-

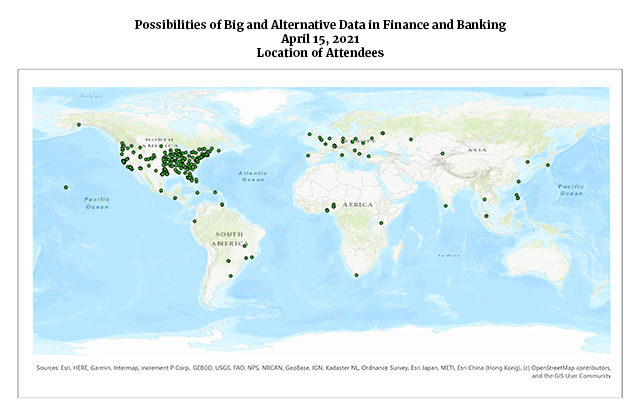

WEBINAR 1: Possibilities of Big and Alternative Data in Finance and Banking

April 15, 2021

Research and analysis on the application of methodologies, tools, and techniques to derive information, trends, and patterns from large data sets.

| Featured Speakers |

|---|

|

|

|

|

|

Duffie’s research focus is the design and regulation of financial markets. His books include How Big Banks Fail (Princeton University Press, 2010), Measuring Corporate Default Risk (Oxford University Press, 2011), and Dark Markets (Princeton University Press, 2012), and Fragmenting Markets, Post-Crisis Bank Regulations and Financial Market Liquidity (de Gruyter, forthcoming). |

|

Roberto is a Venezuelan economist whose areas of research are international economics, monetary economics, and development economics. Currently he works on measurement of economic and social responsibility variables. He is one of the two founding members of the Billion Prices Project, and a co-founder of PriceStats. He is the director of the Aggregate Confusion Project which studies how to improve ESG measures. |

Questions

If you have questions about the webinar series, please email your inquiry to SHR_BnkonDataCf-2021@FDIC.gov.

Stay up to date with the Banking on Data: Great Possibilities, Great Responsibilities Webinar Series by following #FDICResearch.

PDF Help - Information on downloading and using the PDF reader.