-

WEBINAR 4: Open Banking

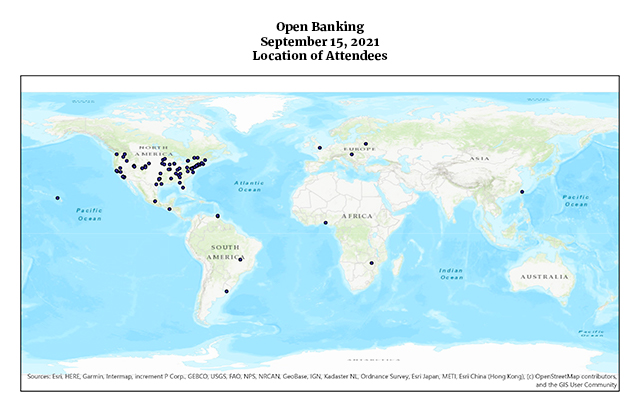

September 15, 2021

Policy and consumer impact perspectives on enabling “open banking” through APIs, national vs. state privacy laws, data ownership, and liability standards.

| Featured Speakers |

|---|

|

Ms. Ellis has extensive executive-level experience in deposit insurance pricing and insurance fund management. She led the FDIC’s efforts to implement the Federal Deposit Insurance Reform Act of 2005, which resulted in comprehensive changes to the FDIC’s risk-based pricing system. During the last financial crisis, she oversaw the FDIC’s efforts to recapitalize the deposit insurance fund and provide for its liquidity needs. Following passage of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, Ms. Ellis led the development and implementation of a comprehensive, long-term deposit insurance fund management strategy. Ms. Ellis started her FDIC career as a bank examiner in the Orange County, California field office where she examined numerous troubled banks and thrifts during a severe recession. She then joined the Division of Insurance in Washington, D.C. where she analyzed emerging risks to the banking and thrift industries, with particular emphasis on the consumer sector and credit conditions. Other roles Ms. Ellis has served in at the FDIC include Deputy to the Vice Chairman, Special Assistant to the Chief Operating Officer, Associate Director for Financial Risk Management, and Deputy Director for Financial Risk Management and Research. Ms. Ellis holds a BBA in Finance from Texas Christian University, Ft. Worth, Texas, and is a Chartered Financial Analyst. She currently serves on the Executive Council of the International Association of Deposit Insurers. |

|

Before joining Plaid, John served as the Deputy Assistant Director for Intergovernmental Affairs at the Consumer Financial Protection Bureau. At the Bureau, John worked with the state Attorneys General to promote cooperation and coordination between the states in enforcing the Dodd-Frank Consumer Financial Protection Act. He was a regular speaker on NAAG, CWAG, and State Center panels on topics including student lending, payday lending, and emerging financial technologies like cryptocurrencies. John started his career as an attorney with Orrick, Herrington & Sutcliffe. |

|

Prior to joining a16z, Angela was a product manager at Google where she launched and grew Chrome for Android and Chrome for iOS into two of Google's most successful mobile products. Previously, she was the director of product management and business development at Ruba.com (acquired by Google) and a senior associate partner at Bay Partners where she focused on the consumer internet sector. Prior to that, Angela was a consultant at Mercer Management Consulting in Toronto. Angela is a proud Canadian and served as co-chair of the C100, a non-profit that bridges Canadian entrepreneurs with Silicon Valley, and on the Canadian Finance Minister Morneau's Economic Growth Council. Angela has a Mechanical Engineering degree from Queen's University, in Canada, and an MBA from Stanford. Angela is a world-class athlete and spent two years training professionally as a runner; she has won several marathons and achieved a seventh place national ranking in Canada. |

|

Prior to joining the CMA he was with what is now Thomson Reuters, playing a variety of senior commercial roles in their information businesses and before that he was Deputy Director of Which? (the UK equivalent of the Consumers’ Union) where he was responsible for the magazines, laboratories and associated commercial operations. |

|

|

Questions

If you have questions about the webinar series, please email your inquiry to SHR_BnkonDataCf-2021@FDIC.gov.

Stay up to date with the Banking on Data: Great Possibilities, Great Responsibilities Webinar Series by following #FDICResearch.

PDF Help - Information on downloading and using the PDF reader.