Chief Financial Officer's (CFO) Report to the Board

| Fund Financial Results | ($ in millions) |

| FSLIC Resolution Fund | |||||

Mar-18 |

Dec -17 |

Quarterly Change |

Mar -17 |

Year-Over-Year Change |

Cash and cash equivalents | $889 | $885 | $4 | $879 | $10 |

|---|---|---|---|---|---|

| Accumulated deficit | (124,601) | (124,604) | 3 | (124,609) | 8 |

| Total resolution equity | 889 | 886 | 3 | 880 | 9 |

| Total revenue | 3 | 8 | 1 | 2 | |

| Operating expenses | 0 | 1 | 0 | 0 | |

| Losses related to thrift resolutions | 0 | 0 | 0 | 0 | |

| Net Income (Loss) | $3 | $7 | $1 | 2 |

| Receivership Selected Statistics March 2018 vs. March 2017 |

| $ in millions | DIF |

FRF |

ALL FUNDS |

||||||

|---|---|---|---|---|---|---|---|---|---|

| Mar-18 | Mar-17 | Change | Mar-18 | Mar-17 | Change | Mar-18 | Mar-17 | Change | Total Receiverships | 317 | 375 | (58) | - | - | - | 317 | 375 | (58) |

| Assets in Liquidation | $2,097 | $3,006 | ($909) | $2 | $2 | - | $2,099 | $3,008 | ($909) |

| YTD Collections | $492 | $379 | $113 | - | - | $- | $492 | $379 | $113 |

| YTD Dividend/ Other Pymts - Cash | $847 | $1,203 | ($356) | - | - | - | $847 | $1,203 | ($356) |

DIF's portfolio Performance Compared to U.S. Treasury Benchmark (year-to-date return) |

|||||

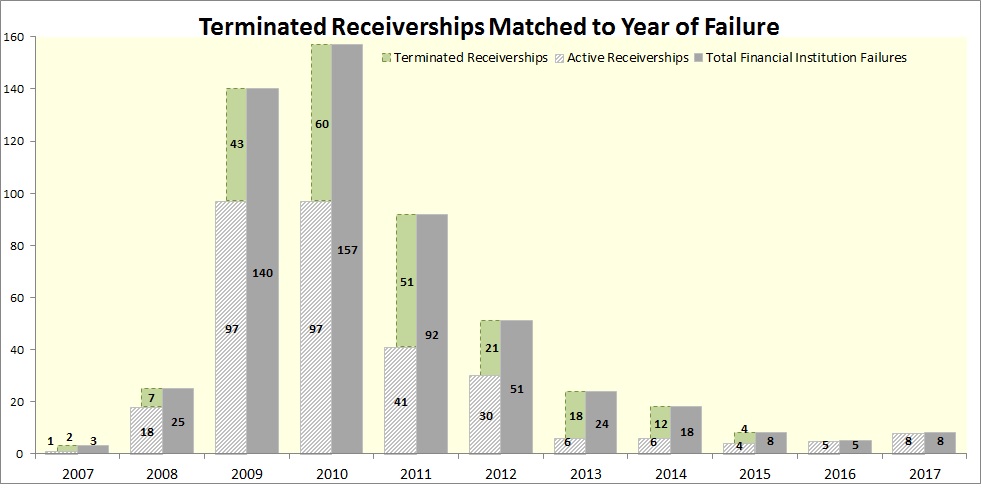

| Active Receiverships | Total Financial Institution Failures | Variance | Base Variance | Terminated Receiverships | |

|---|---|---|---|---|---|

| 2007 | 1 | 3 | 2 | 1 | 2 |

| 2008 | 18 | 25 | 7 | 18 | 7 |

| 2009 | 97 | 140 | 43 | 97 | 43 |

| 2010 | 97 | 157 | 60 | 97 | 60 |

| 2011 | 41 | 92 | 51 | 41 | 51 |

| 2012 | 30 | 51 | 21 | 30 | 21 |

| 2013 | 6 | 24 | 18 | 6 | 18 |

| 2014 | 6 | 18 | 12 | 6 | 12 |

| 2015 | 4 | 8 | 4 | 4 | 4 |

| 2016 | 5 | 5 | 0 | 5 | 0 |

| 2017 | 8 | 8 | 0 | 8 | 0 |

The FDIC, as receiver, manages failed banks with the goal of expeditiously winding up their affairs. The oversight and prompt termination of receiverships help to perserve value for the uninsured depositors and other creditors by reducing overhead and other holding costs. Once the assets of a failed institution have been sold, the final distribution of any proceeds is made and the FDIC terminates the receivership. As of March 31, 2018, the FDIC has inactivated 218 receiverships (or 41 percent) of the 531 receiverships created from 2007 through 2017.