Selected Financial Data - Third Quarter 2023

| FSLIC Resolution Fund | |||||

|---|---|---|---|---|---|

| Sep-23 | Jun-23 | Quarterly Change | Sep-22 | Year-Over-Year Change | |

| Cash and cash equivalents | $956 | $944 | $12 | $914 | $42 |

| Accumulated deficit | (124,513) |

(124,525) |

12 |

(124,555) |

42 |

| Total resolution equity | 957 |

945 |

12 |

914 |

43 |

| Total revenue | 34 |

22 |

12 |

7 |

27 |

| Operating expenses | 0 |

0 |

0 |

0 |

0 |

| Losses related to thrift resolutions | 0 |

0 |

0 |

0 |

0 |

| Net Income (Loss) | $34 |

$22 |

12 |

$7 |

$27 |

| $ in millions | DIF | FRF | ALL FUNDS | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Sep 23 | Sep 22 | Change | Sep 23 | Sep 22 | Change | Sep 23 | Sep 22 | Change | |

| Total Receiverships | 103 | 156 | (53) | 0 | 0 | 0 | 103 | 156 | (53) |

| Assets in Liquidation | $79,673 |

$48 |

$79,625 |

$0 |

$0 |

$0 |

$79,673 |

$48 |

$79,625 |

| YTD Collections | $175,621 |

$133 |

$175,488 |

$0 |

$0 |

$0 |

$175,621 |

$133 |

$175,488 |

| YTD Dividend/Other Pmts - Cash | $40,273 |

$417 |

$39,856 |

$0 |

$0 |

$0 |

$40,273 |

$417 |

$39,856 |

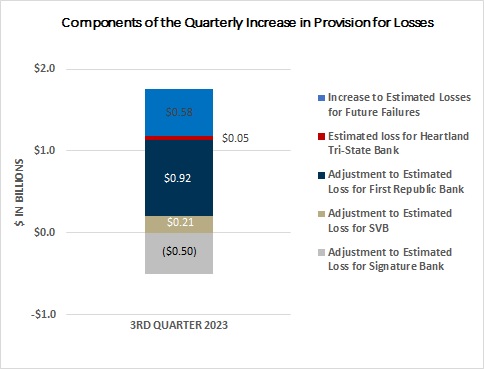

During the 3rd quarter 2023, the provision for insurance losses increased by $1.2 billion to $19.7 billion at 9/30/23. The total estimated losses for the three large regional bank failures in 2023 rose by $1.1 billion to $35.2 billion as of quarter-end. The portion of the estimated losses that are attributable to uninsured deposits ($16.3 billion) will be recovered from the banking industry through a special assessment.

| September 30, 2023 | |

|---|---|

| Increase to Estimated Losses for Future Failures | $0.58 |

| Estimated loss for Heartland Tri-State Bank | $0.05 |

| Adjustement to Estimated Loss for First Republic Bank | $0.92 |

| Adjustment to Estimated Loss for SVB | $0.21 |

| Adjustment to Estimated Loss for Signature Bank | ($0.50) |