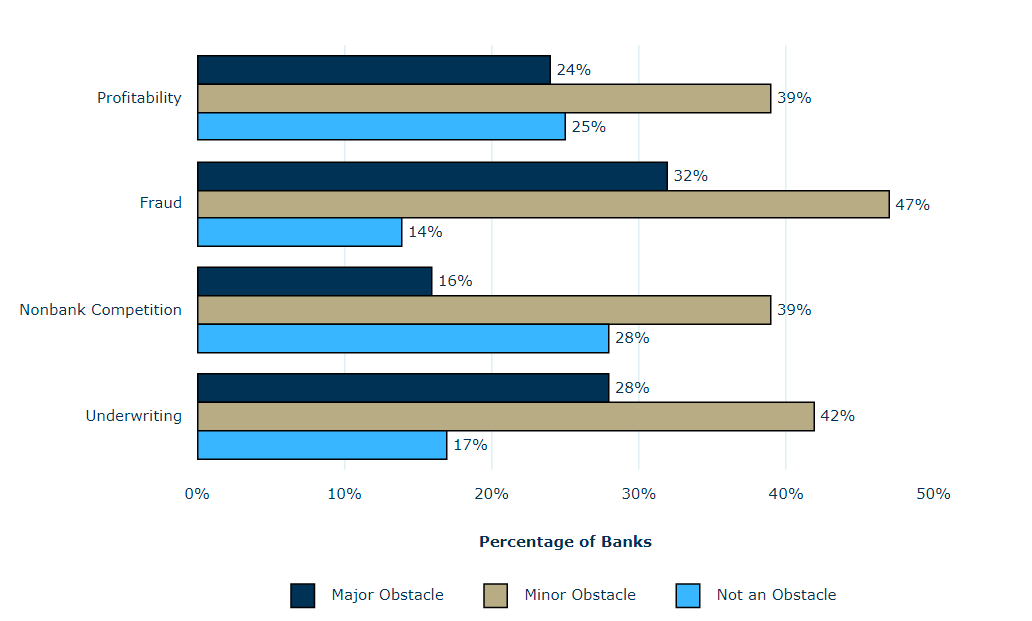

Bank Business Challenges as Obstacles

About one-third of banks identified fraud as the largest perceived major business-related challenge for banks in serving the underserved. Behind fraud (32 percent), underwriting (28 percent) and profitability (24 percent) were also cited relatively frequently as major obstacles. Only 16 percent of banks cited non-bank competition as a major obstacle.

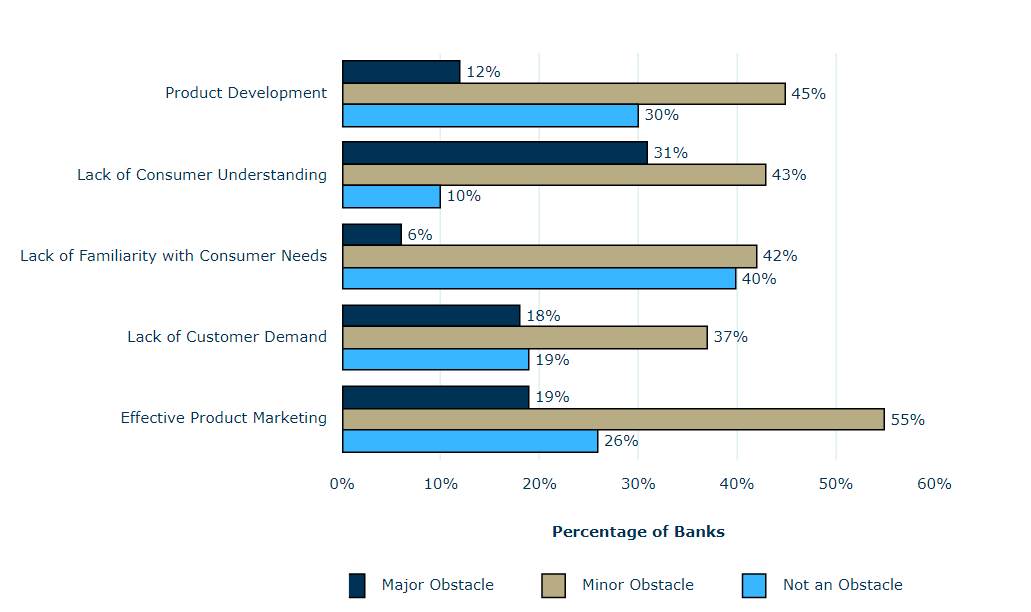

Product-Related Challenges as Obstacles

Thirty percent of banks reported that consumers' lack of understanding of financial products and services was a major product-related challenge. Among the other product related challenges, relatively fewer banks stated that lack of familiarity with financial or banking needs of underserved consumers (6 percent), developing products that meet the needs of the underserved (12 percent), effectively marketing products to the underserved (19 percent), and lack of consumer demand (18 percent) were major challenges in offering financial products and services to unbanked and underbanked consumers.

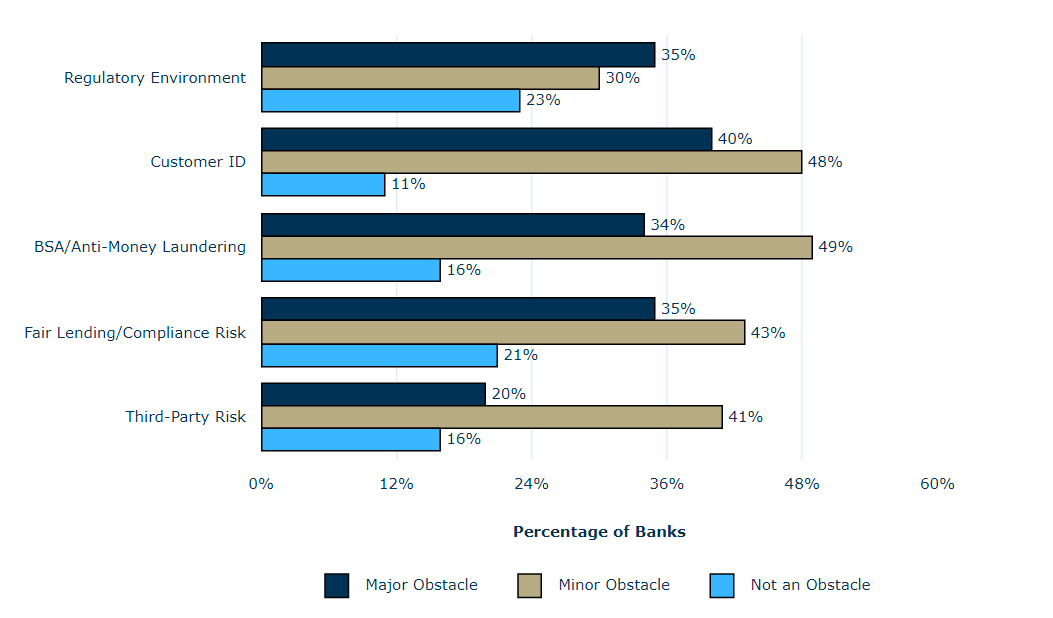

Regulatory Challenges as Obstacles

One in three banks (35 percent) cited regulatory requirements as a major obstacle in serving unbanked and underbanked consumers and an additional 30 percent cited them as a minor obstacle. Thirty-four to 40 percent of these banks reported that BSA/anti-money laundering (34 percent), fair lending/compliance risks (35 percent), and customer ID concerns (40 percent) were major obstacles in offering financial products and services to underserved consumers. In contrast, a relatively smaller proportion of banks (almost 20 percent) stated that third-party relationship risk was a major obstacle.