SUMMARY

There are more than 6 million households in the U.S. headed by a single parent, 2.7 million of which are Black or Hispanic.1 This segment was already more likely to be financially vulnerable and was disproportionately affected by the economic impact of the COVID-19 pandemic, highlighting a real need for banking strategies that can help single parents save, build credit histories, and, ultimately, strengthen their financial resilience. This issue of Consumer Analytic Insights looks at the financial challenges facing single parents and opportunities to use digital mobile technology to improve their financial resilience to future financial shocks.

KEY TAKEAWAYS

1

Even before the pandemic, single parents were more likely to be financially vulnerable, lagging in income, savings, and access to credit compared to national averages.

2

Banking relationships could offer consumers opportunities to build emergency savings and access credit to withstand future financial challenges. However, many single parents conduct financial transactions outside of the banking system.

3

Mobile technology could be part of the strategy to engage single parents. Most single parents, even those with very low incomes, have smartphones and use them for financial transactions and digital payments.

4

There is a real need to focus on banking strategies to help single parents save, build credit histories, and, ultimately, strengthen their financial resilience to weather financial shocks.

Even before the pandemic, single parents were more likely to be financially vulnerable, lagging in income, savings, and access to credit compared to national averages.

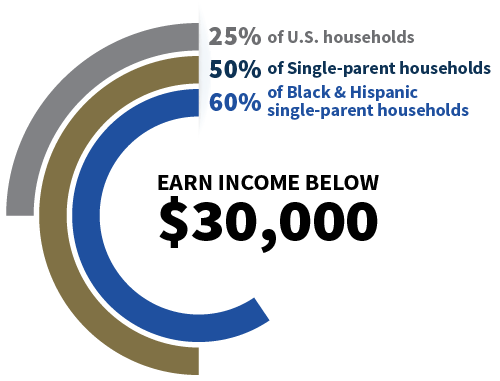

- In 2019, almost half of all single-parent households had annual income below $30,000, compared to 25 percent of households overall.2 Nearly 60 percent of Black and Hispanic single-parent households had income below $30,000.

- Overall, 55 percent of single parents saved for unexpected expenses or emergencies, compared to almost two thirds of households overall. Single parents with incomes below $30,000 were less likely to save for emergencies.

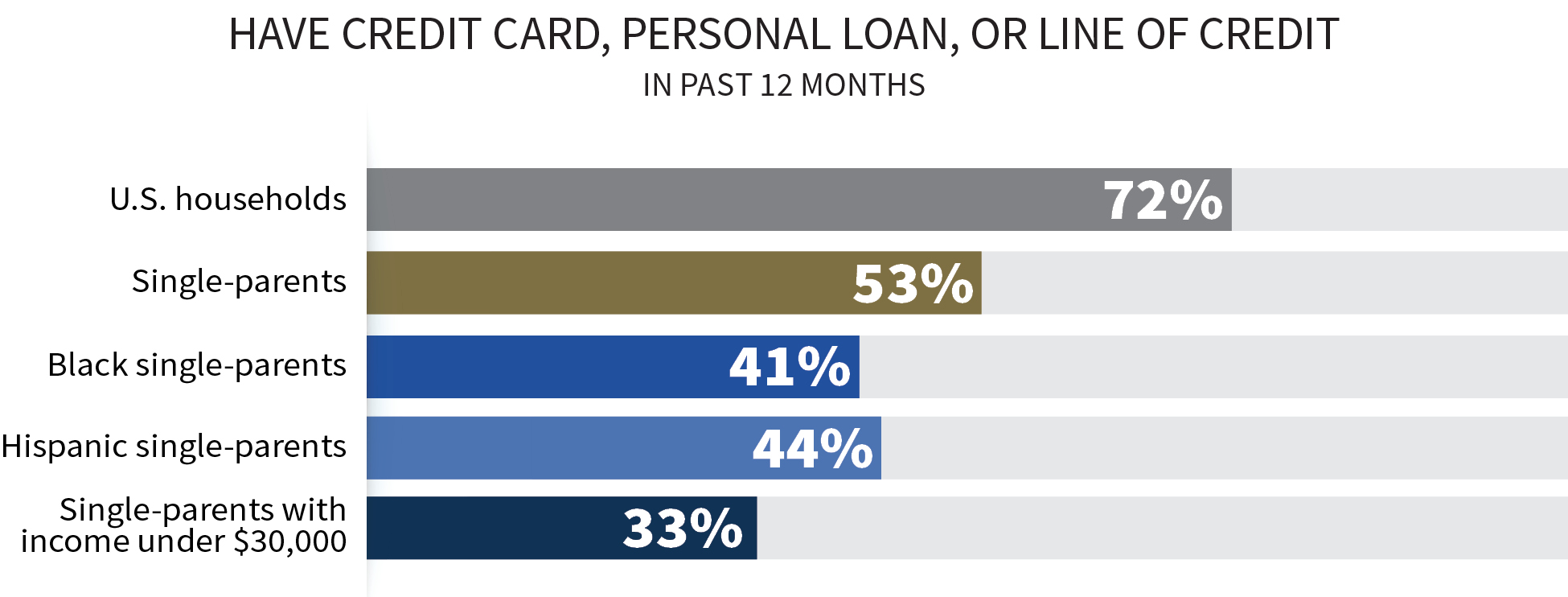

- Just over half of single parents reported having a credit card, personal loan, or line of credit in the past 12 months, a considerably lower share than the national average (72 percent). This type of bank credit is less prevalent among Black (41 percent) and Hispanic (44 percent) single-parent households, and lowest among those with income under $30,000 (33 percent).

- Single parents were impacted by both childcare and economic challenges brought on by the pandemic and the resulting disruptions to schools and businesses. Single parents were disproportionately employed in sectors that experienced the most significant job losses when the pandemic hit in 2020 (e.g., hospitality). At the end of that year, the U.S. unemployment rate was 6.5 percent, but unemployment among single parents was 10.4 percent.3

Banking relationships could offer consumers opportunities to build emergency savings and access credit to withstand future financial challenges. However, many single parents conduct financial transactions outside of the banking system.

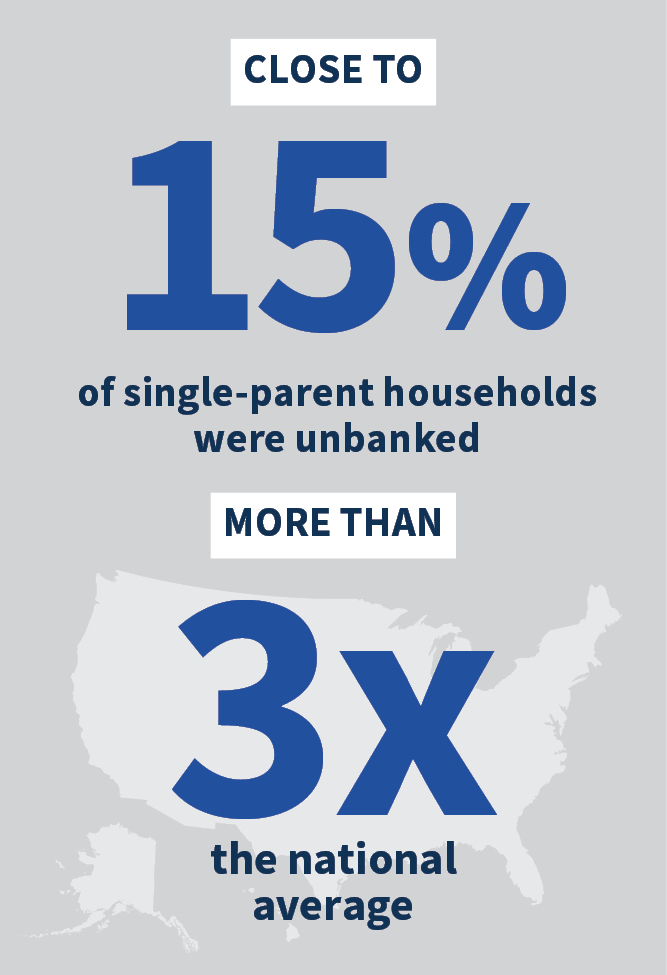

- Close to 15 percent of single-parent households did not have an account at a bank or a credit union (i.e., are unbanked) in 2021; this is more than three times the national average. Unbanked rates are higher for Black and Hispanic single parents (22 and 19 percent, respectively) and for single parents with income below $30,000 (27 percent). Single parents account for 15 percent of unbanked households, despite representing only 4.6 percent of all households. Notably, more than half of the children living in unbanked households live with single parents.

- About one-quarter of single parents had used nonbank money orders, check cashing, or money transfer services like Western Union in the past 12 months, compared to 16 percent of all households. Use is higher among certain minority groups, particularly Black single parents (35 percent) and Hispanic single parents (27 percent). Single parents without bank accounts make use of these products at an even higher rate (51 percent).

- Many banks offer tools that target customers with little or no credit histories and can help them build savings and credit histories. For example, low-fee, secured credit cards guaranteed by a savings account can help customers build their credit history and potentially improve their future access to more affordable credit.

Mobile technology could be part of the strategy to engage single parents. Most single parents, even those with very low incomes, have smartphones and use them for financial transactions and digital payments.

More than two-thirds of single parents who have a bank account most commonly access their account using mobile banking.

- Nearly all single parents, across all racial and income groups, have access to smartphones, and mobile banking is the most common way that single parents access their bank account. More than two-thirds of single parents who have a bank account most commonly access their account using mobile banking. This demonstrates that they are comfortable using technology for financial matters. Notably, online banking (on a computer) is much less common among single parents, who often do not have access to home internet. In fact, only 10 percent of single parents use online banking as the primary way to access their bank account.

- The use of nonbank peer-to-peer (P2P) apps and websites (e.g., PayPal, Venmo, and Cash App) is fairly common among single parents, which suggests they may have comfort with financial technology. Just over half of single parents had used nonbank P2P services in the last 12 months, usage that is on par with households overall. Usage increases with income: About 40 percent of single parents with income below $30,000 use nonbank P2P, compared to 70 percent of those with income above $50,000. In many cases, single parents are using nonbank P2P for core financial transactions; nearly 40 percent of single parents who use nonbank P2P do so to pay bills or receive income, compared to 31 percent of all households.

OPPORTUNITIES TO TAKE ACTION

There is a real need to focus on banking strategies to help single parents save, build credit histories, and, ultimately, strengthen their financial resilience to weather financial shocks. If they wish to reach this constituency, financial institutions and other stakeholders could potentially consider approaches that:

![]()

Expand outreach to single parents. Many single parents are financially vulnerable. Targeted strategies and focused messaging that resonates with this group could strengthen their connection to the financial mainstream.

![]()

Match single parents to appropriate products and tools. Safe and affordable bank accounts, such as Bank On certified accounts, could be an entry point to banking, especially for those who were previously unbanked.

![]()

Help single parents build resilience for now and the future. Connecting single parents to tools that can help them accumulate savings to draw from in emergencies and build positive credit histories to help them borrow money affordably when needed could help them better withstand financial shocks of the magnitude seen during the pandemic, or smaller, unexpected emergencies.

![]()

Leverage mobile technology. Most single parents are highly connected to mobile technology and are open to using it to conduct core financial transactions. Mobile technology could be part of effective messaging for single parents, and could be used to anchor financial relationships and facilitate savings and credit building.

Yazmin Osaki | Susan Burhouse

Division of Depositor and Consumer Protection, FDIC

Learn more

National Survey of Unbanked and Underbanked Households

Get engaged

Community Affairs Program and Contacts

- Single-parent households have a female or a male householder who is widowed, divorced, never married, or married but the spouse is absent (including separated). One or more children age 17 or younger live in the household, and no other individuals age 18 or older live in the household (including the householder’s own children age 18 or older). See 2021 FDIC National Survey of Unbanked and Underbanked Households.

- Unless otherwise noted, all data are from the 2019 FDIC Survey of Household Use of Banking and Financial Services and the 2021 FDIC National Survey of Unbanked and Underbanked Households.

- See The Pew Charitable Trusts, “Single Mothers Hit Hard by Job Losses,” May 26, 2020; and Bureau of Labor Statistics, Employment Characteristics of Families – 2020, April 21, 2021.

Recommended citation

Susan Burhouse and Yazmin Osaki, “Single Parents: Financial Resilience, Banking and Mobile Technology,” (Consumer Analytic Insights, Federal Deposit Insurance Corporation, April 2024), https://www.fdic.gov/analysis/consumer-research/consumer-analytic-insights/single-parents.html