 34

A1 and P-1 (Prime-1) ratings represent Standard & Poor's and Moody's highest short-term debt ratings, respectively.

- 35

Risk-based capital rules for recourse obligations and direct credit substitutes are discussed in the Regulatory Capital chapter of this manual.