Chief Financial Officer's (CFO) Report to the Board

Selected Financial Data - First Quarter 2017

| Fund Financial Results | ($ in millions) |

| FSLIC Resolution Fund | |||||

Mar-17 |

Dec -16 |

Quarterly Change |

Mar -16 |

Year-Over-Year Change |

Cash and cash equivalents | $879 | $874 | $5 | $872 | $7 |

| Accumulated deficit | (124,609) | (124,611) | 2 | (124,617) | 8 |

| Total resolution equity | 880 | 878 | 2 | 872 | 8 |

| Total revenue | 1 | 5 | 1 | 0 | |

| Operating expenses | 0 | 3 | 1 | (1) | |

| Losses related to thrift resolutions | 0 | (1) | (1) | 1 | |

| Net Income (Loss) | $1 | $7 | $1 | $0 |

| Receivership Selected Statistics March 2017 vs. March 2016 |

| $ in millions | DIF |

FRF |

ALL FUNDS |

||||||

| Mar-17 | Mar-16 | Change | Mar-17 | Mar-16 | Change | Mar-17 | Mar-16 | Change | Total Receiverships | 375 | 439 | (64) | - | - | - | 375 | 439 | (64) |

| Assets in Liquidation | $3,006 | $4,433 | ($1,427) | $2 | $2 | - | $3,008 | $4,435 | ($1,427) |

| YTD Collections | $379 | $372 | $7 | - | $1 | ($1) | $379 | $373 | $6 |

| YTD Dividend/ Other Pymts - Cash | $1,203 | $1,789 | ($586) | - | - | - | $1,203 | $1,789 | ($586) |

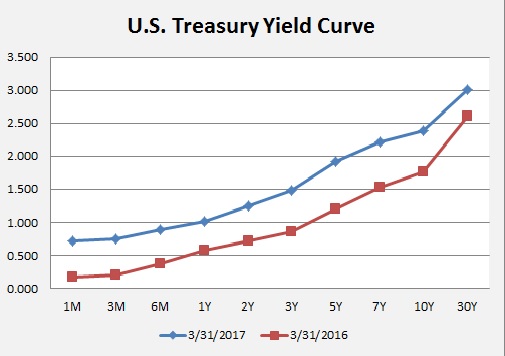

U.S. Treasury Yield Curve |

||

| Years | 03/31/2017 | 03/31/2016 |

| 1 month | 0.725 | 0.168 |

| 3 months | 0.752 | 0.198 |

| 6 months | 0.896 | 0.376 |

| 1 year | 1.016 | 0.58 |

| 2 years | 1.254 | 0.721 |

| 3 year | 1.489 | 0.852 |

| 5 years | 1.921 | 1.205 |

| 7 years | 2.21 | 1.533 |

| 10 years | 2.387 | 1.769 |

| 30 years | 3.009 | 2.612 |

Short-maturity yields have risen reflecting the Federal Reserve's December 2016 and March 2017 hike in the federal funds target rate, while longer-maturity sector securities have risen due to the expectation of higher inflation.