The History of FDIC

SCROLL

The Federal Deposit Insurance Corporation was created in 1933 during the economic turmoil of the Great Depression in order to maintain stability and public confidence in the nation’s financial system.

Between 1886 and 1933, Congress considered 150 proposals to create a national deposit insurance system.

Since 1933, the FDIC has worked to make certain America’s banks can provide a strong foundation for our nation’s growth, in good times and during moments of economic uncertainty.

...and since the FDIC’s creation, no one has lost a penny of their FDIC-insured deposits.

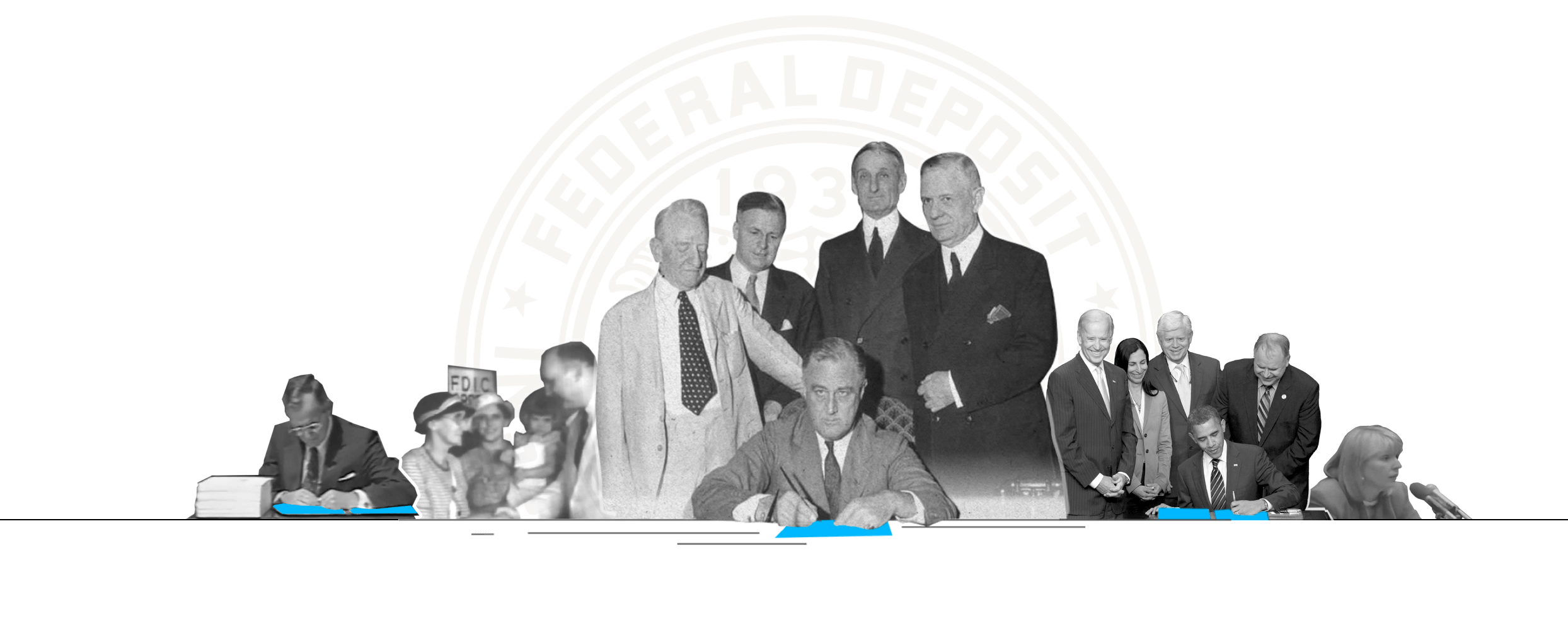

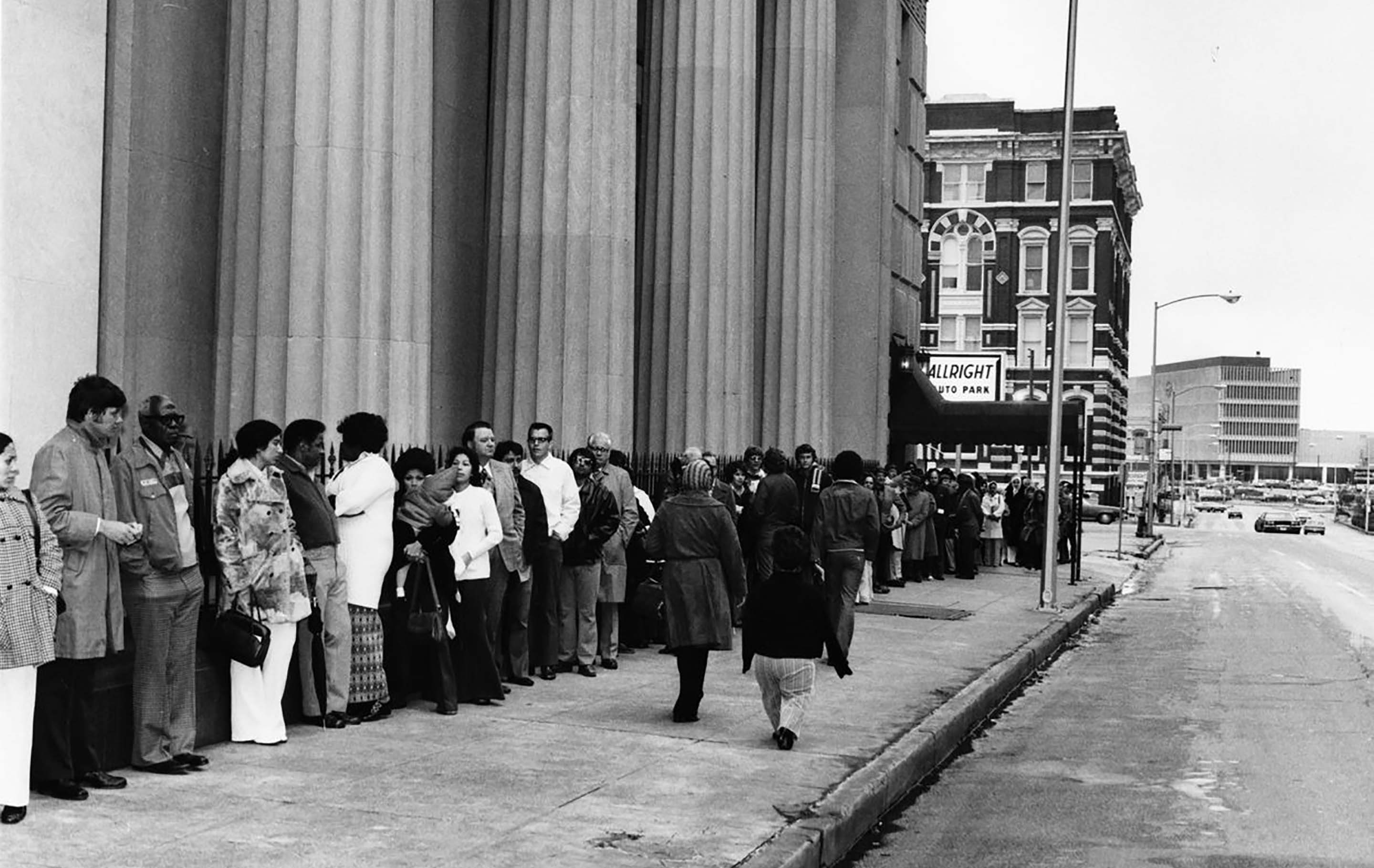

When the Great Depression began, people panicked and raced to withdraw their money from banks. These bank runs forced many institutions to suspend their operations…many never reopened, and countless families and businesses lost everything.

From 1930 to 1933, approximately 9,000 banks suspended operations.

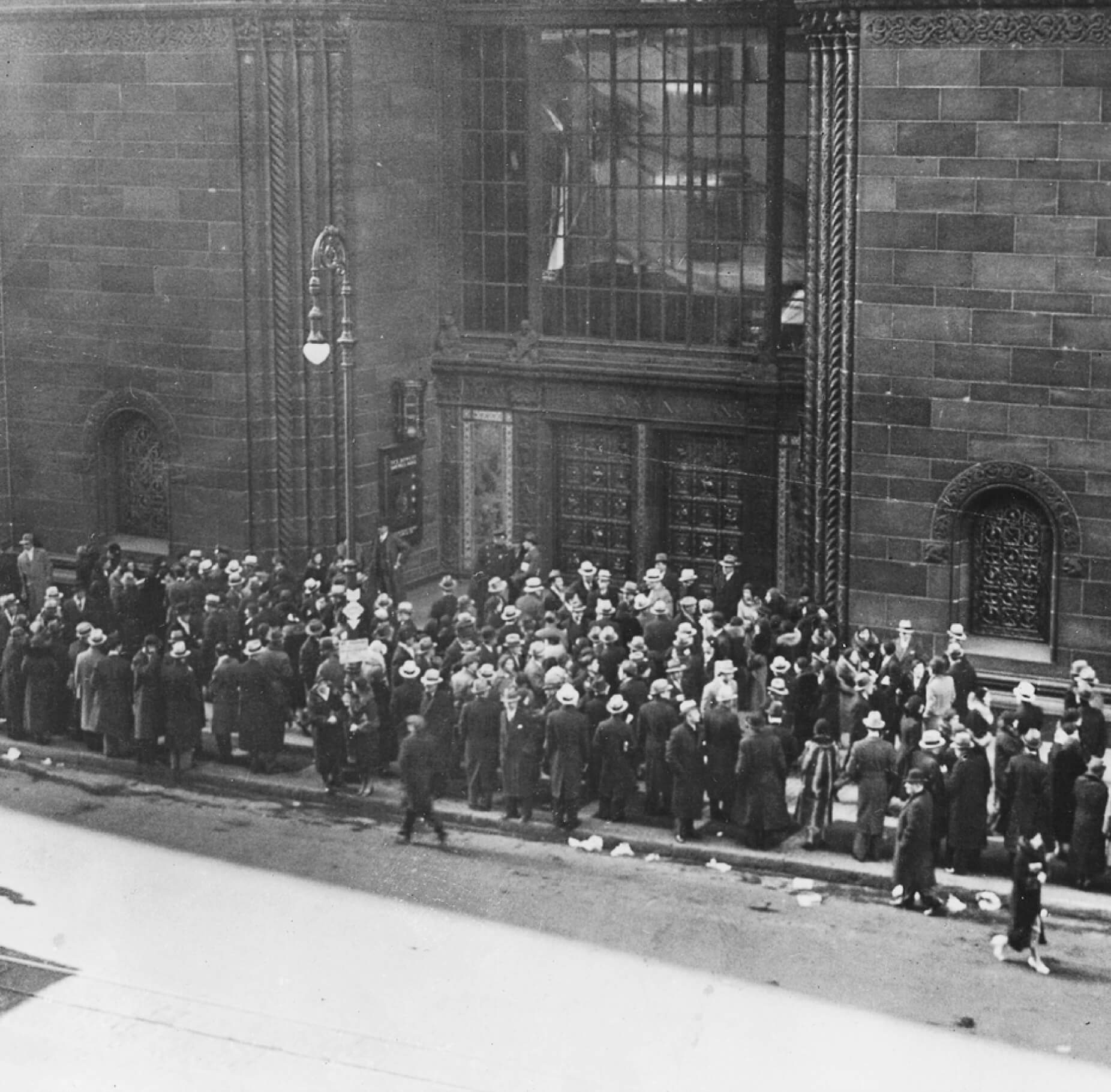

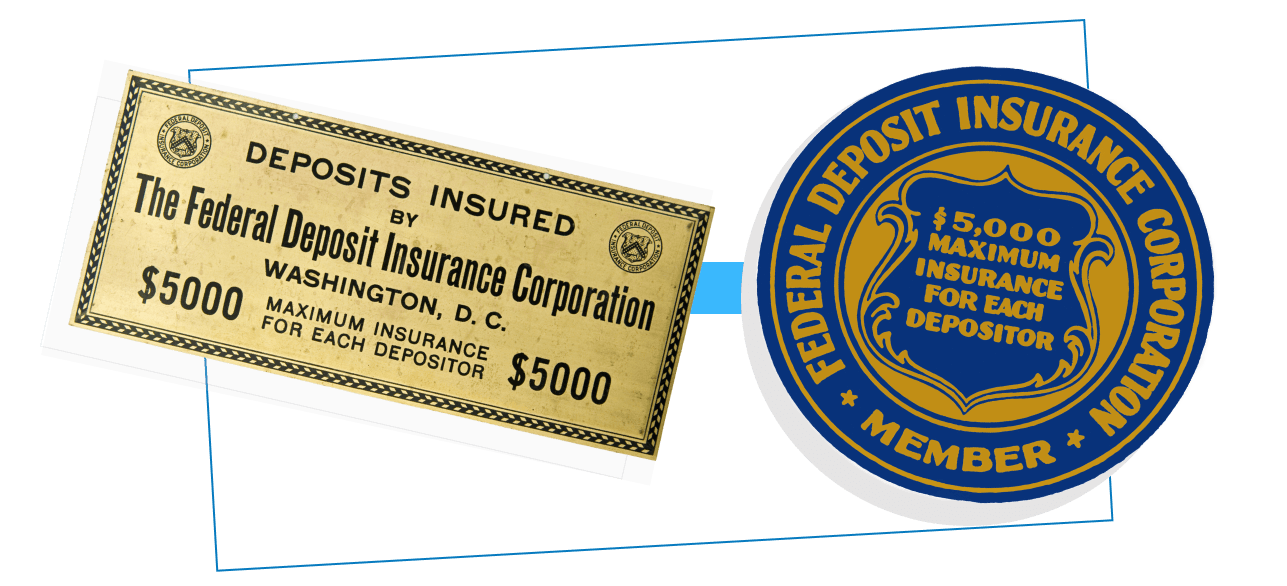

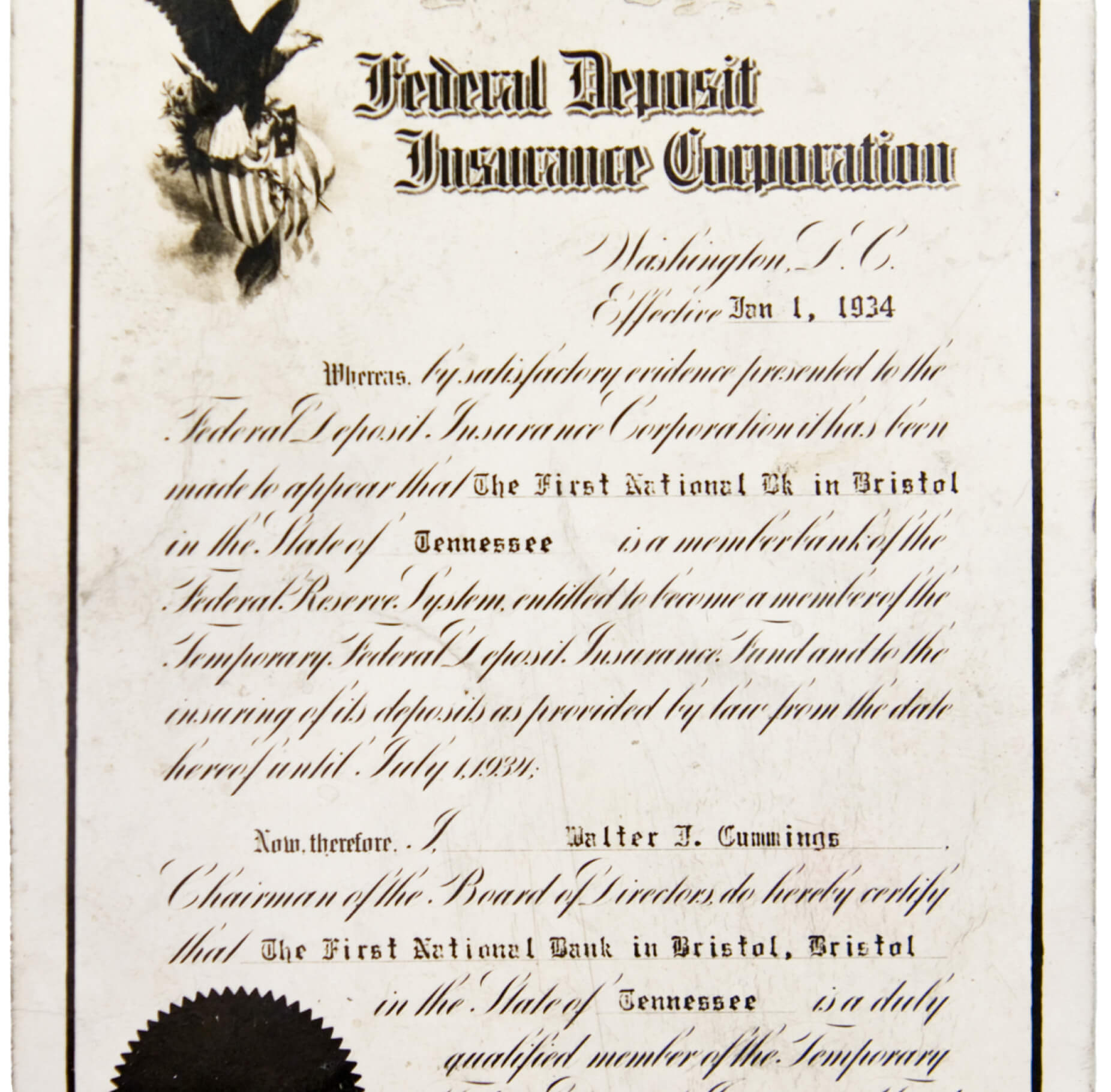

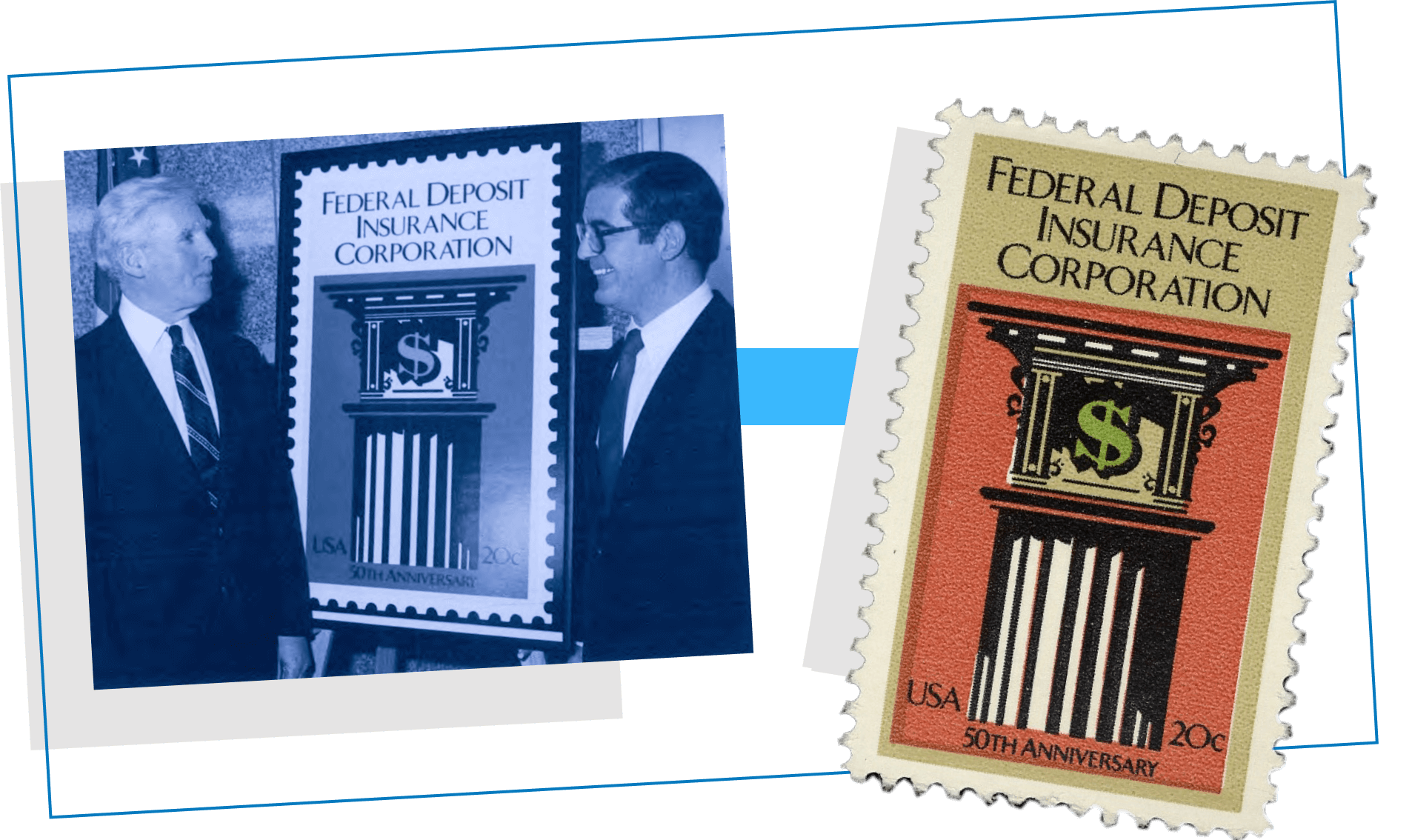

The first-ever national system of deposit insurance begins, protecting up to $2,500 per depositor at FDIC-insured banks.

At its start, FDIC deposit insurance guarantees $11 billion in deposits.

The FDIC makes its first deposit insurance claim payments to insured depositors of the Fon Du Lac State bank in East Peoria, Illinois.

Lydia Lobsiger is the first depositor to receive an FDIC payment which restores her life savings of $1,250.

President Roosevelt signs the Banking Act of 1935 into law making the FDIC’s deposit insurance program a permanent part of the U.S. financial system.

FDIC deposit insurance guarantees

$27 billion

in deposits.

During World War II, the FDIC continues its mission to support the nation’s financial system and give Americans the peace of mind their funds were protected.

FDIC deposit insurance guarantees

$91 billion

in deposits.

FDIC deposit insurance guarantees

$150 billion

in deposits.

Franklin National Bank of Long Island, New York fails with total assets of $3.6 billion. At the time, this is the largest single bank failure in the FDIC’s history.

President Jimmy Carter signs the Community Reinvestment Act into law after Congress found that communities need “credit services as well as deposit services.” The Act was designed to encourage federally insured financial institutions to reinvest in their communities, including low- and moderate-income communities.

FDIC deposit insurance guarantees

$950 billion

in deposits.

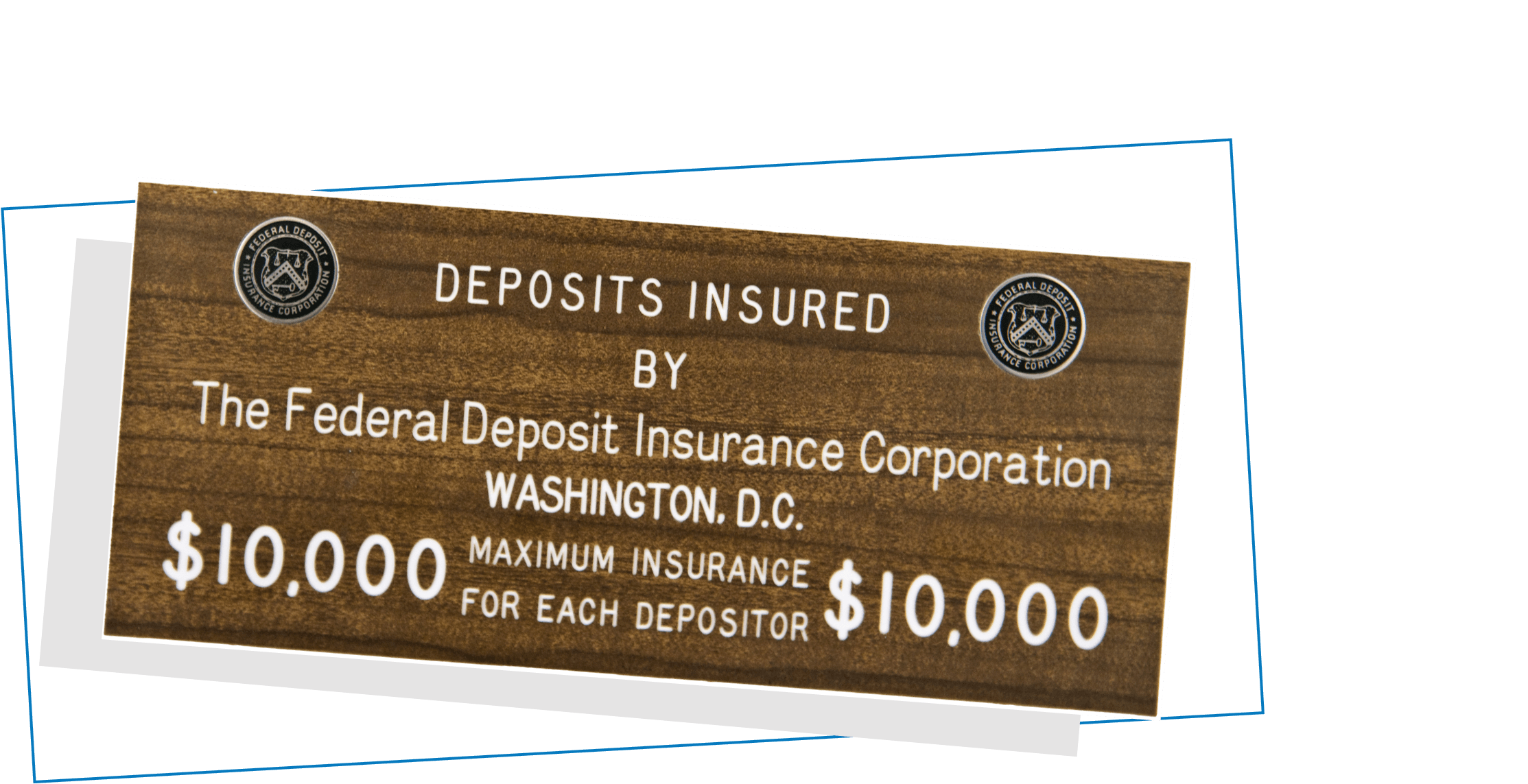

The Depository Institutions Deregulation and Monetary Control Act of 1980 is signed into law by President Jimmy Carter.

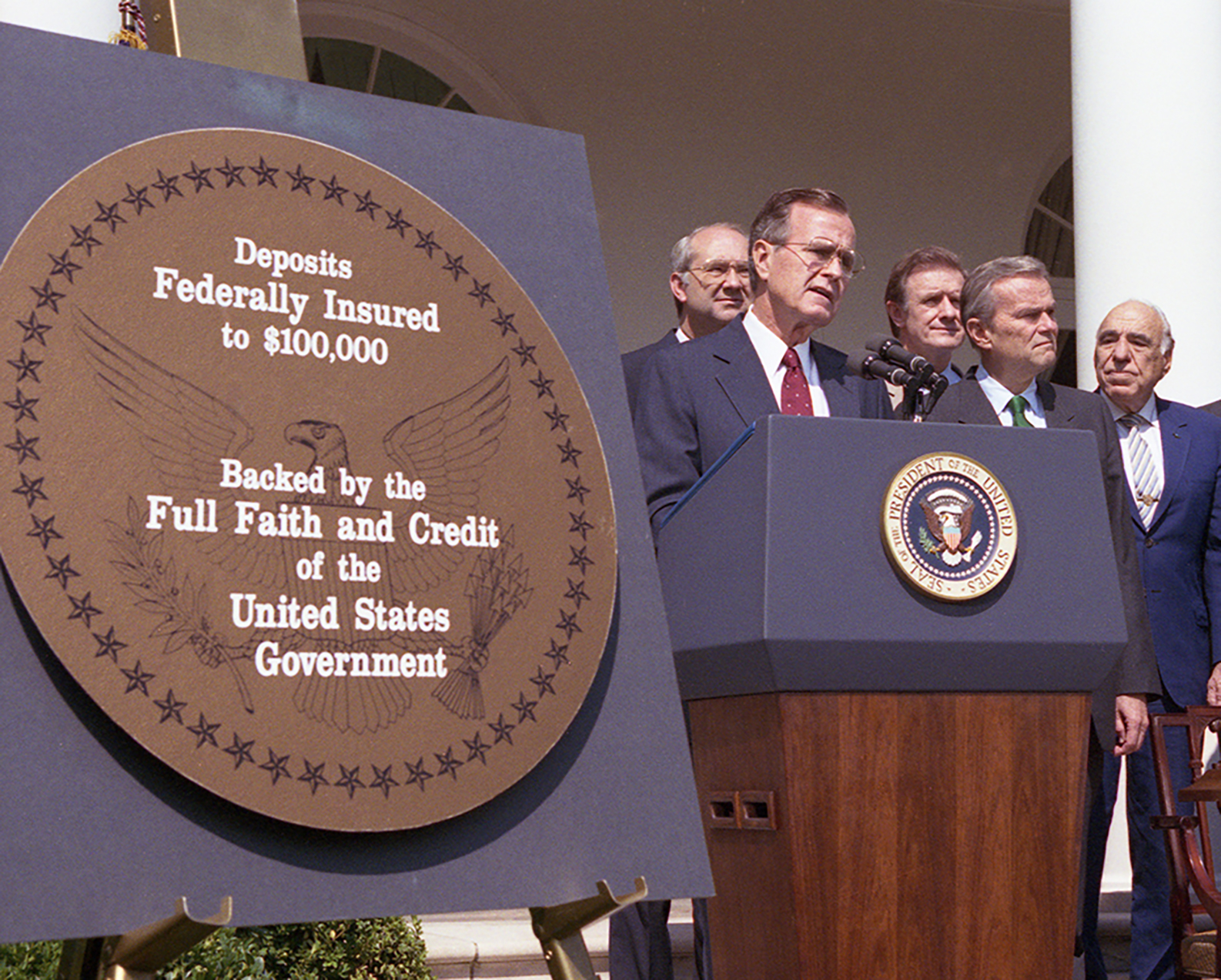

The statute increases the FDIC’s basic deposit insurance limit to $100,000 per depositor. At the time, Congress justified this increase to the FDIC’s coverage as necessary to help meet inflationary needs and to stem the outflows of deposits from depository institutions.

Financially troubled Continental Illinois National Bank and Trust of Chicago, then the nation’s seventh-largest bank, requires significant assistance from the FDIC, the Federal Reserve, and other commercial banks to remain operating. The bank’s resolution would ultimately cost the FDIC $1.1 billion.

The government’s open bank assistance package to Continental Illinois sparks a new policy debate over whether some financial institutions are “too big to fail.”

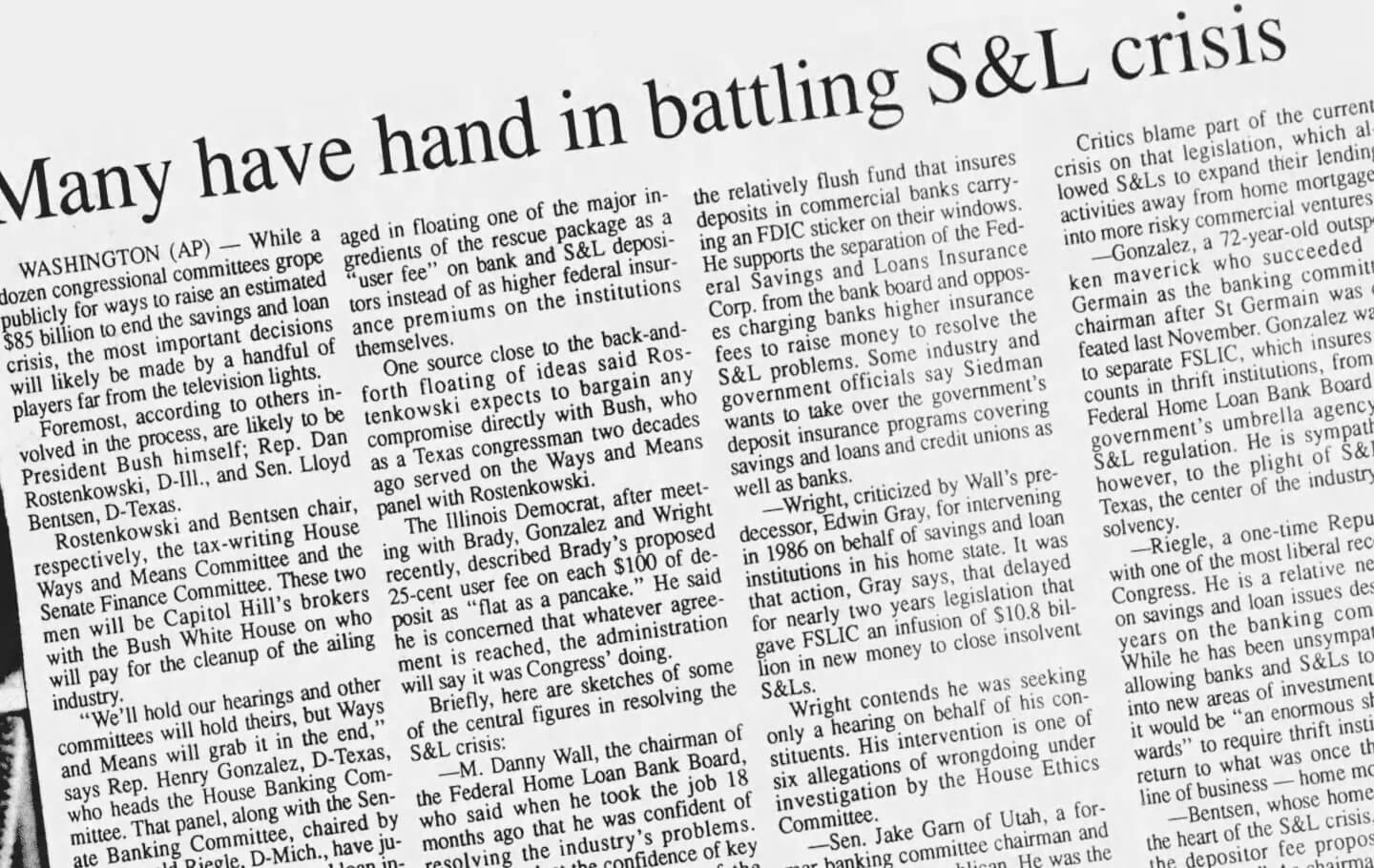

Rising interest rates and poor lending practices force nearly 1,300 Savings and Loans (S&Ls) to fail. Meanwhile, the nation experiences a series of rolling regional recessions in the agriculture, energy and real estate sectors causing 1,618 banks to fail.

During this period, the FDIC and the Resolution Trust Corporation (RTC) retained and managed a large volume of assets from failed banks and thrifts. In the years following this crisis, the FDIC adopted a resolution strategy to sell the assets of failed banks back into the private sector as quickly as possible.

In the wake of the S&L crisis, President George H. W. Bush signs the Financial Institutions Reform, Recovery and Enforcement Act of 1989 (FIRREA) into law.

The Act gives the FDIC responsibility to insure the deposits of S&Ls creating two FDIC deposit insurance funds...one for thrifts and one for banks. In 2006, these funds were merged into a single Deposit Insurance Fund.

FDIC deposit insurance guarantees approximately

$2.8 trillion

in deposits.

For the first time in its history, the FDIC’s Deposit Insurance Fund falls below zero on an accounting basis. Losses related to bank failures forced the agency to impose higher premiums on banks to replenish reserves.

The Federal Deposit Insurance Corporation Improvement Act of 1991 is signed into law by President George H.W. Bush.

The law requires the FDIC to resolve failed banks promptly and at the least cost to the Deposit Insurance Fund. However, the law also provides an exception to this ‘least-cost’ resolution method should the Federal government determine the failure of an institution would have serious adverse effects on economic conditions or financial stability.

The Gramm-Leach-Bliley Act is signed into law by President Bill Clinton.

Among its provisions, this statute repeals the parts of the Banking Act of 1933 (the Glass-Steagall Act) that restricted banks from affiliating with securities firms.

The statute also requires financial institutions to explain their information-sharing practices to consumers and to safeguard their sensitive information.

FDIC deposit insurance guarantees approximately

$3 trillion

in deposits.

Between June 26, 2004, and February 1, 2007, the FDIC experienced the longest period in its history without having to resolve a failed bank.

In 2008, the U.S. was confronted with its most severe financial crisis since the Great Depression. The crisis resulted in a prolonged economic contraction that impacts the global economy for years.

During this period, millions of households would lose their homes to foreclosure and more than 500 banks would fail.

But through it all, no depositor lost a penny of their FDIC-insured deposits.

IndyMac Bank, a California thrift with total assets of $31 billion, fails. At the time, IndyMac’s failure is the costliest in FDIC history with estimated losses of about $12 billion.

Washington Mutual Bank fails. With assets of $307 billion, “WaMu” is the largest failure in FDIC history.

JPMorgan Chase acquires Washington Mutual with no cost to the FDIC’s Deposit Insurance Fund.

The Emergency Economic Stabilization Act of 2008 is signed into law by President George W. Bush.

The law authorizes the $700 billion Temporary Asset Relief Program (TARP) and temporarily increases FDIC’s basic deposit insurance coverage to $250,000.

The FDIC announces, part of a broader effort by the federal government to stabilize the U.S. financial system, the creation of an unprecedented new program — the Temporary Liquidity Guarantee Program (TLGP).

Made possible under a systemic risk determination, the emergency program allows the FDIC, for the first time in its history, to guarantee certain bank, bank holding company, and other affiliate debt. The temporary program also allows the FDIC to offer unlimited deposit insurance on certain business accounts.

The federal government determines Citigroup, one of the world’s largest banks, is at risk of failure presenting a systemic risk to the U.S. financial system. The bank receives a complex package of “open bank assistance.”

Two months later, regulators determine Bank of America’s possible failure would also present a systemic risk and move to assist the bank. Bank of America ultimately declines this offer but is later required to pay $425 million for receiving the benefit of the federal government’s having approved the assistance.

FDIC deposit insurance guarantees approximately

$6.3 trillion

in deposits.

President Barack Obama signs the Dodd-Frank Wall Street Reform and Consumer Protection Act into law, the most comprehensive legislative reform of the U.S. financial sector since the Great Depression.

The law sought to improve supervision of systemically important nonbank financial companies and large bank holding companies. The Act also attempted to improve consumer financial protection, mortgage lending practices and enhance the transparency of financial derivatives.

Among its many provisions, the law grants the FDIC the authority to manage the orderly failure of large financial firms, prohibits government assistance to open and operating institutions, and limits systemic risk determinations to resolve failed banks only.

“Dodd-Frank” also permanently increases the FDIC’s basic deposit insurance coverage to $250,000.

As required under the Dodd-Frank Act, the FDIC approves deposit insurance assessment surcharges on banks with total assets of

$10 billion or more.

The surcharge was intended to increase the FDIC’s fund while limiting the impact of that increase on smaller banks.

FDIC deposit insurance guarantees approximately

$9 trillion

in deposits.

In the face of a global coronavirus pandemic and corresponding shutdowns across the globe, financial markets and the broader economy experienced significant stress and volatility.

In response, the FDIC instituted a number of regulatory flexibilities and supervision measures to mitigate the impact of the pandemic on the U.S. financial system and to support American households, communities, and small businesses.

The FDIC reports

4.5%

of U.S. households lacked a bank or credit union account in 2021. This is the lowest reported “unbanked rate” since the survey began in 2009.

Expanding Americans' access to safe, secure, and affordable banking services is an important part of the FDIC's mission of maintaining the stability of and public confidence in the U.S. financial system.

The FDIC National Survey of Unbanked and Underbanked Households is one contribution to this mission.

Conducted every two years since 2009, the FDIC and the U.S. Census Bureau seeks to measure the share of U.S. households that lack a basic bank or credit union account.

On March 10th, Silicon Valley Bank of Santa Clara, California is closed by the California Department of Financial Protection and Innovation.

Two days later, the New York Department of Financial Services closes Signature Bank of New York, New York.

To avoid further bank runs, the Federal government determines these large regional bank failures pose a systemic risk to the U.S. financial system and moves to protect all depositors of these banks, including uninsured depositors.

On March 19th, the FDIC enters into an agreement with Flagstar Bank, a subsidiary of New York Community Bancorp, to assume all deposits and certain assets of the failed Signature Bank

On March 26th, First-Citizens Bank & Trust Co. of Raleigh, North Carolina agrees to purchase all deposits and loans of the failed Silicon Valley Bank.

On May 1st, state bank regulators in California close First Republic Bank of San Francisco. JP Morgan Chase agrees to assume all deposits and to purchase nearly all of the assets of the failed institution

The failures of First Republic Bank, Silicon Valley Bank, and Signature Bank during the spring of 2023 represent the second, third and fourth largest bank failures in FDIC history, respectively.