Community Banking Initiatives

Community banks provide traditional, relationship-based banking services in their local communities, and as the primary federal supervisor for the majority of community banks, the FDIC has a particular responsibility for the safety and soundness of this segment of the banking system.

As defined for FDIC research purposes, community banks made up 92 percent of all FDIC-insured institutions at mid-year 2018. While these banks hold just 13 percent of banking industry assets, community banks are of critical importance to the U.S. economy and local communities across the nation. They hold 42 percent of the industry’s small loans to farmers and businesses, making them the lifeline to entrepreneurs and small enterprises of all types, and they hold the majority of bank deposits in U.S. rural counties and micropolitan counties with populations up to 50,000. In fact, as of June 2018, community banks held more than 75 percent of deposits in more than 1,200 U.S. counties. In more than 600 of these counties, the only banking offices available to consumers were those operated by community banks.

In 2012, the FDIC launched a Community Banking Initiative to better understand and support these institutions. As part of the initiative, the FDIC publishes research on issues of importance to community banks, and provides them with resources to manage risk, enhance the expertise of their staff, and adapt to changes in the regulatory environment.

Community Banking Research

The FDIC pursues an ambitious, ongoing agenda of research and outreach focused on community banking issues. Since the 2012 publication of the FDIC Community Banking Study, FDIC researchers have published more than a dozen additional studies on topics ranging from small business financing to the factors that have driven industry consolidation over the past 30 years.

The FDIC Quarterly Banking Profile (QBP) includes a section focused specifically on community bank performance, providing a detailed statistical picture of the community banking sector that can be accessed by analysts, other regulators, and bankers themselves. The most recent report shows that net income at community banks continued to grow at a healthy annual rate in the first half of 2018.

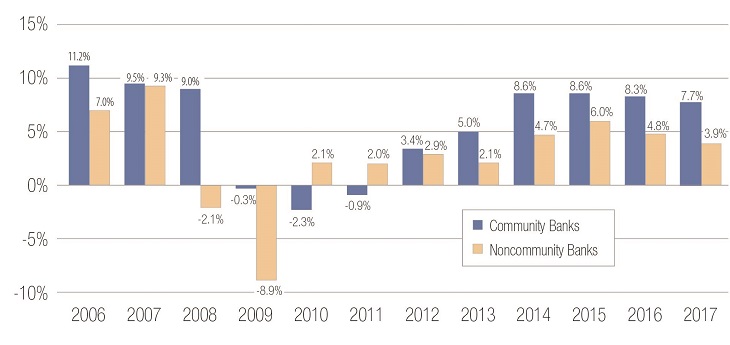

The long-term trend of consolidation has done little to diminish the role of community banks in the banking industry. More than three-quarters of the community banks that merged in 2017 and early 2018 were acquired by other community banks. On a merger-adjusted basis, loan growth at community banks exceeded growth at noncommunity banks in every year between 2012 and 2017. (See Chart 1.) From June 2017 to June 2018, currently operating noncommunity banks closed far more offices than they acquired. In contrast, currently operating community banks acquired offices and opened still more offices, on net, during the year. (See Table 1)

Community Bank Advisory Committee

The FDIC’s Advisory Committee on Community Banking is an ongoing forum for discussing current issues and receiving valuable feedback from the industry. The committee, which met twice during 2018, is composed of as many as 18 community bank CEOs from around the country. It is a valuable resource for information on a wide range of topics, including examination policies and procedures, capital and other supervisory issues, credit and lending practices, deposit insurance assessments and coverage, and regulatory compliance issues.

At the July 2018 meeting, DIR discussed the current financial performance of community banks, and how selected risk indicators compare to those seen before the financial crisis. As compared to the pre-crisis years, community banks have higher capital ratios than noncommunity banks, and far fewer of community banks have extremely high concentrations in construction lending. The presenters also noted, however, that community banks are holding generally more loans, fewer liquid assets, and face potential pressures on deposit costs as interest rates increase.

Chart 1: Community Bank Loan Growth has Exceeded Growth at Noncommunity Banks for Six Consecutive Years

Merger Adjusted Annual Growth in Total Loans and Leases 2006-2017

Source: FDIC. All calculations are merger adjusted.

| Offices of the June 2018 Group of Institutions in June 2017 | Offices of Banks Acquired | Number of Offices in June 2017, Merger-adjusted | New Offices Opened | Offices Closed | Net Offices Purchased or Sold | Number of Offices in June 2018 | |

|---|---|---|---|---|---|---|---|

| Community Banks | 29,832 | 619 | 30,451 | 585 | 500 | 15 | 30,551 |

| Noncommunity Banks | 57,886 | 1,481 | 59,367 | 404 | 2,254 | -15 | 57,502 |

| Total | 87,718 | 2,100 | 89,818 | 989 | 2,754 | 0 | 88,053 |

Source: FDIC.

Committee members indicated that deposit pricing pressures had been relatively modest, but that further interest rate increases could begin to pressure their deposit costs.

De Novo Banks

In 2018, the FDIC pursued multiple initiatives to fulfill its commitment to working with, and providing support to, any group with interest in starting a bank. In general, these initiatives focused on reviewing and, as appropriate, updating the processes, procedures, and management systems by which the FDIC receives, reviews, and acts on applications.

Most significantly, in December 2018, the FDIC announced new measures to promote a more transparent, streamlined, and accountable process for all de novo applications submitted to the agency. Specifically, the FDIC issued a Request for Information soliciting comments on the deposit insurance application process, including the transparency and efficiency of the process, and any unnecessary burdens that impede the process.

The agency also established a process to receive and review draft deposit insurance proposals. This process will help organizers of new financial institutions by providing an early opportunity for both the FDIC and organizers to identify potential challenges with respect to the statutory criteria, areas that may require further detail or support, and potential issues or concerns. It will also promote a more transparent and efficient deposit insurance application process. The FDIC also established an Applications Mailbox as an additional means by which bankers and other applicants may pose questions regarding a specific application or the application process.

Other measures to support de novo formation, included:

- Re-publishing timeframe guidelines for processing applications, notices, requests, and other filings submitted on behalf of proposed and existing institutions and other parties to help applicants in their planning.

- Updating Applying for Deposit Insurance – A Handbook for Organizers of De Novo Institutions. The handbook was designed to help organizers become familiar with the deposit insurance application process.

- Updating the Deposit Insurance Applications Procedures Manual. The manual provides comprehensive instruction to staff regarding the review and processing of deposit insurance applications.

Technical Assistance Program

As part of the Community Banking Initiative, the FDIC continued to provide a robust technical assistance program for bank directors, officers, and employees. The technical assistance program includes Directors’ College events held across the country, industry teleconferences and webinars, and a video program.

In 2018, the FDIC hosted Directors’ College events in five of its six regions. These events were typically conducted jointly with state trade associations and addressed issues such as corporate governance, regulatory capital, community banking, concentrations management, consumer protection, BSA, and interest-rate risk, among other topics.

The FDIC also offers a series of banker events in order to maintain open lines of communication and to keep bank management and staff up-to-date on important banking regulatory and emerging issues of interest to community bankers. In 2018, the FDIC offered 11 teleconferences or webinars focused on the following topics:

- Understanding Reasonably Expected Market Area (REMA) and Community Reinvestment Act (CRA) Assessment area,

- Liquidity and funding risk management,

- Current Expected Credit Losses (CECL) accounting methodology,

- The impact of rising interest rates on asset/liability management,

- Money Smart for Small Businesses,

- Regulatory and accounting issues,

- Common exam findings,

- Update on compliance and CRA, and

- Information sharing on standardized export of imaged loan documents.

In October 2018, the FDIC hosted a teleconference to provide information about EGRRCPA implementation, and to answer questions. The call was part of the FDIC’s consumer compliance teleconference and webinar series, which allows the FDIC to communicate important information to supervised institutions on a variety of topics and to respond to industry questions.

In November 2018, the FDIC hosted another teleconference to discuss results of the 2017 National Survey of Unbanked and Underbanked Households. During this call, participants also discussed economic inclusion resources pertinent to community banks, including the Money Smart for Adults financial education program, and CRA consideration for activities that benefit underserved communities.

Economic Growth and Regulatory Paperwork Reduction Act

The Economic Growth and Regulatory Paperwork Reduction Act (EGRPRA) directs the federal banking agencies and the FFIEC to conduct a joint review of regulations every 10 years to determine whether any of those regulations are outdated or unnecessary.

In March 2017, the FFIEC submitted a report to Congress that described actions the agencies had already taken to address comments received during the EGRPRA process, as well as actions the agencies planned to take in the future. During 2018, the FDIC along with the other FFIEC member agencies, continued to work together to reduce burden in the following areas raised during the EGRPRA review process.

-

Capital Simplification Proposal

In 2017, the federal banking agencies issued an NPR to seek comment on simplifications to the capital framework as part of the agencies’ EGRPRA efforts. Parts of the proposed rulemaking was superseded by certain capital framework provisions of the Economic Growth, Regulatory Relief and Consumer Protection Act. As a result, the federal banking agencies issued in September 2018 an NPR to seek comment on implementation of the revised statutory definition of High Volatility Commercial Real Estate and issued in November 2018 an additional NPR to seek comment on the leverage ratio for qualifying community banks. FDIC staff, along with the staff of other federal banking agencies, continued to review comments received in response to the 2017 NPR to simplify the capital rules for small banks not eligible for the community bank leverage ratio, including the regulatory capital treatment of mortgage servicing assets, deferred tax assets, investments in the capital instruments of other financial institutions, and minority interest. FDIC staff, along with the staff of other federal banking agencies, plan to put forth final rules on both of these capital simplification efforts in 2019 and explore other areas of regulatory capital rules that may be simplified or streamlined.

-

Commercial and Residential Real Estate Appraisal Thresholds

On April 9, 2018, the FDIC, FRB, and OCC jointly published a final rule that raised the threshold for requiring an appraisal on commercial real estate transactions from $250,000 to $500,000.

Similarly, on December 7, 2018, the FDIC, FRB, and OCC jointly published an NPR requesting comment on an increase in the threshold for requiring an appraisal on residential real estate transactions from $250,000 to $400,000.

-

Frequently Asked Questions (FAQs) on the Appraisal Regulations and the Interagency Appraisal and Evaluation Guidelines

In October 2018, the FDIC, FRB, and OCC jointly issued FAQs on real estate appraisals and evaluations, in response to questions raised during the EGRPRA process about the agencies’ appraisal regulations and guidance. The FAQs do not introduce new policy or guidance, but instead assemble previously communicated policy and interpretations. The FAQs complement the agencies’ appraisal regulations, the real estate lending standards, the Interagency Appraisal and Evaluation Guidelines, the Interagency Advisory on the Use of Evaluations in Real Estate-Related Financial Transactions, and other regulations and advisories related to appraisals and evaluations. The FAQs rescinded and replaced FAQs that the agencies previously issued in March 2005.

-

Advisory on the Availability of Appraisers

The FDIC, FRB, OCC, and NCUA issued an advisory that discusses two existing methods that may address appraiser shortages, particularly in rural areas: temporary practice permits and temporary waivers. The advisory addresses concerns raised pursuant to the EGRPRA review process.

The first method, temporary practice permits, may be granted by state appraiser regulatory agencies to allow credentialed appraisers to provide their services in states experiencing a shortage of appraisers, subject to state law. Reciprocity is a widely used practice in which one state recognizes the appraiser certification and licensing of another state, permitting state-certified and -licensed appraisers to perform appraisals across state lines. The second method, temporary waivers, sets aside requirements relating to the certification or licensing of individuals to perform appraisals under Title XI of FIRREA in states or geographic political subdivisions while there is a scarcity of certified or licensed appraisers that has caused significant delays in performing appraisals. Authority to grant temporary waiver requests rests with the FFIEC's Appraisal Subcommittee, and is subject to FFIEC approval. To further communicate about the availability of the waiver process and get a deeper understanding of rural appraisal issues, the Conference of State Bank Supervisors organization arranged six roundtables between federal banking regulators, state commissioners and rural community bankers. Roundtables were held in Michigan, Tennessee, Wyoming, North Dakota, South Dakota, and Montana.

-

Call Report Burden Reduction

Effective with the June 30, 2018, reporting date, burden-reducing revisions were made to all three versions of the Call Report (FFIEC 051, FFIEC 041, and FFIEC 031 Call Reports). These changes were the result of multi-phase review of the data collected in all Call Report schedules, the re-evaluation of certain previously reviewed schedules, and consideration of industry comments and feedback. These changes were designed to ease reporting requirements and lessen the reporting burden for small and large institutions.

Additionally, during 2018 the FFIEC’s Task Force on Reports developed options for expanding eligibility to file the FFIEC 051 Call Report beyond the initial asset size eligibility threshold of $1 billion. This effort included analyzing Call Report data from institutions with domestic offices only and $1 billion or more in total assets. Section 205 of the EGRRCPA requires the banking agencies to issue regulations that allow for a reduced reporting requirement in the first and third quarter Call Reports for institutions that have less than $5 billion in total assets and satisfy other appropriate criteria established by the agencies. An NPR to expand eligibility for filing FFIEC 051 and to reduce the quarterly reporting frequency for some items to semiannual (i.e., June and December only) was published in November 2018. As of June 30, 2018, approximately 90 percent of IDIs were eligible to file the FFIEC 051 Call Report. If the rule is finalized as proposed, approximately 95 percent of IDIs would be eligible to file the FFIEC 051 Call Report.

-

Part 350 Disclosure of Financial and Other Information

In October 2018, the FDIC published an NPR to rescind and remove Part 350 of its regulations, which requires insured state nonmember banks and insured state-licensed branches of foreign banks to prepare an annual disclosure statement containing specified financial information and make it available to the public. The FDIC determined that widespread access to the internet allows interested persons to readily access more extensive and timely financial information about individual institutions than an annual disclosure statement, and that the burden of providing this annual disclosure statement is no longer justified.

-

Management Official Interlocks

In December 2018, the FDIC, OCC, and FRB approved a proposed rule that would increase the major assets prohibition thresholds for management interlocks in the agencies’ rules implementing the Depository Institution Management Interlocks Act (DIMIA). The DIMIA major assets prohibition prohibits a management official of a depository organization with total assets exceeding $2.5 billion (or any affiliate of such an organization) from serving at the same time as a management official of an unaffiliated depository organization with total assets exceeding $1.5 billion (or any affiliate of such an organization). Raising the thresholds will account for changes in the U.S. banking market and inflation since the current thresholds were established in 1996, and relieve certain institutions (i.e., those below the adjusted threshold) from having to ask the agencies for an exemption from the major assets prohibition. The agencies proposed three alternative approaches to increasing the thresholds, and do not expect the proposal to materially increase anticompetitive risk.

-

Retirement of Certain Financial Institution Letters

Financial Institution Letters (FILs) serve as the primary tool for delivering information to financial institutions about new regulations, supervisory guidance, management tools, regulatory relief, and other subjects of interest. As part of a continuing effort to reduce regulatory burden, in December 2018, the FDIC retired 374 risk management supervision-related FILs and 119 FILs related to consumer protection that were issued between 1995 and 2017. The retired FILs were identified as being outdated or as conveying regulations or other information that is still in effect but available elsewhere on the FDIC's website.

-

Examination Modernization

Recognizing that regulatory burden does not emanate only from statutes and regulations, the FDIC, along with the FFIEC, continued the FFIEC Examination Modernization project in 2018 as a follow-up to the review of regulations under EGRPRA. The project is focused on identifying ways to improve the efficiency of processes, procedures, and tools related to safety-and-soundness examinations and supervisory oversight, while maintaining the quality of the examination process.

In March 2018, the FFIEC issued an update on the Examination Modernization project, which noted that, in response to feedback from both bankers and examiners, the FFIEC would initially focus on the following measures to reduce supervisory burden:

- Highlight and reinforce regulator communication objectives before, during, and after examinations.

- Continue to tailor examinations based on risk.

- Leverage technology and shift, as appropriate, examination work from on-site to off-site.

- Improve electronic file transfer systems to facilitate the secure exchange of information between institutions and supervisory offices or examiners.

As a first step, and to address the first theme, the FDIC and other banking agencies issued a statement describing the principles of communication the agencies follow during the examination process, and committed to issue guidance to examination staff to reinforce and clarify the importance of being clear and transparent with community bankers during the examination process.

In April 2018, the FDIC conducted an information sharing session to introduce a methodology for examiners to review standardized imaged loan files off-site. This technology is designed to reduce the amount of time examiners must spend onsite during a bank examination. A pilot program began in May, and several institutions have participated.

Also in 2018, the Examination Modernization project team reviewed and compared principles and processes for risk-focusing examinations of community banks. This review concluded that the agencies have developed and implemented similar programs and processes for risk-tailoring examinations.

On November 27, 2018, the FFIEC issued a statement to update the industry on efforts to reduce supervisory burden by tailoring examinations based on risk. In this statement, the FDIC and other agencies committed to issue reinforcing and clarifying guidance to examiners on risk-focused examination principles.

-

OTS Rule Integration

The FDIC also streamlined and clarified certain regulations through the Office of Thrift Supervision (OTS) rule integration process. Under Section 316(b) of the Dodd-Frank Act, former OTS rules remain in effect “until modified, terminated, set aside, or superseded in accordance with applicable law” by the relevant successor agency, a court of competent jurisdiction, or operation of law. When the FDIC republished the transferred OTS regulations as new FDIC regulations applicable to state savings associations, the FDIC stated in the Federal Register notice that its staff would evaluate the transferred OTS rules and might later recommend incorporating them into other FDIC rules, amending them, or rescinding them. This process began in 2013 and continues, involving publication in the Federal Register of a series of NPRs and final rules.

In April 2018, two transferred OTS rules, Prompt Corrective Action and Capital, were removed as part of Basel III implementation. Additionally, in May 2018, the FDIC issued final rules to remove two transferred OTS rules, Minimum Security Procedures and Consumer Protection in Sales of Insurance, and to make technical amendments to related FDIC rules for applicability to FDIC-supervised state banks and savings associations. In November 2018, the FDIC issued a final rule to remove the transferred OTS rule regarding Fiduciary Powers of State Savings Associations, and to amend and revise rules regarding Consent Requirements for the Exercise of Trust Powers. The final rule makes all FDIC-supervised institutions subject to the same application procedures for obtaining consent to exercise trust powers.

Finally, in December 2018, the FDIC approved an NPR seeking comment on the removal of a transferred rule regarding lending and investment that is duplicative of standards in existing FDIC regulations. The NPR also seeks to remove rules related to the registration of residential mortgage loan originators in light of Title X of the Dodd-Frank Act, which transferred this authority to the CFPB. Staff will continue to review the remaining nine transferred regulations.