Chief Financial Officer's (CFO) Report to the Board

| Fund Financial Results | ($ in millions) |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

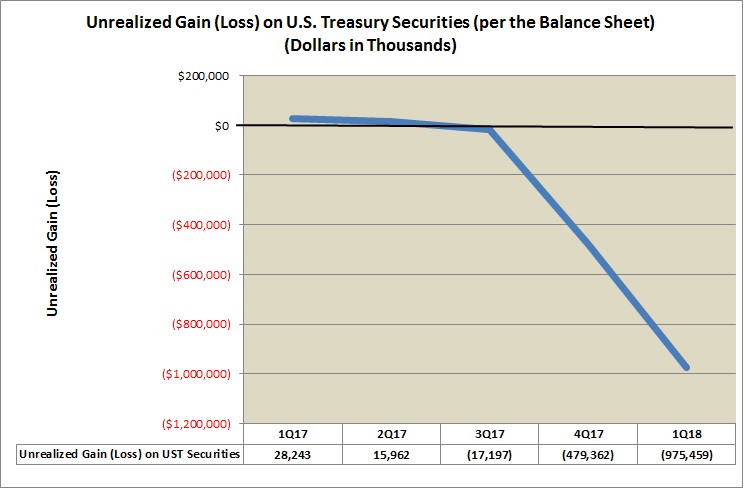

Highlights of Unrealized Gain (Loss) on U.S. Treasury Securities (per the Balance Sheet) (dollars in thousands) |

|

| Year | Unrealized Gains (Loss) |

|---|---|

| 1Q17 | 28,243 |

| 2Q17 | 15,962 |

| 3Q17 | (17,197) |

| 4Q17 | (479,362) |

| 1Q18 | (975,459) |

The larger unrealized losses on the DIF portfolio's U.S. Treasury securities lately has been the result of yields continuing to rise dramatically across all maturity sectors of the Treasury yield curve, resulting in further declines in the securities' market values relative to their book values.