B. More About the FDIC

FDIC Board of Directors

Jelena McWilliams

Jelena McWilliams

Jelena McWilliams is the 21st Chairman of the FDIC. She was nominated by President Donald J. Trump on November 30, 2017, and confirmed by the Senate on May 24, 2018, to serve a six-year term on the FDIC Board of Directors, and designated as Chairman for a term of five years.

Ms. McWilliams was Executive Vice President, Chief Legal Officer, and Corporate Secretary for Fifth Third Bank in Cincinnati, Ohio. Prior to joining Fifth Third Bank, Ms. McWilliams worked in the United States Senate for six years, most recently as Chief Counsel and Deputy Staff Director with the Senate Committee on Banking, Housing and Urban Affairs, and previously as Assistant Chief Counsel with the Senate Small Business and Entrepreneurship Committee. From 2007 to 2010, Ms. McWilliams served as an attorney at the Federal Reserve Board of Governors. Before entering public service, she practiced corporate and securities law at Morrison & Foerster LLP in Palo Alto, California, and Hogan & Hartson LLP (now Hogan Lovells LLP) in Washington, D.C.

Ms. McWilliams graduated with highest honors from the University of California at Berkeley with a B.S. in political science, and earned her law degree from U.C. Berkeley School of Law.

Martin J. Gruenberg

Martin J. Gruenberg

Martin J. Gruenberg is the 20th Chairman of the FDIC, receiving Senate confirmation on November 15, 2012, for a five-year term. Mr. Gruenberg served as Vice Chairman and Member of the FDIC Board of Directors from August 22, 2005, until his confirmation as Chairman. He served as Acting Chairman from July 9, 2011, to November 15, 2012, and also from November 16, 2005, to June 26, 2006.

Mr. Gruenberg joined the FDIC Board after broad congressional experience in the financial services and regulatory areas. He served as Senior Counsel to Senator Paul S. Sarbanes (D-MD) on the staff of the Senate Committee on Banking, Housing, and Urban Affairs from 1993 to 2005. Mr. Gruenberg advised the Senator on issues of domestic and international financial regulation, monetary policy, and trade. He also served as Staff Director of the Banking Committee's Subcommittee on International Finance and Monetary Policy from 1987 to 1992. Major legislation in which Mr. Gruenberg played an active role during his service on the Committee includes the Financial Institutions Reform, Recovery, and Enforcement Act of 1989 (FIRREA); the Federal Deposit Insurance Corporation Improvement Act of 1991 (FDICIA); the Gramm-Leach-Bliley Act; and the Sarbanes-Oxley Act of 2002.

Mr. Gruenberg served as Chairman of the Executive Council and President of the International Association of Deposit Insurers (IADI) from November 2007 to November 2012.

Mr. Gruenberg holds a J.D. from Case Western Reserve Law School and an A.B. from Princeton University, Woodrow Wilson School of Public and International Affairs.

Kathleen L. Kraninger

Kathleen L. Kraninger

Kathy Kraninger became Director of the Consumer Financial Protection Bureau (CFPB) in December, 2018. From her early days as a Peace Corps volunteer, to her role establishing the Department of Homeland Security (DHS), to her policy work at the Office of Management and Budget (OMB) to the CFPB, Director Kraninger has dedicated her career to public service.

Director Kraninger came to the CFPB from OMB, where as a Policy Associate Director she oversaw the budgets for executive branch agencies including the Departments of Commerce, Justice, DHS, Housing and Urban Development, Department of Transportation (DOT), and the Department of Treasury, in addition to 30 other government agencies.

Previously she worked in the U.S. Senate, where she was the Clerk for the Senate Appropriations Subcommittee on Homeland Security, which provides DHS with its $40 billion discretionary budget. On Capitol Hill, she also worked for the House Appropriations Subcommittee on Homeland Security as well as the Senate Homeland Security and Governmental Affairs Committee.

Ms. Kraninger also served in executive branch posts with DOT. There, after the terrorist attacks on September 11, 2001, she volunteered to join the leadership team that set up the newly created DHS.

Her work at DHS led to awards including the Secretary of Homeland Security’s Award of Exceptional Service, the International Police and Public Safety 9/11 Medal, and the Meritorious Public Service Award from the United States Coast Guard.

Ms. Kraninger graduated magna cum laude from Marquette University and earned a law degree from Georgetown University Law Center. She served as a U.S. Peace Corps Volunteer in Ukraine.

Joseph M. Otting

Joseph M. Otting

Joseph M. Otting was sworn in as the 31st Comptroller of the Currency on November 27, 2017.

The Comptroller of the Currency is the administrator of the federal banking system and chief officer of the Office of the Comptroller of the Currency (OCC). The OCC supervises nearly 1,400 national banks, federal savings associations, and federal branches and agencies of foreign banks operating in the United States. The mission of the OCC is to ensure that national banks and federal savings associations operate in a safe and sound manner, provide fair access to financial services, treat customers fairly, and comply with applicable laws and regulations.

The Comptroller also serves as a director of the Federal Deposit Insurance Corporation and member of the Financial Stability Oversight Council and the Federal Financial Institutions Examination Council.

Prior to becoming Comptroller of the Currency, Mr. Otting was an executive in the banking industry. He served as President of CIT Bank and Co-President of CIT Group.

Mr. Otting previously was President, Chief Executive Officer, and a member of the Board of Directors of OneWest Bank, N.A. Prior to joining OneWest Bank, he served as Vice Chairman of U.S. Bancorp, where he managed the Commercial Banking Group and served on the Bancorp’s executive management committee. He also served as a member of U.S. Bank’s main subsidiary banks’ Board of Directors.

From 1986 to 2001, Mr. Otting was with Union Bank of California, where he was Executive Vice President and Group Head of Commercial Banking. Before joining Union Bank, he was with Bank of America and held positions in branch management, preferred banking, and commercial lending.

Mr. Otting has played significant roles in charitable and community development organizations. He has served as a board member for the California Chamber of Commerce, the Killebrew-Thompson Memorial foundation, the Associated Oregon Industries, the Oregon Business Council, the Portland Business Alliance, the Minnesota Chamber of Commerce, and Blue Cross Blue Shield of Oregon. He was also a member of the Financial Services Roundtable, the Los Angeles Chamber of Commerce, and the Board and Executive Committee of the Los Angeles Economic Development Corporation.

Mr. Otting holds a bachelor of arts in management from the University of Northern Iowa and is a graduate of the School of Credit and Financial Management, which was held at Dartmouth College in Hanover, New Hampshire.

Mick Mulvaney

Mick Mulvaney

Mick Mulvaney, former Acting Director of the Consumer Financial Protection Bureau, resigned from the FDIC Board of Directors as of December 11, 2018. Mr. Mulvaney had been a Board member since November 25, 2017.

Thomas M. Hoenig

Thomas M. Hoenig

Thomas M. Hoenig, former Vice Chairman, resigned on April 30, 2018. Mr. Hoenig served a six-year term as FDIC Vice Chairman and member of the Board of Directors.

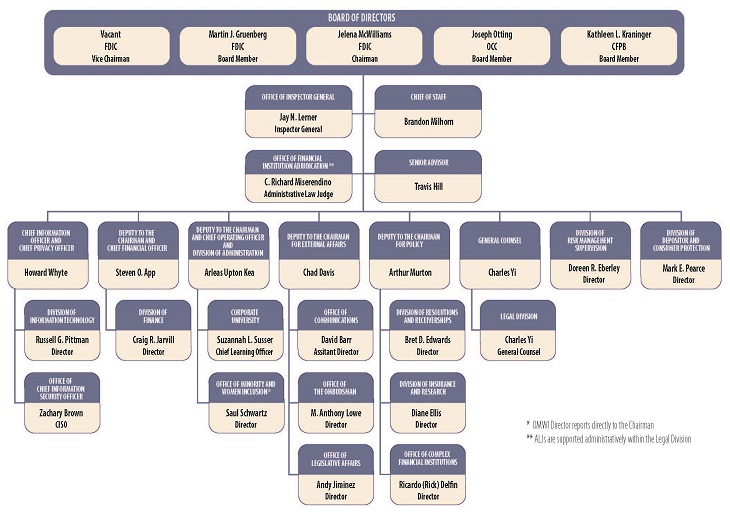

FDIC Organization Chart/Officials

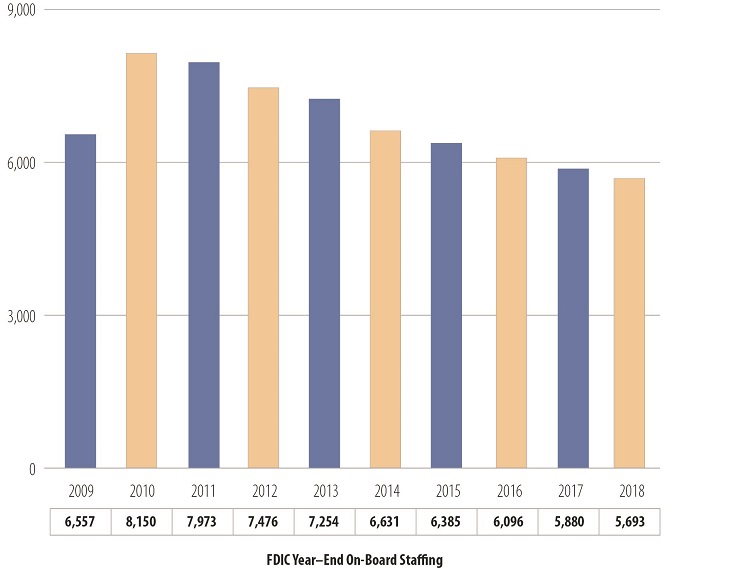

CORPORATE STAFFING

STAFFING TRENDS 2009-2018

Notes: 2009-2018 staffing totals reflect year-end full time equivalent staff.

| Division or Office | Total | Washington | Regional | |||

|---|---|---|---|---|---|---|

| 2018 | 2017 | 2018 | 2017 | 2018 | 2017 | |

| Division of Risk Management Supervision | 2,499 | 2,558 | 207 | 197 | 2,293 | 2,361 |

| Division of Depositor and Consumer Protection | 816 | 831 | 122 | 120 | 694 | 711 |

| Division of Resolutions and Receiverships | 387 | 457 | 119 | 134 | 268 | 323 |

| Legal Division | 474 | 506 | 314 | 326 | 160 | 180 |

| Division of Administration | 353 | 358 | 246 | 246 | 108 | 112 |

| Division of Information Technology | 280 | 276 | 216 | 219 | 64 | 57 |

| Corporate University | 204 | 217 | 197 | 211 | 7 | 6 |

| Division of Insurance and Research | 204 | 194 | 168 | 157 | 36 | 37 |

| Division of Finance | 164 | 166 | 160 | 162 | 4 | 4 |

| Office of the Chief Information Security Officer2 | 37 | 36 | 37 | 36 | 0 | 0 |

| Office of Inspector General | 126 | 126 | 80 | 78 | 46 | 48 |

| Office of Complex Financial Institutions | 62 | 62 | 49 | 48 | 13 | 14 |

| Executive Offices3 | 20 | 26 | 20 | 26 | 0 | 0 |

| Executive Support Offices4 | 67 | 68 | 60 | 60 | 7 | 8 |

| Total | 5,693 | 5,880 | 1,994 | 2,019 | 3,699 | 3,861 |

1 The FDIC reports staffing totals using a full-time equivalent methodology, which is based on an employee’s scheduled work hours. Division/Office staffing has been rounded to the nearest whole FTE. Totals may not foot due to rounding.

2 Formerly known as the Information Security and Privacy Staff.

3 Includes the Offices of the Chairman, Vice Chairman, Director (Appointive), Chief Operating Officer, Chief Financial Officer, Chief Policy Officer, External Affairs, and Chief Information Officer.

4 Includes the Offices of Legislative Affairs, Communications, Ombudsman, Financial Adjudication, and Minority and Women Inclusion.

Sources of Information

FDIC Website

www.fdic.gov

A wide range of banking, consumer, and financial information is available on the FDICʼs website. This includes the FDICʼs Electronic Deposit Insurance Estimator (EDIE), which estimates an individual’s deposit insurance coverage; the Institution Directory, which contains financial profiles of FDIC-insured institutions; Community Reinvestment Act evaluations and ratings for institutions supervised by the FDIC; Call Reports, which are bank reports of condition and income; and Money Smart, a training program to help individuals outside the financial mainstream enhance their money management skills and create positive banking relationships. Readers also can access a variety of consumer pamphlets, FDIC press releases, speeches, and other updates on the agencyʼs activities, as well as corporate databases and customized reports of FDIC and banking industry information.

FDIC Call Center

Phone: 877-275-3342 (877-ASK-FDIC)

703-562-2222

Hearing Impaired: 800-925-4618

703-562-2289

The FDIC Call Center in Washington, DC, is the primary telephone point of contact for general questions from the banking community, the public, and FDIC employees. The Call Center directly, or with other FDIC subject-matter experts, responds to questions about deposit insurance and other consumer issues and concerns, as well as questions about FDIC programs and activities. The Call Center also refers callers to other federal and state agencies as needed. Hours of operation are 8:00 a.m. to 8:00 p.m., Eastern Time, Monday – Friday, and 9:00 a.m. to 5:00 p.m., Saturday – Sunday. Recorded information about deposit insurance and other topics is available 24 hours a day at the same telephone number.

As a customer service, the FDIC Call Center has many bilingual Spanish agents on staff and has access to a translation service, which is able to assist with over 40 different languages.

Public Information Center

3501 Fairfax Drive

Room E-1021

Arlington, VA 22226

Phone: 877-275-3342 (877-ASK-FDIC), 703-562-2200

Fax: 703-562-2296

FDIC Online Catalog: https://catalog.fdic.gov

E-mail: publicinfo@fdic.gov

Publications such as FDIC Quarterly and Consumer News and a variety of deposit insurance and consumer pamphlets are available at www.fdic.gov or may be ordered in hard copy through the FDIC online catalog. Other information, press releases, speeches and congressional testimony, directives to financial institutions, policy manuals, and FDIC documents are available on request through the Public Information Center. Hours of operation are 9:00 a.m. to 4:00 p.m., Eastern Time, Monday – Friday.

Office of the Ombudsman

3501 Fairfax Drive

Room E-2022

Arlington, VA 22226

Phone: 877-275-3342 (877-ASK-FDIC)

Fax: 703-562-6057

E-mail: ombudsman@fdic.gov

The Office of the Ombudsman (OO) is an independent, neutral, and confidential resource and liaison for the banking industry and the general public. The OO responds to inquiries about the FDIC in a fair, impartial, and timely manner. It researches questions and fields complaints from bankers and bank customers. OO representatives are present at all bank closings to provide accurate information to bank customers, the media, bank employees, and the general public. The OO also recommends ways to improve FDIC operations, regulations, and customer service.

Regional and Area Offices

Atlanta Regional Office

Michael J. Dean, Regional Director

10 Tenth Street, NE

Suite 800

Atlanta, Georgia 30309

(678) 916-2200

States represented:

- Alabama

- Florida

- Georgia

- North Carolina

- South Carolina

- Virginia

- West Virginia

Chicago Regional Office

John P. Conneely, Regional Director

300 South Riverside Plaza

Suite 1700

Chicago, Illinois 60606

(312) 382-6000

States represented:

- Illinois

- Indiana

- Kentucky

- Michigan

- Ohio

- Wisconsin

Dallas Regional Office

Kristie K. Elmquist, Regional Director

1601 Bryan Street

Dallas, Texas 75201

(214) 754-0098

States represented:

- Colorado

- New Mexico

- Oklahoma

- Texas

Memphis Area Office

Kristie K. Elmquist, Director

6060 Primacy Parkway

Suite 300

Memphis, Tennessee 38119

(901) 685-1603

States represented:

- Arkansas

- Louisiana

- Mississippi

- Tennessee

Kansas City Regional Office

James D. LaPierre, Regional Director

1100 Walnut Street

Suite 2100

Kansas City, Missouri 64106

(816) 234-8000

States represented:

- Iowa

- Kansas

- Minnesota

- Missouri

- Nebraska

- North Dakota

- South Dakota

New York Regional Office

John F. Vogel, Regional Director

350 Fifth Avenue

Suite 1200

New York, New York 10118

(917) 320-2500

States and territories represented:

- Delaware

- District of Columbia

- Maryland

- New Jersey

- New York

- Pennsylvania

- Puerto Rico

- Virgin Islands

Boston Area Office

John F. Vogel, Director

15 Braintree Hill Office Park

Suite 100

Braintree, Massachusetts 02184

(781) 794-5500

States represented:

- Connecticut

- Maine

- Massachusetts

- New Hampshire

- Rhode Island

- Vermont

San Francisco Regional Office

Kathy L. Moe, Regional Director

25 Jessie Street at Ecker Square

Suite 2300

San Francisco, California 94105

(415) 546-0160

States and territories represented:

- Alaska

- American Samoa

- Arizona

- California

- Federated States of Micronesia

- Guam

- Hawaii

- Idaho

- Montana

- Nevada

- Oregon

- Utah

- Washington

- Wyoming