301 Moved Permanently

301 Moved Permanently

openresty

|

DIF

Balance Sheet -

Third Quarter 2013

| Fund Financial Results |

($

in millions) |

Balance

Sheet |

|

Unaudited Sep-13 |

Unaudited Jun-13 |

Quarterly

Change |

Unaudited Sep-12 |

Year-Over-Year

Change |

| Cash and cash equivalents |

$5,330 |

$531 |

$4,799 |

$1,587 |

$3,743 |

| Cash and investments - restricted - systemic risk |

- |

- |

- |

1,115 |

(1,115) |

| Investment in U.S. Treasury obligations, net |

32,729 |

33,286 |

(557) |

35,460 |

(2,731) |

| Trust preferred securities |

- |

2,240 |

(2,240) |

2,255 |

(2,255) |

| Assessments receivable, net |

2,391 |

2,594 |

(203) |

660 |

1,731 |

| Receivables and other assets - systemic risk |

- |

- |

- |

1,568 |

(1,568) |

| Interest receivable on investments and other assets, net |

409 |

533 |

(124) |

462 |

(53) |

| Receivables from resolutions, net |

16,938 |

18,442 |

(1,504) |

18,948 |

(2,010) |

| Property and equipment, net |

373 |

376 |

(3) |

379 |

(6) |

| Total Assets |

$58,170 |

$58,002 |

$168 |

$62,434 |

$(4,264) |

| Accounts payable and other liabilities |

265 |

296 |

(31) |

346 |

(81) |

| Unearned revenue - prepaid assessments |

- |

- |

- |

9,219 |

(9,219) |

| Refunds of prepaid assessments |

- |

- |

- |

- |

- |

| Liabilities due to resolutions |

15,754 |

17,179 |

(1,425) |

21,215 |

(5,461) |

| Deferred revenue - systemic risk |

- |

- |

- |

2,682 |

(2,682) |

| Postretirement benefit liability |

224 |

224 |

- |

188 |

36 |

| Contingent liability for anticipated failures |

1,164 |

2,426 |

(1,262) |

3,556 |

(2,392) |

| Contingent liability for litigation losses |

5 |

6 |

(1) |

4 |

1 |

| Total Liabilities |

$17,412 |

$20,131 |

$(2,719) |

$37,210 |

$(19,798) |

| FYI: Unrealized gain (loss) on U.S. Treasury investments, net |

39 |

(8) |

47 |

65 |

(26) |

| FYI: Unrealized gain (loss) on trust preferred securities |

- |

278 |

(278) |

293 |

(293) |

| FYI: Unrealized postretirement benefit (loss) gain |

(61) |

(61) |

- |

(34) |

(27) |

| Fund Balance |

$40,758 |

$37,871 |

$2,887 |

$25,224 |

$15,534 |

|

|

|

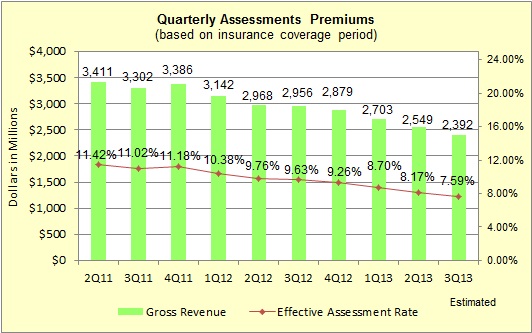

| Quarterly Assessments Premiums (based on insurance coverage period) |

| $ in Millions |

Gross Revenue |

Effective Assessment Rate |

| 2Q11 |

3,411 |

11.42% |

| 3Q11 |

3,302 |

11.02% |

4Q11 |

3,386 |

11.18% |

1Q12 |

3,142 |

10.38% |

| 2Q12 |

2,968 |

9.76% |

| 3Q12 |

2,956 |

9.63% |

| 4Q12 |

2,879 |

9.26% |

| 1Q13 |

2,703 |

8.70% |

| 2Q13 |

2,549 |

8.17% |

| 3Q13 |

2,392 |

7.59% |

|

The decline in both the gross revenue and the effective assessment rate was primarily attributed to the overall improving health of the banking industry.

|