301 Moved Permanently

301 Moved Permanently

openresty

|

DIF

Balance Sheet -

Third Quarter 2014

| Fund Financial Results |

($

in millions) |

| Balance

Sheet |

| |

Unaudited Sep-14 |

Unaudited Jun-14 |

Quarterly

Change |

Unaudited Sep -13 |

Year-Over-Year

Change |

| Cash and cash equivalents |

$2,115 |

$2,409 |

$(294) |

$5,330 |

$(3,215) |

| Investment in U.S. Treasury obligations, net |

47,783 |

45,416 |

2,367 |

32,729 |

15,054 |

| Assessments receivable, net |

2,072 |

2,204 |

(132) |

2,391 |

(319) |

| Interest receivable on investments and other assets, net |

382 |

577 |

(195) |

409 |

(27) |

| Receivables from resolutions, net |

15,227 |

14,211 |

1,016 |

16,938 |

(1,711) |

| Property and equipment, net |

357 |

359 |

(2) |

373 |

(16) |

| Total Assets |

$67,936 |

$65,176 |

$2,760 |

$58,170 |

$9,766 |

| Accounts payable and other liabilities |

255 |

256 |

(1) |

265 |

(10) |

| Liabilities due to resolutions |

11,260 |

12,169 |

(909) |

15,754 |

(4,494) |

| Postretirement benefit liability |

194 |

194 |

- |

224 |

(30) |

| Contingent liability for anticipated failures |

1,902 |

1,493 |

409 |

1,164 |

738 |

| Contingent liability for litigation losses |

5 |

5 |

- |

5 |

- |

| Total Liabilities |

$13,616 |

$14,117 |

$(501) |

$17,412 |

$(3,796) |

| FYI: Unrealized gain (loss) on U.S. Treasury investments, net |

27 |

118 |

(91) |

39 |

(12) |

| FYI: Unrealized gain (loss) on trust preferred securities |

- |

- |

- |

- |

- |

| FYI: Unrealized postretirement benefit (loss) gain |

(16) |

(16) |

- |

(61) |

45 |

| Fund Balance |

$54,320 |

$51,059 |

$3,261 |

$40,758 |

$13,562 |

|

|

|

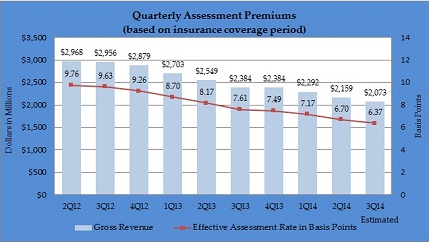

Quarterly Assessment Premiums (based on insurance coverage period) |

| |

Gross Revenue |

Effective Assessment Rate in Basis Points |

2Q12 |

$2,968 |

9.76 |

3Q12 |

$2,956 |

9.63 |

4Q12 |

$2,879 |

9.26 |

1Q13 |

$2,703 |

8.70 |

2Q13 |

$2,549 |

8.17 |

3Q13 |

$2,384 |

7.61 |

4Q13 |

$2,384 |

7.49 |

1Q14 |

$2,292 |

7.17 |

2Q14 |

$2,159 |

6.70 |

3Q14 |

$2,073 |

6.37 |

Assessment Revenue has been decreasing due to lower effective assessment rates, which reflect the improving health of the banking industry. |